Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0119

Pages:98

Published On:December 2025

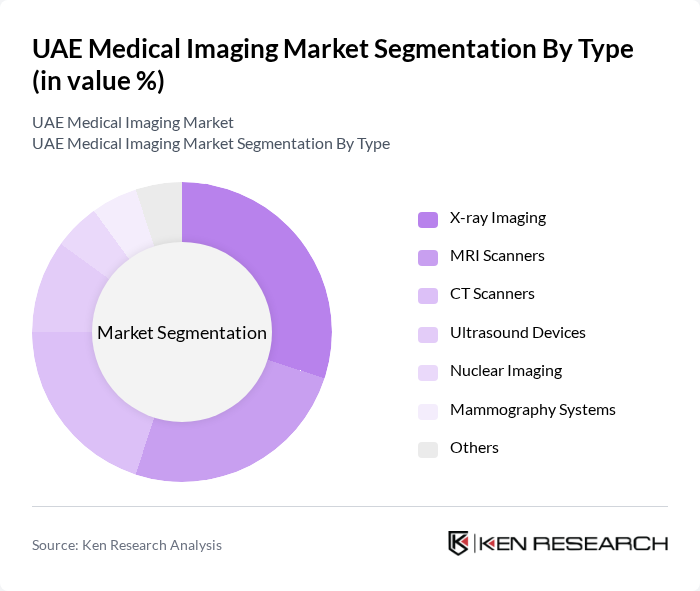

By Type:The medical imaging market is segmented into various types, including X-ray Imaging, MRI Scanners, CT Scanners, Ultrasound Devices, Nuclear Imaging, Mammography Systems, and Others. Among these, X-ray Imaging holds a significant share due to its widespread use in hospitals and clinics for diagnostic purposes. The increasing demand for early disease detection and the convenience of X-ray technology contribute to its dominance in the market.

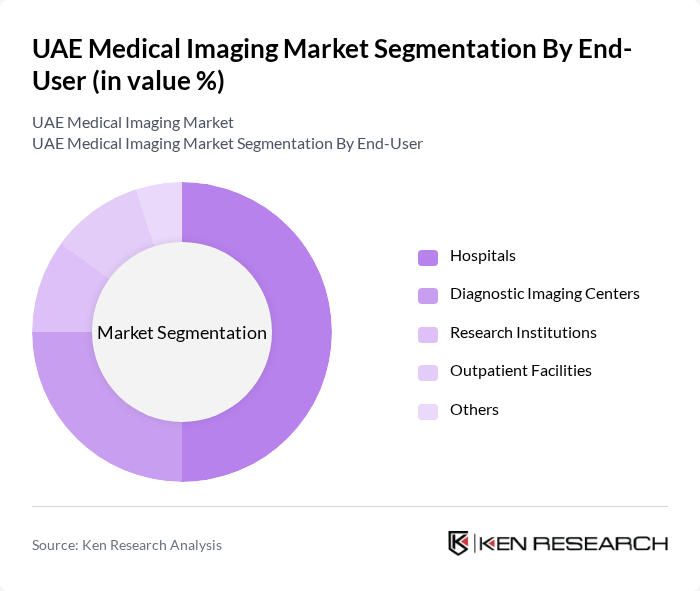

By End-User:The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Research Institutions, Outpatient Facilities, and Others. Hospitals dominate this segment due to their comprehensive healthcare services and the need for advanced imaging technologies to support various medical specialties. The increasing patient volume and the need for accurate diagnostics in hospitals drive the demand for medical imaging equipment.

The UAE Medical Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Fujifilm Medical Systems, Hitachi Medical Systems, Agfa HealthCare, Carestream Health, Hologic, Mindray Medical International, Varian Medical Systems, Samsung Medison, Neusoft Medical Systems, Esaote, and Bracco Imaging contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE medical imaging market is poised for significant transformation, driven by advancements in AI-powered imaging diagnostics and the growth of digital health ecosystems. Innovations such as AI algorithms for imaging interpretation and tele-radiology services will enhance diagnostic accuracy and efficiency. Additionally, the integration of intelligent health systems, supported by unified health records and national AI infrastructure, will facilitate improved patient care and operational effectiveness in imaging services across the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | X-ray Imaging MRI Scanners CT Scanners Ultrasound Devices Nuclear Imaging Mammography Systems Others |

| By End-User | Hospitals Diagnostic Imaging Centers Research Institutions Outpatient Facilities Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Technology | Digital Imaging Analog Imaging Hybrid Imaging Others |

| By Application | Oncology Cardiology Neurology Orthopedics Others |

| By Investment Source | Private Investments Government Funding International Aid Others |

| By Policy Support | Subsidies for Equipment Purchase Tax Incentives for Healthcare Providers Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 150 | Radiologists, Imaging Technologists |

| Medical Equipment Suppliers | 100 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 80 | Health Administrators, Regulatory Officials |

| Private Imaging Clinics | 70 | Clinic Owners, Operations Managers |

| Insurance Providers | 60 | Claims Managers, Underwriters |

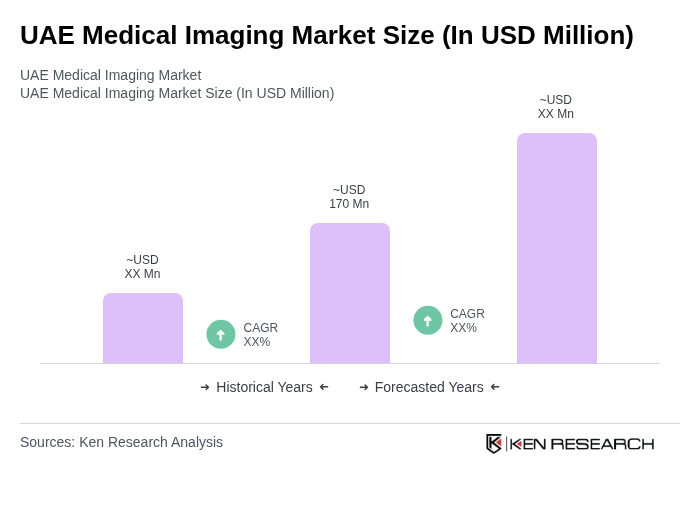

The UAE Medical Imaging Market is valued at approximately USD 170 million, reflecting a robust growth trajectory driven by factors such as universal health insurance coverage and advancements in medical technology.