Region:Africa

Author(s):Rebecca

Product Code:KRAA2379

Pages:94

Published On:August 2025

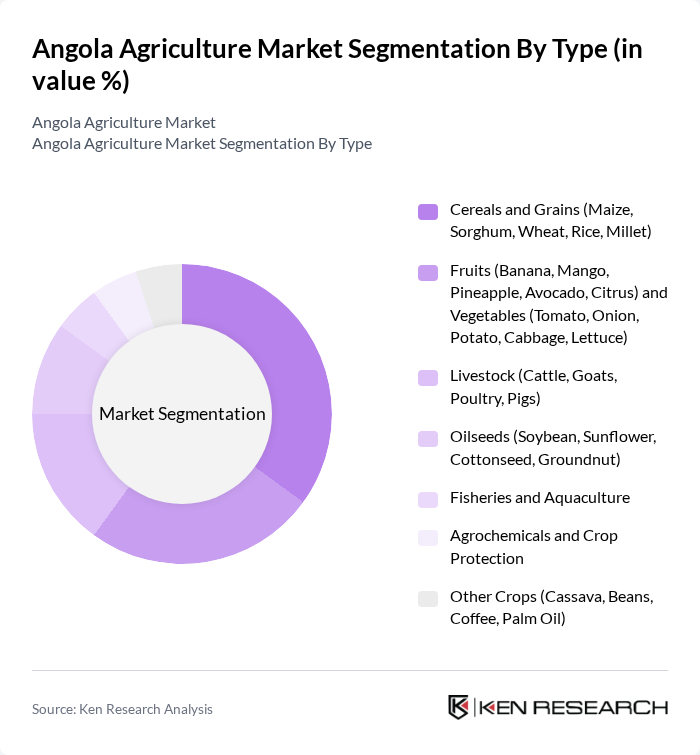

By Type:The agriculture market in Angola is segmented into cereals and grains, fruits and vegetables, livestock, oilseeds, fisheries and aquaculture, agrochemicals, and other crops. Cereals and grains, especially maize, sorghum, and rice, constitute the largest share, driven by staple food demand and government support. Fruits (notably bananas and mangoes) and vegetables (such as tomatoes and potatoes) are expanding rapidly, supported by investments in irrigation and improved seed varieties. Livestock, oilseeds, and fisheries are also significant, with ongoing modernization and value-chain development initiatives .

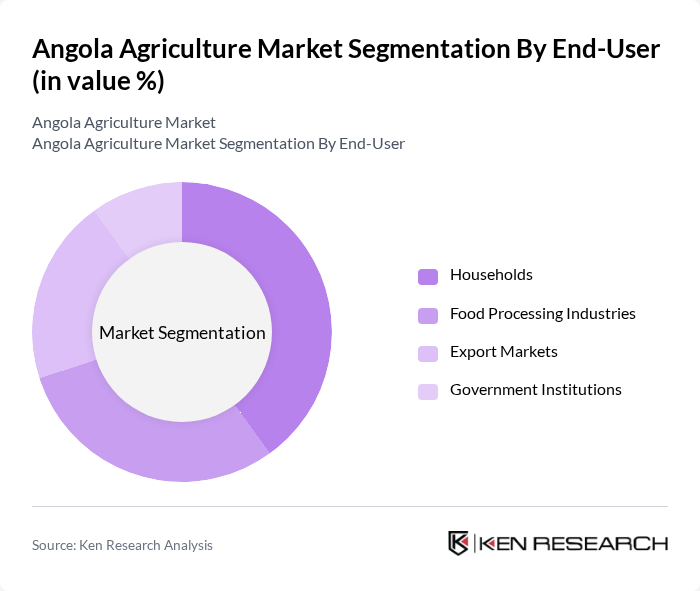

By End-User:The end-user segmentation of the agriculture market includes households, food processing industries, export markets, and government institutions. Households remain the largest consumers, reflecting the predominance of subsistence and smallholder farming. Food processing industries are growing due to increased investment in agro-processing, while export markets and government procurement are expanding as Angola seeks to boost value-added exports and ensure institutional food supply .

The Angola Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gesterra S.A., Aldeia Nova, Quiminha Project (PIDARQ), Angola Coton S.A., Agropecuária do Kwanza S.A., Sodepac S.A., Olam International Angola, Cotonang S.A., Agroindústria de Luanda S.A., Cargill Angola, Ceres Media S.A., Cacau de Angola S.A., Frutal S.A., Agropecuária do Sul S.A., Angolagro S.A., Companhia de Abastecimento de Angola S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Angola's agriculture market appears promising, driven by increasing investments in technology and government initiatives aimed at enhancing food security. As the country continues to prioritize local production, the agricultural sector is expected to evolve with a focus on sustainability and innovation. The integration of digital tools in farming practices will likely improve efficiency and yield, while the expansion of export markets presents new opportunities for growth. Overall, the sector is poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cereals and Grains (Maize, Sorghum, Wheat, Rice, Millet) Fruits (Banana, Mango, Pineapple, Avocado, Citrus) and Vegetables (Tomato, Onion, Potato, Cabbage, Lettuce) Livestock (Cattle, Goats, Poultry, Pigs) Oilseeds (Soybean, Sunflower, Cottonseed, Groundnut) Fisheries and Aquaculture Agrochemicals and Crop Protection Other Crops (Cassava, Beans, Coffee, Palm Oil) |

| By End-User | Households Food Processing Industries Export Markets Government Institutions |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms Wholesale Markets |

| By Crop Type | Annual Crops (Maize, Beans, Rice) Perennial Crops (Coffee, Fruit Trees) Horticultural Crops (Vegetables, Flowers) |

| By Farming Method | Conventional Farming Organic Farming Precision Agriculture/Smart Farming |

| By Region | Luanda Benguela Huambo Cunene Huíla Moxico |

| By Investment Type | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 100 | Farm Owners, Agronomists |

| Horticulture Sector | 60 | Greenhouse Managers, Crop Specialists |

| Coffee and Cocoa Farmers | 40 | Cooperative Leaders, Export Managers |

| Livestock Farmers | 50 | Livestock Managers, Veterinary Officers |

| Agricultural Input Suppliers | 50 | Sales Representatives, Supply Chain Managers |

The Angola Agriculture Market is valued at approximately USD 8.5 billion, reflecting significant growth driven by increased food security demands, government investments, and modern farming techniques. This growth is part of a broader strategy to diversify the economy away from oil dependency.