Region:Africa

Author(s):Geetanshi

Product Code:KRAA2348

Pages:90

Published On:August 2025

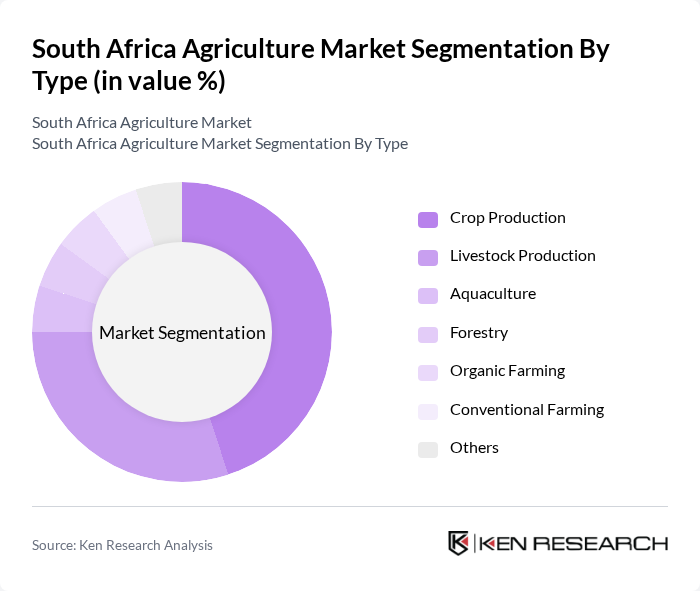

By Type:The agriculture market in South Africa can be segmented into crop production, livestock production, aquaculture, forestry, organic farming, conventional farming, and others. Among these,crop productionis the most dominant segment, driven by the country's favorable climate and fertile land, which supports a wide variety of crops such as maize, citrus, grapes, and deciduous fruits. The increasing demand for food, biofuels, and export commodities has further propelled this segment's growth.Livestock productionalso plays a significant role, with a growing focus on meat, dairy, and poultry products, reflecting changing consumer preferences and export opportunities .

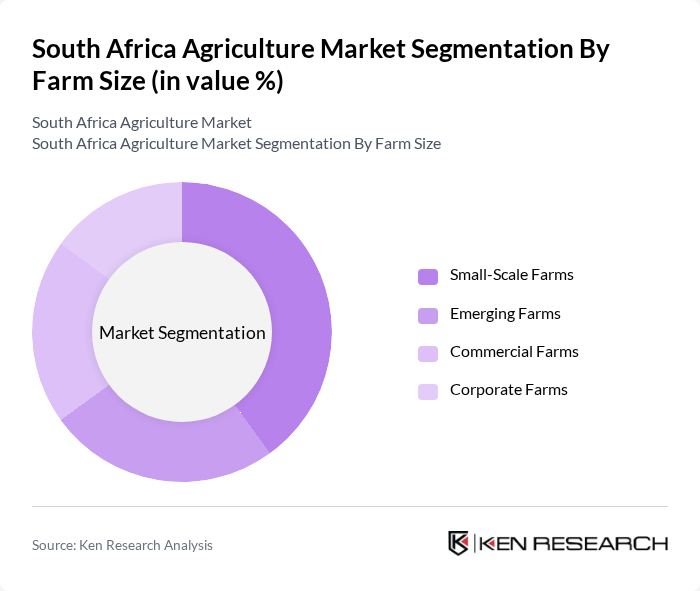

By Farm Size:The segmentation by farm size includes small-scale farms, emerging farms, commercial farms, and corporate farms.Small-scale farmsdominate the market, accounting for a significant portion of agricultural production and playing a vital role in local food supply and rural employment.Emerging farmsare gaining traction as they receive targeted support from government initiatives aimed at promoting agricultural development among previously disadvantaged communities.Commercial and corporate farms, while fewer in number, contribute significantly to the overall agricultural output due to their scale, advanced technology adoption, and export orientation .

The South Africa Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agri SA, Grain SA, South African Farmers' Development Association, Capespan Group, AFGRI Group Holdings, RCL Foods Limited, Tongaat Hulett Limited, Illovo Sugar Africa, Senwes Ltd, VKB Group, ZZ2, Tiger Brands Limited, Bidvest Group Limited, Distell Group Holdings, Pioneer Foods (now part of PepsiCo South Africa) contribute to innovation, geographic expansion, and service delivery in this space.

The South African agriculture market is poised for transformation, driven by technological advancements and a shift towards sustainable practices. The integration of digital platforms is expected to enhance efficiency and transparency in supply chains. Additionally, the increasing focus on climate-resilient crops will likely lead to innovations that mitigate the impacts of climate change. As consumer preferences evolve, the demand for organic and locally sourced products will further shape the market landscape, fostering growth and resilience in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Crop Production Livestock Production Aquaculture Forestry Organic Farming Conventional Farming Others |

| By Farm Size | Small-Scale Farms Emerging Farms Commercial Farms Corporate Farms |

| By End-User | Food Processing Industry Retail Sector Export Markets Local Consumers |

| By Distribution Channel | Direct Sales Wholesale Distributors Online Retail Farmers' Markets |

| By Crop Type | Maize Wheat Barley Sorghum Oats and Other Grains Fruits and Vegetables Oilseeds Pulses |

| By Livestock Type | Cattle Poultry Sheep Goats |

| By Farming Method | Conventional Farming Organic Farming Hydroponics Permaculture |

| By Investment Source | Private Investments Government Grants International Aid Crowdfunding |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 60 | Farm Owners, Agronomists |

| Livestock Farmers | 50 | Livestock Managers, Veterinary Experts |

| Agrochemical Suppliers | 40 | Sales Managers, Product Development Specialists |

| Agro-processing Companies | 40 | Operations Managers, Quality Control Supervisors |

| Exporters of Agricultural Products | 40 | Export Managers, Trade Compliance Officers |

The South Africa Agriculture Market is valued at approximately USD 17.3 billion, reflecting growth driven by increasing food demand, advancements in agricultural technology, and government support for sustainable practices.