Region:Asia

Author(s):Dev

Product Code:KRAB4235

Pages:88

Published On:October 2025

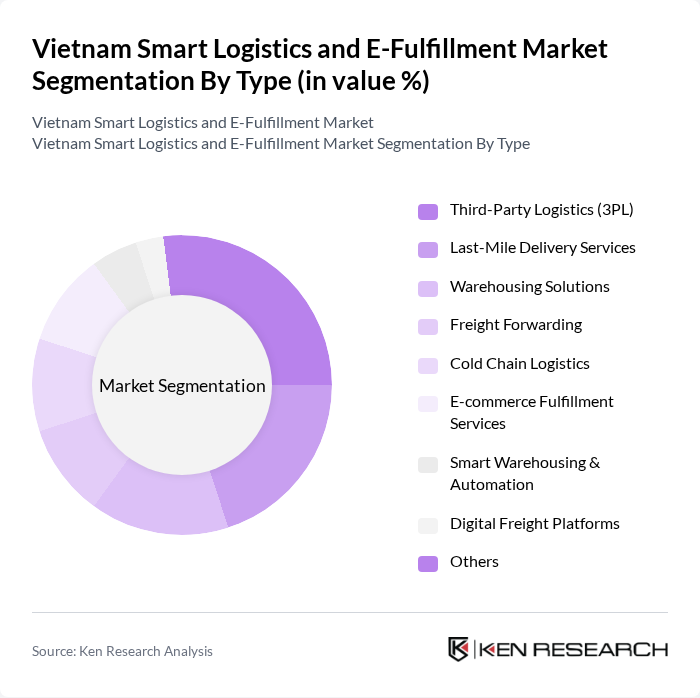

By Type:The market is segmented into Third-Party Logistics (3PL), Last-Mile Delivery Services, Warehousing Solutions, Freight Forwarding, Cold Chain Logistics, E-commerce Fulfillment Services, Smart Warehousing & Automation, Digital Freight Platforms, and Others. Each segment addresses distinct operational needs, with 3PL and last-mile delivery services being particularly critical due to e-commerce growth. Smart warehousing and automation are gaining traction, with investments in robotic systems, automated storage and retrieval, and IoT-enabled management software becoming more common as firms seek to reduce costs and improve accuracy.

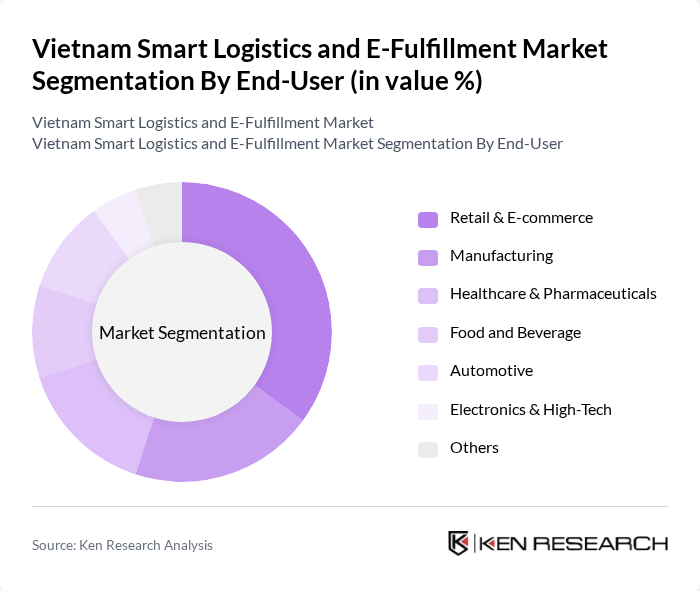

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, Electronics & High-Tech, and Others. Retail and e-commerce lead demand, driven by the country’s dynamic online shopping sector and the need for rapid, reliable fulfillment. Manufacturing remains a key driver due to Vietnam’s position as a regional production hub, while healthcare, food, automotive, and high-tech industries each require specialized logistics solutions to meet regulatory and operational standards.

The Vietnam Smart Logistics and E-Fulfillment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viettel Post, Giao Hàng Nhanh (GHN), J&T Express Vietnam, GrabExpress, DHL Supply Chain Vietnam, TikiNOW Smart Logistics (TNSL), Lazada Logistics Vietnam, VNPost (Vietnam Post), Scommerce (including AhaMove, GHN, Gido), AhaMove, Shopee Xpress Vietnam, Transimex Corporation, Gemadept Logistics, B?u ?i?n Vi?t Nam (Vietnam Post), contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's smart logistics and e-fulfillment market appears promising, driven by ongoing technological advancements and increasing e-commerce activity. As urbanization accelerates, logistics providers are expected to adopt more sophisticated solutions to enhance efficiency. Additionally, the government's commitment to improving infrastructure will likely facilitate smoother operations. Companies that leverage data analytics and automation will be well-positioned to capitalize on emerging trends, ensuring they meet the evolving demands of consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Third-Party Logistics (3PL) Last-Mile Delivery Services Warehousing Solutions Freight Forwarding Cold Chain Logistics E-commerce Fulfillment Services Smart Warehousing & Automation Digital Freight Platforms Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive Electronics & High-Tech Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport Others |

| By Sales Channel | Direct Sales Online Sales Platforms Distributors Retail Outlets Others |

| By Service Type | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery Reverse Logistics Others |

| By Customer Segment | B2B B2C C2C Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Pay-per-Use Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Operations | 120 | Logistics Managers, E-commerce Directors |

| Smart Logistics Technology Adoption | 90 | IT Managers, Operations Directors |

| Last-Mile Delivery Solutions | 60 | Delivery Managers, Supply Chain Analysts |

| Warehouse Automation Practices | 50 | Warehouse Managers, Automation Engineers |

| Logistics Cost Management Strategies | 70 | Financial Analysts, Procurement Managers |

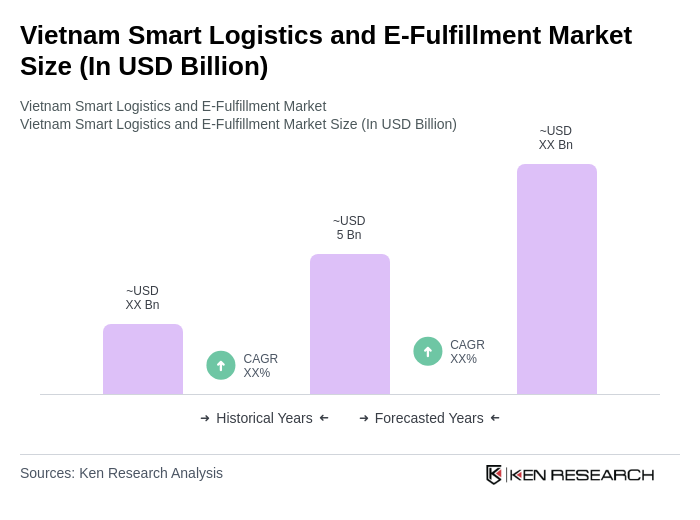

The Vietnam Smart Logistics and E-Fulfillment Market is valued at approximately USD 5 billion, significantly lower than the overall logistics market, which reached USD 65 billion in 2024. This growth is primarily driven by the rapid expansion of e-commerce and technological advancements.