Region:Asia

Author(s):Rebecca

Product Code:KRAD8386

Pages:97

Published On:December 2025

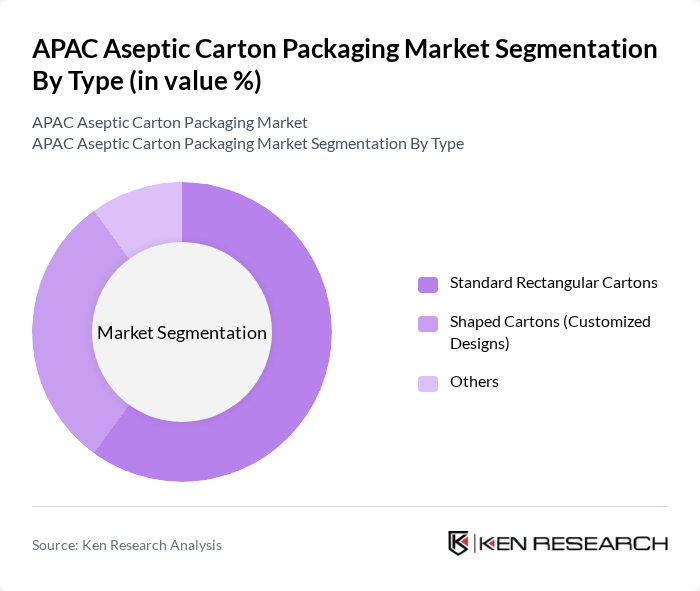

By Type:The market is segmented into three types: Standard Rectangular Cartons, Shaped Cartons (Customized Designs), and Others. Among these, Standard Rectangular Cartons dominate the market due to their versatility and cost-effectiveness, making them a preferred choice for various applications. The demand for Shaped Cartons is also growing as brands seek to differentiate their products through unique designs, appealing to consumer preferences for aesthetics and functionality.

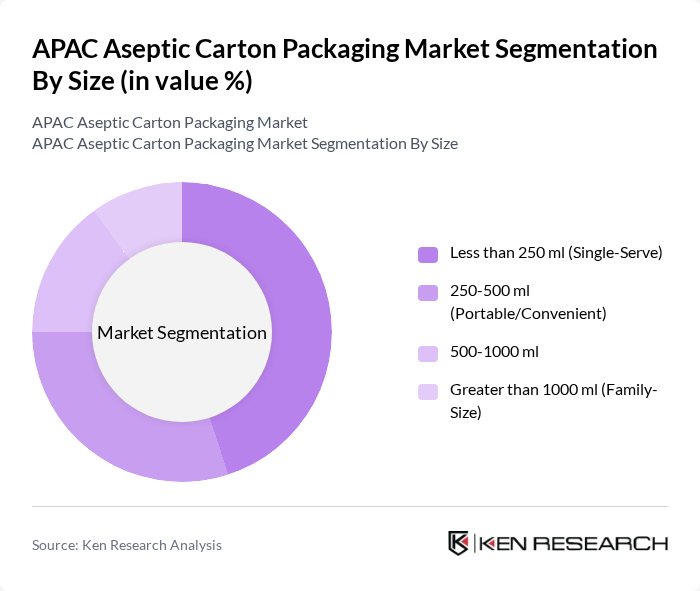

By Size:The market is categorized into four sizes: Less than 250 ml (Single-Serve), 250-500 ml (Portable/Convenient), 500-1000 ml, and Greater than 1000 ml (Family-Size). The Less than 250 ml segment is leading due to the rising trend of single-serve packaging, particularly in beverages and dairy products. The convenience factor and portion control offered by this size are driving consumer preferences, especially among younger demographics.

The APAC Aseptic Carton Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tetra Pak, SIG Combibloc, Elopak, Nippon Paper Industries, Huhtamaki, Amcor Limited, Mondi Group, Stora Enso, Smurfit Kappa Group, International Paper Company, Graphic Packaging International, WestRock Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC aseptic carton packaging market appears promising, driven by technological advancements and evolving consumer preferences. As sustainability becomes a priority, companies are increasingly adopting eco-friendly materials and smart packaging technologies. The rise of e-commerce and online food delivery services is also expected to boost demand for convenient packaging solutions. With a focus on innovation and sustainability, the market is poised for significant growth, catering to the needs of health-conscious consumers and environmentally aware businesses.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Rectangular Cartons Shaped Cartons (Customized Designs) Others |

| By Size | Less than 250 ml (Single-Serve) 500 ml (Portable/Convenient) 1000 ml Greater than 1000 ml (Family-Size) |

| By Application | Dairy Products (Milk, Flavored Milk, Yogurt Drinks) Beverages (Juices, Energy Drinks, Plant-Based Drinks) Pharmaceuticals Others |

| By Material | Paperboard Plastic Aluminum |

| By Country | China India Japan South Korea Southeast Asia Australia Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Convenience Stores Specialty Stores |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 120 | Product Managers, Packaging Engineers |

| Dairy Product Packaging | 80 | Supply Chain Managers, Quality Assurance Heads |

| Juice & Beverage Packaging | 100 | Operations Managers, Procurement Officers |

| Pharmaceutical Packaging | 60 | Regulatory Affairs Specialists, R&D Managers |

| Market Trends & Innovations | 70 | Industry Analysts, Marketing Directors |

The APAC Aseptic Carton Packaging Market is valued at approximately USD 24.1 billion, driven by the increasing demand for convenient and long-shelf-life packaging solutions in the food and beverage sector, as well as advancements in packaging technology.