Region:Central and South America

Author(s):Dev

Product Code:KRAC0564

Pages:98

Published On:August 2025

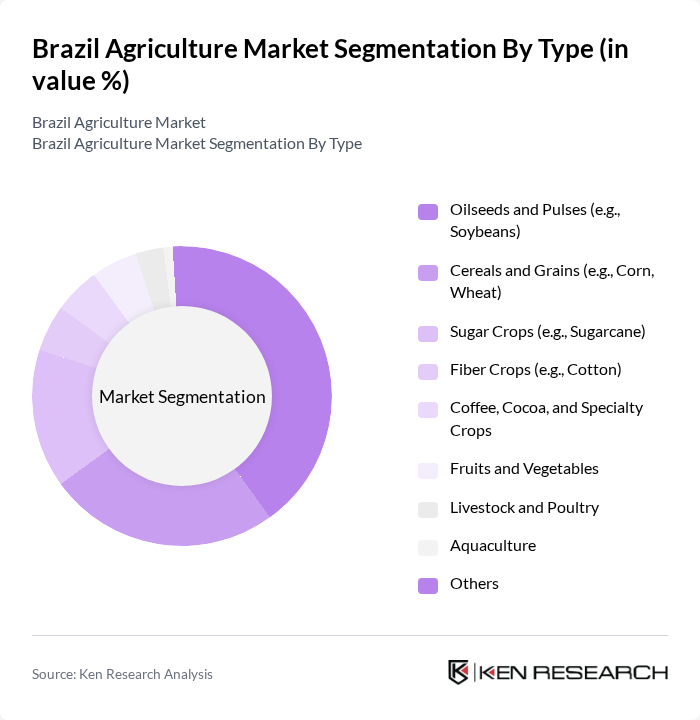

By Type:The agriculture market in Brazil can be segmented into various types, including oilseeds and pulses, cereals and grains, sugar crops, fiber crops, coffee, cocoa, and specialty crops, fruits and vegetables, livestock and poultry, aquaculture, and others. Each of these segments plays a crucial role in the overall agricultural output and contributes to the economy.

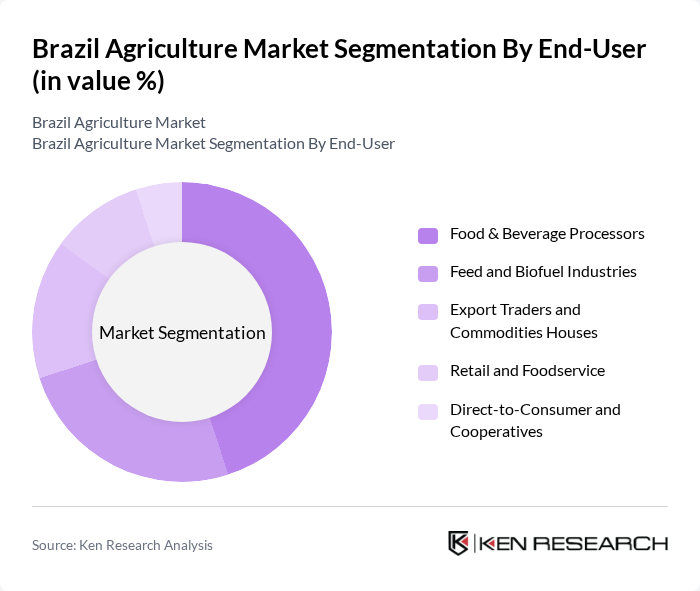

By End-User:The agriculture market serves various end-users, including food and beverage processors, feed and biofuel industries, export traders and commodities houses, retail and foodservice, and direct-to-consumer and cooperatives. Each end-user segment has distinct requirements and contributes to the overall demand for agricultural products.

The Brazil Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as JBS S.A., BRF S.A., Bunge Brasil (Bunge Alimentos S.A.), Cargill Agrícola S.A., Syngenta Proteção de Cultivos Ltda. (Syngenta Brasil), Bayer S.A. (Bayer Crop Science Brasil), Corteva Agriscience Brasil, Amaggi (Grupo André Maggi), Coamo Agroindustrial Cooperativa, SLC Agrícola S.A., Raízen S.A. (Sugarcane/Ethanol), Marfrig Global Foods S.A., Minerva Foods (Athena Foods/Minerva S.A.), Copersucar S.A., Embaré/Vertentes (Dairy) or Aurora Coop (Aurora Cooperativa Central) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's agriculture market appears promising, driven by technological innovations and a growing emphasis on sustainability. As farmers increasingly adopt precision agriculture and sustainable practices, productivity is expected to rise significantly. Additionally, the expansion of export markets, particularly for organic and specialty crops, will provide new revenue streams. However, addressing infrastructure challenges and climate resilience will be crucial for maintaining growth and ensuring long-term sustainability in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Oilseeds and Pulses (e.g., Soybeans) Cereals and Grains (e.g., Corn, Wheat) Sugar Crops (e.g., Sugarcane) Fiber Crops (e.g., Cotton) Coffee, Cocoa, and Specialty Crops Fruits and Vegetables Livestock and Poultry Aquaculture Others |

| By End-User | Food & Beverage Processors Feed and Biofuel Industries Export Traders and Commodities Houses Retail and Foodservice Direct-to-Consumer and Cooperatives |

| By Distribution Channel | Bulk/Wholesale and Cooperatives Direct Contracting (B2B/Institutional) Online B2B Platforms and Marketplaces Modern Trade (Supermarkets/Hypermarkets) |

| By Production Practice | Conventional Organic and Bioinputs |

| By Region | Southeast (Sudeste) South (Sul) Central-West (Centro-Oeste) Northeast (Nordeste) North (Norte) |

| By Farm Size | Large-Scale Commercial Farms Small and Medium-Sized Farms |

| By Technology Adoption | Precision Farming and Digital Tools Mechanized/Conventional Operations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 120 | Farm Owners, Agronomists |

| Livestock Farmers | 100 | Livestock Managers, Veterinary Experts |

| Agrochemical Distributors | 80 | Sales Managers, Product Specialists |

| Export Market Analysts | 60 | Trade Analysts, Export Managers |

| Agri-tech Innovators | 50 | Research & Development Heads, Technology Officers |

The Brazil Agriculture Market is valued at approximately USD 130 billion, reflecting its status as a leading global producer of key commodities such as soybeans, corn, sugarcane, beef, and coffee, driven by favorable conditions and technological advancements.