Region:Africa

Author(s):Geetanshi

Product Code:KRAB0133

Pages:94

Published On:August 2025

By Type:The agriculture market in Algeria can be segmented into various types, including cereals, fruits, vegetables, legumes and pulses, oilseeds, livestock, dairy products, processed foods, organic products, and others. Cereals such as wheat, barley, and oats dominate the segment, particularly in the northern and high plateau regions. Fruits (notably citrus and dates), vegetables (including potatoes and tomatoes), and legumes are also significant contributors. Livestock and dairy products are vital for both domestic consumption and rural livelihoods. Processed foods and organic products are emerging segments, reflecting changing consumer preferences and export opportunities .

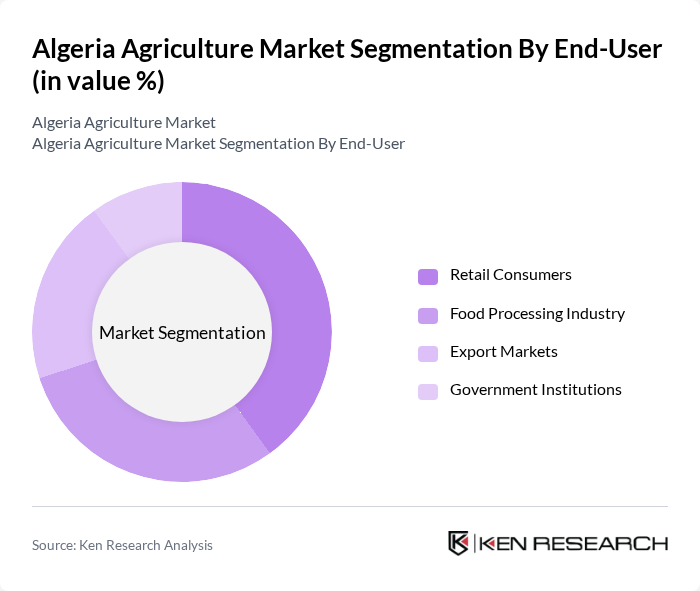

By End-User:The end-user segmentation of the agriculture market includes retail consumers, the food processing industry, export markets, and government institutions. Retail consumers are the largest segment, reflecting the importance of domestic food demand. The food processing industry is expanding due to modernization and value addition. Export markets are growing, especially for dates, citrus, and olive oil, while government institutions play a key role in procurement and food security programs .

The Algeria Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Groupe Cevital, SIM (Société des Industries Alimentaires du Maghreb), NCA Rouiba, Groupe Benamor, Groupe Benhamadi, ONAB (Office National des Aliments de Bétail), Eriad Alger, Frigomedit, Laiterie Soummam, Giplait (Groupe Industriel des Produits Laitiers), Hodna Lait, Sarl Agri-Food, Eurl El-Moustaqbal, Société de Distribution de Produits Agricoles, Eurl Agri-Plus contribute to innovation, geographic expansion, and service delivery in this space.

The future of Algeria's agriculture market appears promising, driven by increasing domestic food demand and government initiatives aimed at modernization. As investments in technology and irrigation expand, farmers are likely to adopt more sustainable practices, enhancing productivity. Additionally, the growing interest in organic farming and agro-tourism presents new avenues for growth. However, addressing climate change and financing challenges will be crucial for realizing the sector's full potential and ensuring food security for the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Cereals (Wheat, Barley, Oats, Maize) Fruits (Citrus, Dates, Grapes, Apples) Vegetables (Potatoes, Tomatoes, Onions, Carrots) Legumes and Pulses (Chickpeas, Lentils, Beans) Oilseeds (Olives, Sunflower, Peanuts) Livestock (Cattle, Sheep, Goats, Poultry) Dairy Products Processed Foods Organic Products Others |

| By End-User | Retail Consumers Food Processing Industry Export Markets Government Institutions |

| By Distribution Channel | Direct Sales Wholesale Online Retail Farmers' Markets |

| By Region | Northern Algeria Southern Algeria Eastern Algeria Western Algeria |

| By Farming Method | Conventional Farming Organic Farming Hydroponics |

| By Crop Type | Annual Crops Perennial Crops |

| By Investment Source | Private Investment Government Funding International Aid Cooperative Investments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 100 | Farm Owners, Agricultural Cooperative Leaders |

| Livestock Farmers | 80 | Livestock Managers, Veterinary Professionals |

| Agrochemical Distributors | 60 | Sales Managers, Product Specialists |

| Exporters of Agricultural Products | 50 | Export Managers, Trade Compliance Officers |

| Government Agricultural Policy Makers | 40 | Policy Analysts, Agricultural Economists |

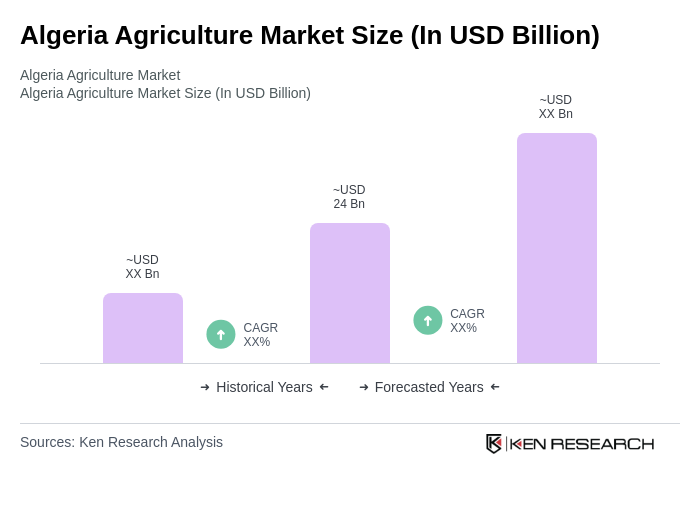

The Algeria Agriculture Market is valued at approximately USD 24 billion, reflecting significant growth driven by increasing food security demands, government initiatives, and investments in technology and infrastructure aimed at enhancing agricultural productivity.