Region:Asia

Author(s):Rebecca

Product Code:KRAD6228

Pages:87

Published On:December 2025

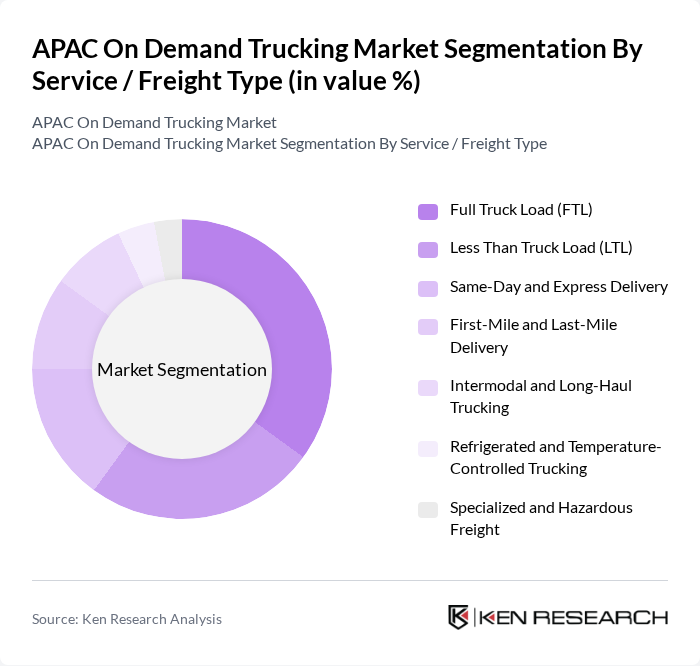

By Service / Freight Type:The service type segmentation includes various subsegments such as Full Truck Load (FTL), Less Than Truck Load (LTL), Same-Day and Express Delivery, First-Mile and Last-Mile Delivery, Intermodal and Long-Haul Trucking, Refrigerated and Temperature-Controlled Trucking, and Specialized and Hazardous Freight. Among these, the Full Truck Load (FTL) segment is currently leading the market due to its efficiency in transporting large volumes of goods, which is particularly favored by manufacturers and retailers looking to optimize logistics costs.

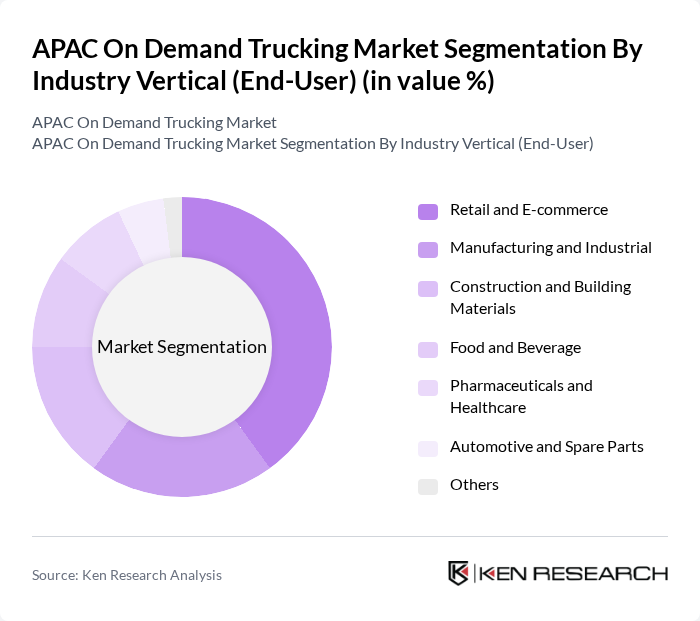

By Industry Vertical (End-User):The industry vertical segmentation encompasses Retail and E-commerce, Manufacturing and Industrial, Construction and Building Materials, Food and Beverage, Pharmaceuticals and Healthcare, Automotive and Spare Parts, and Others. The Retail and E-commerce segment is the most dominant, driven by the surge in online shopping and the need for quick delivery solutions. This trend has led to increased investments in logistics and technology to meet consumer demands.

The APAC On Demand Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Full Truck Alliance (Manbang Group, China), Delhivery (India), BlackBuck (Zinka Logistics Solutions, India), Rivigo (India), Porter (SmartShift Logistics Solutions, India), Gojek (Indonesia), Grab (Singapore), Lalamove (Hong Kong), Ninja Van (Singapore), Blue Dart Express (India), J&T Express (Indonesia), Kerry Logistics Network (Hong Kong), SF Express (SF Holding, China), JD Logistics (China), XPO Logistics (Asia-Pacific Operations), DB Schenker (Asia-Pacific Operations) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC on-demand trucking market appears promising, driven by ongoing technological advancements and increasing consumer expectations for rapid delivery. As urbanization continues to rise, logistics companies are likely to invest in innovative solutions to enhance efficiency. Additionally, the growing emphasis on sustainability will push firms to adopt greener practices, such as electric vehicles, which could reshape the competitive landscape and create new market dynamics in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service / Freight Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Same-Day and Express Delivery First-Mile and Last-Mile Delivery Intermodal and Long-Haul Trucking Refrigerated and Temperature-Controlled Trucking Specialized and Hazardous Freight |

| By Industry Vertical (End-User) | Retail and E-commerce Manufacturing and Industrial Construction and Building Materials Food and Beverage Pharmaceuticals and Healthcare Automotive and Spare Parts Others |

| By Country | China India Japan South Korea Australia Southeast Asia (Indonesia, Thailand, Vietnam, Malaysia, Singapore, Others) Rest of Asia-Pacific |

| By Vehicle Type | Light-Duty Trucks Medium-Duty Trucks Heavy-Duty Trucks Electric and New-Energy Trucks Others |

| By Service Model | One-Time / Spot Market Services Contractual / Dedicated Contract Carriage Platform / Marketplace Aggregator Services Cross-Border and Intermodal Services Others |

| By Technology Integration | GPS and Real-Time Tracking Fleet Management and TMS Platforms Telematics and IoT-Enabled Trucks AI-Based Load and Route Optimization E-Documentation and Digital Payments Others |

| By Operating Environment | Urban and Intra-City Intercity and Regional Long-Haul and Cross-Border |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| On-Demand Trucking for E-commerce | 120 | Logistics Managers, E-commerce Operations Heads |

| Last-Mile Delivery Solutions | 100 | Delivery Coordinators, Fleet Supervisors |

| Cold Chain Logistics | 80 | Supply Chain Managers, Quality Assurance Officers |

| Intercity Freight Services | 70 | Transport Managers, Business Development Executives |

| Urban Freight Solutions | 90 | City Logistics Planners, Environmental Officers |

The APAC On Demand Trucking Market is valued at approximately USD 84 billion, driven by the rapid expansion of e-commerce, increasing demand for logistics services, and the need for efficient supply chain solutions across the region.