Region:Africa

Author(s):Dev

Product Code:KRAA1509

Pages:86

Published On:August 2025

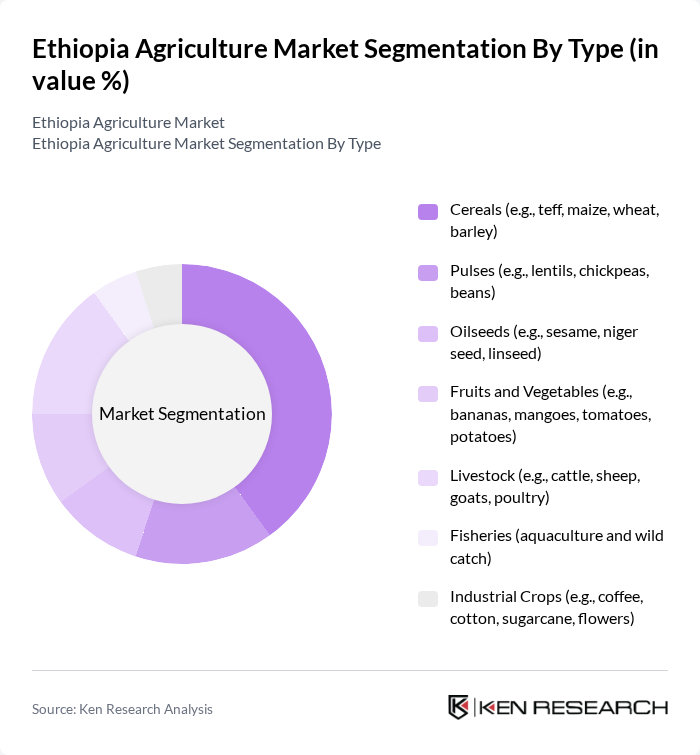

By Type:The market can be segmented into cereals, pulses, oilseeds, fruits and vegetables, livestock, fisheries, and industrial crops. Each of these subsegments plays a vital role in Ethiopia’s agricultural landscape, supporting both domestic consumption and export markets. Cereals, especially teff and maize, are dietary staples and dominate cultivated area and production volumes. Coffee stands out as the leading industrial crop, generating the highest export revenue among agricultural commodities. Livestock is also a significant segment, with Ethiopia holding one of Africa’s largest livestock populations. Fruits and vegetables, oilseeds (notably sesame), and fisheries contribute to both food security and export diversification .

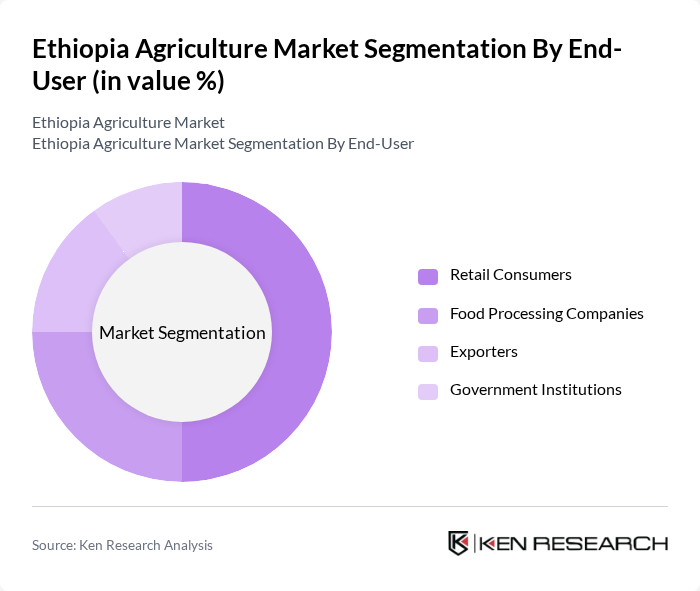

By End-User:The end-user segmentation includes retail consumers, food processing companies, exporters, and government institutions. Retail consumers represent the largest segment, reflecting the country’s large and growing population, as well as the dominance of staple foods in household consumption. Food processing companies are increasingly important, driven by urbanization and rising demand for packaged and value-added products. Exporters play a key role in foreign exchange earnings, especially in coffee, oilseeds, and pulses. Government institutions are involved in procurement, food security programs, and agricultural support services .

The Ethiopia Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ethiopian Agricultural Transformation Agency (ATA), Ethio Agri-CEFT PLC, Horizon Plantations PLC, Awash Wine Share Company, Ethiopian Coffee and Tea Authority, Ethiopian Horticulture Producer Exporters Association (EHPEA), Ethiopian Pulses, Oilseeds, and Spices Processors-Exporters Association (EPOSPEA), Ethiopian Meat and Dairy Industry Development Institute, Ethiopian Grain Trade Enterprise (EGTE), Ethiopian Agricultural Research Institute (EARI), Ethiopian Coffee Association, Ethiopian Seed Enterprise, Ethiopian Fisheries and Aquatic Life Research Center, Ethiopian Agricultural Inputs Supply Enterprise (AISSE), and Ethiopian Institute of Agricultural Research (EIAR) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Ethiopia's agriculture market appears promising, driven by increasing investments in sustainable practices and technology. The government’s focus on enhancing agricultural resilience against climate change is expected to foster innovation and improve productivity. Additionally, the rise of urban agriculture and digital sales platforms will likely reshape market dynamics, providing new opportunities for farmers. As Ethiopia continues to strengthen its agricultural policies, the sector is poised for growth, contributing significantly to the national economy and food security.

| Segment | Sub-Segments |

|---|---|

| By Type | Cereals (e.g., teff, maize, wheat, barley) Pulses (e.g., lentils, chickpeas, beans) Oilseeds (e.g., sesame, niger seed, linseed) Fruits and Vegetables (e.g., bananas, mangoes, tomatoes, potatoes) Livestock (e.g., cattle, sheep, goats, poultry) Fisheries (aquaculture and wild catch) Industrial Crops (e.g., coffee, cotton, sugarcane, flowers) |

| By End-User | Retail Consumers Food Processing Companies Exporters Government Institutions |

| By Distribution Channel | Direct Sales Wholesale Markets Online Platforms Cooperative Societies |

| By Crop Season | Rainy Season Crops Dry Season Crops |

| By Farming Method | Conventional Farming Organic Farming Hydroponics |

| By Market Type | Domestic Market Export Market |

| By Certification Type | Organic Certified Non-Organic Fair Trade Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 150 | Farm Owners, Agricultural Extension Workers |

| Pulses and Legumes Market | 100 | Cooperative Leaders, Agronomists |

| Cash Crop Exporters | 80 | Export Managers, Supply Chain Coordinators |

| Agrochemical Suppliers | 60 | Sales Representatives, Product Managers |

| Farm Equipment Distributors | 40 | Distribution Managers, Retail Buyers |

The Ethiopia Agriculture Market is valued at approximately USD 5 billion, driven by increasing food security demands, government initiatives to boost agricultural productivity, and the expansion of export markets for Ethiopian agricultural products.