Region:Central and South America

Author(s):Dev

Product Code:KRAA1627

Pages:83

Published On:August 2025

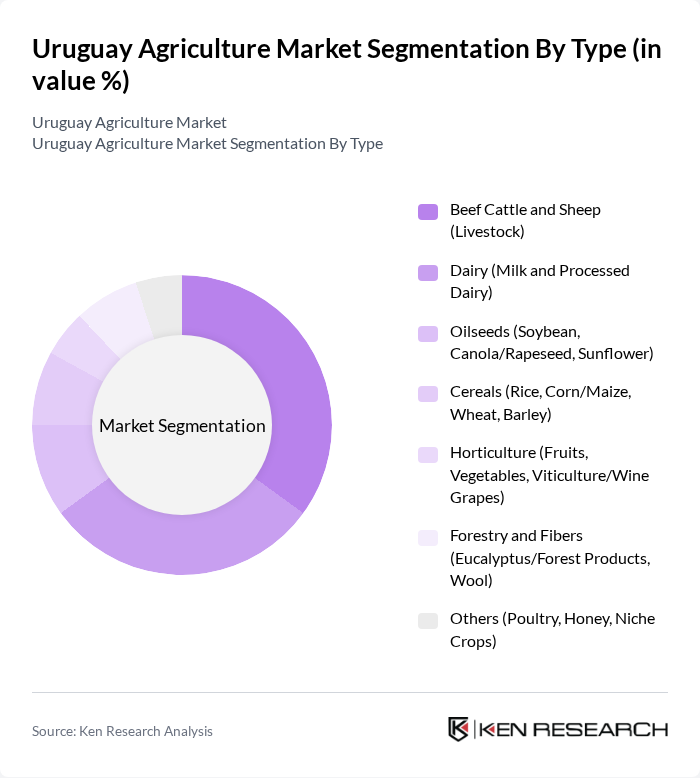

By Type:The agriculture market in Uruguay can be segmented into various types, including livestock, dairy, oilseeds, cereals, horticulture, forestry, and others. Each of these segments plays a crucial role in the overall agricultural output, with specific sub-segments catering to both domestic and international markets.

By End-User:The end-user segmentation of the agriculture market includes various categories such as export markets, food and beverage processing, retail and foodservice, and industrial uses. Each category reflects the diverse applications of agricultural products in both local and international markets.

The Uruguay Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Conaprole (Cooperativa Nacional de Productores de Leche), Frigorífico Las Piedras S.A., Marfrig Global Foods (Operaciones en Uruguay incl. Frigorífico Tacuarembó), Minerva Foods (Pulsa S.A. / Frigorífico Canelones), Olam Uruguay S.A. (arroz/rice), SAMAN – Sociedad Anónima Molinos Arroceros Nacionales, Union Agriculture Group (UAG), Agronegocios del Plata (ADP) – Agroempresa Colonizadora S.A., Cargill Uruguay S.A., Bunge Uruguay S.A., ADM (Archer Daniels Midland) Uruguay, UPM – UPM-Kymmene (celulosa/pulp, forestry supply chain), Montes del Plata (Arauco & Stora Enso JV), Central Lanera Uruguaya (cooperativa de lana/wool), INIA – Instituto Nacional de Investigación Agropecuaria contribute to innovation, geographic expansion, and service delivery in this space.

The future of Uruguay's agriculture market appears promising, driven by increasing global demand for sustainable and organic products. As consumer preferences shift towards healthier food options, the adoption of organic farming practices is expected to rise significantly. Additionally, the integration of digital technologies in supply chains will enhance efficiency and transparency, allowing farmers to better meet market demands. These trends indicate a transformative phase for the agricultural sector, positioning it for sustainable growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Beef Cattle and Sheep (Livestock) Dairy (Milk and Processed Dairy) Oilseeds (Soybean, Canola/Rapeseed, Sunflower) Cereals (Rice, Corn/Maize, Wheat, Barley) Horticulture (Fruits, Vegetables, Viticulture/Wine Grapes) Forestry and Fibers (Eucalyptus/Forest Products, Wool) Others (Poultry, Honey, Niche Crops) |

| By End-User | Export Markets (Beef, Dairy, Rice, Soy, Canola, Wool) Food & Beverage Processing (Meatpacking, Dairy Processing, Milling) Retail & Foodservice (Domestic Consumption) Industrial Uses (Biofuels, Feed, Pulp & Paper) |

| By Distribution Channel | Direct Exporters and Trading Houses Cooperatives and Producer Associations Wholesale Distributors Retailers, Farmers' Markets, and Online |

| By Product Quality | Organic and Certified Sustainable (e.g., grass-fed, carbon-neutral) Conventional |

| By Packaging Type | Bulk/Commodity (sacks, containers, tankers) Retail/Consumer Pack |

| By Seasonality | Seasonal Products Year-Round Products |

| By Price Range | Premium (e.g., branded beef, fine wines, specialty dairy) Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 100 | Farm Owners, Agronomists |

| Livestock Farmers | 80 | Beef Producers, Dairy Farmers |

| Agricultural Technology Providers | 60 | Product Managers, Sales Directors |

| Exporters of Agricultural Products | 70 | Export Managers, Trade Analysts |

| Government Agricultural Policy Makers | 50 | Policy Advisors, Regulatory Officials |

The Uruguay Agriculture Market is valued at approximately USD 9 billion, driven by strong agricultural exports, particularly in beef and dairy products, which are in high global demand. This valuation is based on a five-year historical analysis of the sector.