Region:Central and South America

Author(s):Shubham

Product Code:KRAB0769

Pages:93

Published On:August 2025

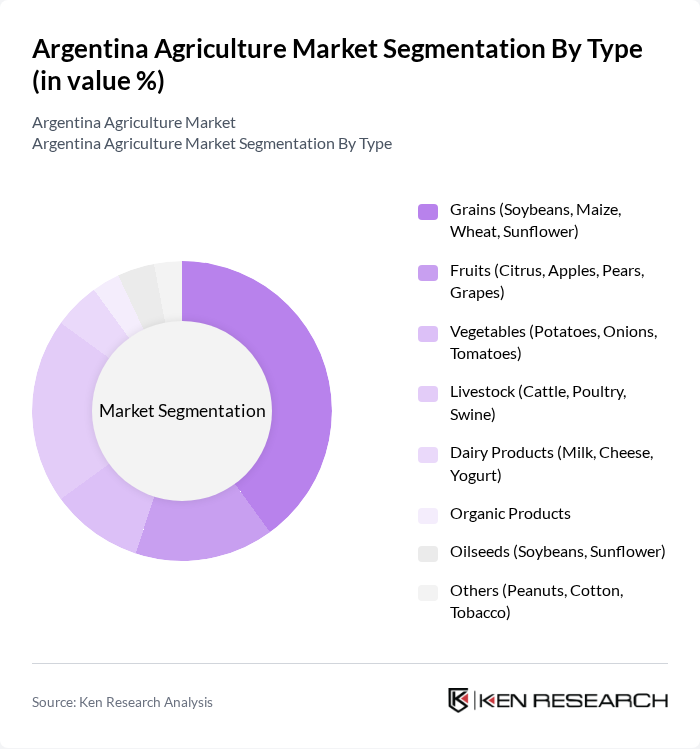

By Type:The agriculture market in Argentina is segmented into grains, fruits, vegetables, livestock, dairy products, organic products, oilseeds, and others. Among these,grains—especially soybeans, maize, and wheat—dominate the market, driven by high demand for both domestic consumption and export. The growing global appetite for protein-rich foods has also strengthened the livestock and dairy segments, which remain significant contributors to overall market value. Technological innovation, such as precision agriculture and biotechnology, is increasingly applied across all segments to boost yields and sustainability .

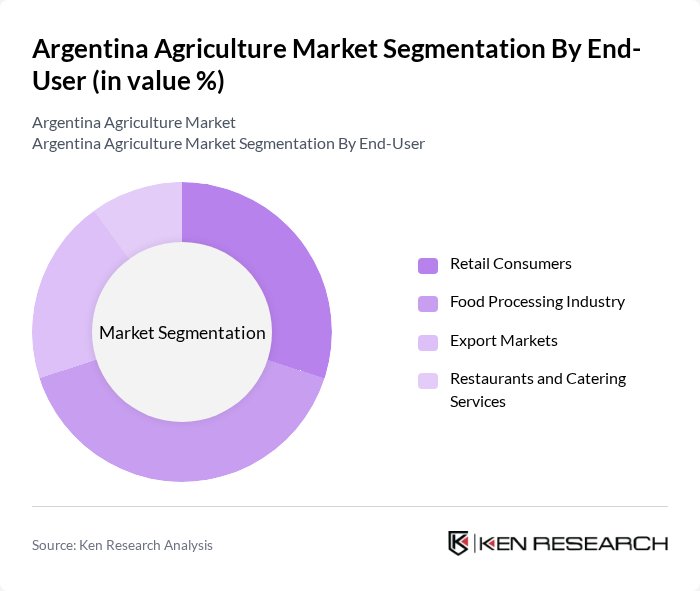

By End-User:The end-user segmentation of the agriculture market includes retail consumers, the food processing industry, export markets, and restaurants and catering services. Thefood processing industryis a major end-user, supported by the increasing demand for processed foods and value-added products. Retail consumers are also significant, as population growth and evolving dietary preferences drive higher consumption of agricultural goods. Export markets remain a key outlet, with Argentina’s agro-industrial products generating substantial foreign currency inflows .

The Argentina Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Los Grobo, Adecoagro S.A., Cargill Argentina S.A., Bunge Argentina S.A., Molinos Río de la Plata S.A., San Miguel S.A., Agrofina S.A., Sodecar S.A., Agricultores Federados Argentinos SCL, La Anónima S.A., Cía. Argentina de Granos S.A., Rizobacter Argentina S.A., Bioceres S.A., Agroindustrial La Estrella S.A., Sancor Cooperativas Unidas Ltda. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Argentina's agriculture market appears promising, driven by a combination of technological advancements and increasing global demand for sustainable practices. As farmers adopt precision agriculture and invest in sustainable methods, productivity is expected to rise. Additionally, the government’s commitment to supporting agricultural exports will likely enhance competitiveness. However, addressing economic instability and infrastructure challenges will be crucial for realizing the full potential of the sector in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Grains (Soybeans, Maize, Wheat, Sunflower) Fruits (Citrus, Apples, Pears, Grapes) Vegetables (Potatoes, Onions, Tomatoes) Livestock (Cattle, Poultry, Swine) Dairy Products (Milk, Cheese, Yogurt) Organic Products Oilseeds (Soybeans, Sunflower) Others (Peanuts, Cotton, Tobacco) |

| By End-User | Retail Consumers Food Processing Industry Export Markets Restaurants and Catering Services |

| By Distribution Channel | Direct Sales Wholesale Markets Online Retail Supermarkets and Hypermarkets |

| By Region | Buenos Aires Córdoba Santa Fe Mendoza Tucumán Others |

| By Product Quality | Conventional Organic Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Production Insights | 120 | Farm Owners, Agronomists |

| Livestock Farming Practices | 90 | Livestock Farmers, Veterinary Experts |

| Agrochemical Usage Trends | 60 | Agrochemical Distributors, Crop Consultants |

| Export Market Dynamics | 50 | Export Managers, Trade Analysts |

| Sustainable Farming Initiatives | 40 | Sustainability Officers, Agricultural Policy Makers |

The Argentina Agriculture Market is valued at approximately USD 26 billion, reflecting its significant contribution to the national economy, accounting for about 10% of GDP and nearly 60% of total exports.