Region:Asia

Author(s):Dev

Product Code:KRAA3530

Pages:89

Published On:September 2025

By Type:The market is segmented into various types of wearable devices, including fitness trackers, smartwatches, medical monitoring devices, wearable ECG monitors, sleep trackers, wearable blood pressure monitors, multiparameter trackers, pulse oximeters, smart clothing, and others. Among these, fitness trackers and smartwatches are leading the market due to their popularity among health-conscious consumers and their ability to provide real-time health data. The increasing trend of fitness and wellness tracking has significantly boosted the demand for these devices.

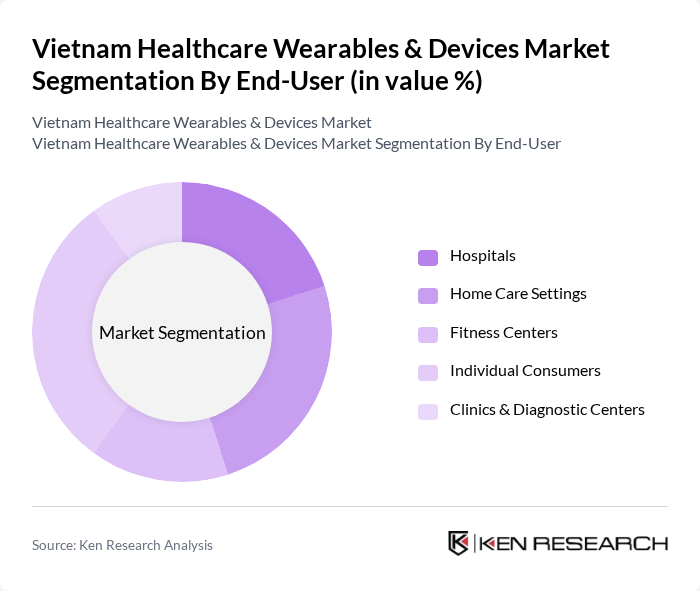

By End-User:The end-user segmentation includes hospitals, home care settings, fitness centers, individual consumers, and clinics & diagnostic centers. Individual consumers are the dominant segment, driven by the growing trend of personal health management and fitness tracking. The increasing adoption of wearable devices for personal use has led to a significant rise in demand, particularly among younger demographics who prioritize health and fitness.

The Vietnam Healthcare Wearables & Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fitbit Inc., Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Xiaomi Corporation, Huawei Technologies Co., Ltd., Philips Healthcare, Medtronic plc, Withings S.A., Omron Corporation, AliveCor, Inc., Polar Electro Oy, Zephyr Technology Corporation, BioTelemetry, Inc., Abbott Laboratories, Bkav Electronics (Vietnam), Viettel Group (Vietnam), Imedical Vietnam JSC, Beetech Group (Vietnam), Masimo Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthcare wearables market in Vietnam appears promising, driven by technological innovations and increasing consumer health consciousness. As telehealth services expand, wearables will play a crucial role in remote patient monitoring, enhancing healthcare delivery. Additionally, the integration of AI in wearables is expected to provide personalized health insights, further driving adoption. With government support for digital health initiatives, the market is poised for significant growth, addressing both consumer needs and healthcare challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Trackers Smartwatches Medical Monitoring Devices Wearable ECG Monitors Sleep Trackers Wearable Blood Pressure Monitors Multiparameter Trackers Pulse Oximeters Smart Clothing Others |

| By End-User | Hospitals Home Care Settings Fitness Centers Individual Consumers Clinics & Diagnostic Centers |

| By Application | Chronic Disease Management Fitness and Wellness Tracking Remote Patient Monitoring Emergency Health Alerts Sleep & Activity Monitoring |

| By Distribution Channel | Pharmacies Online Retail Offline Retail Direct Sales Hypermarkets Healthcare Institutions |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands International Brands Emerging Startups |

| By User Demographics | Age Group Gender Health Status |

| By Grade Type | Consumer-Grade Wearable Healthcare Devices Clinical-Grade Wearable Healthcare Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 120 | Doctors, Nurses, Healthcare Administrators |

| Patients Using Wearables | 90 | Chronic Disease Patients, Fitness Enthusiasts |

| Technology Developers | 60 | Product Managers, R&D Engineers |

| Healthcare Policy Makers | 40 | Government Officials, Health Policy Analysts |

| Insurance Providers | 50 | Underwriters, Claims Adjusters |

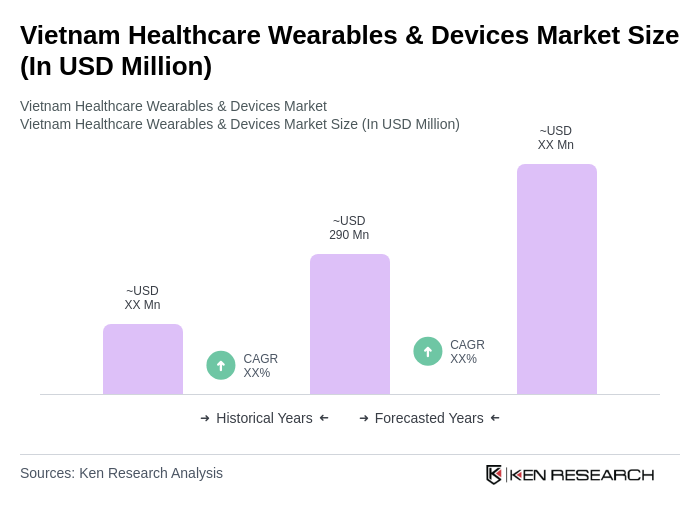

The Vietnam Healthcare Wearables & Devices Market is valued at approximately USD 290 million, driven by the increasing prevalence of chronic diseases, rising health awareness, and technological advancements in wearable devices.