Region:Asia

Author(s):Rebecca

Product Code:KRAE0920

Pages:95

Published On:December 2025

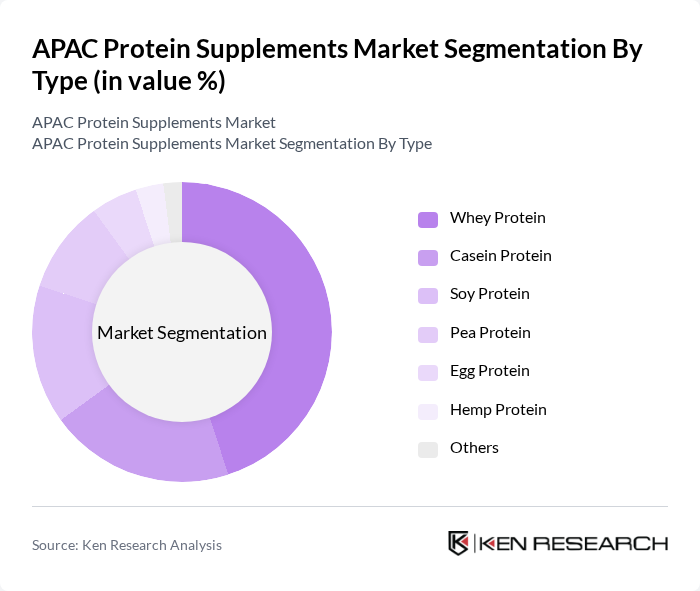

By Type:The protein supplements market is segmented into various types, including whey protein, casein protein, soy protein, pea protein, egg protein, hemp protein, and others. Among these, whey protein dominates the market due to its high biological value, rapid absorption, and popularity among athletes and fitness enthusiasts. The increasing demand for plant-based proteins, particularly soy and pea protein, is also notable as consumers shift towards healthier and sustainable options.

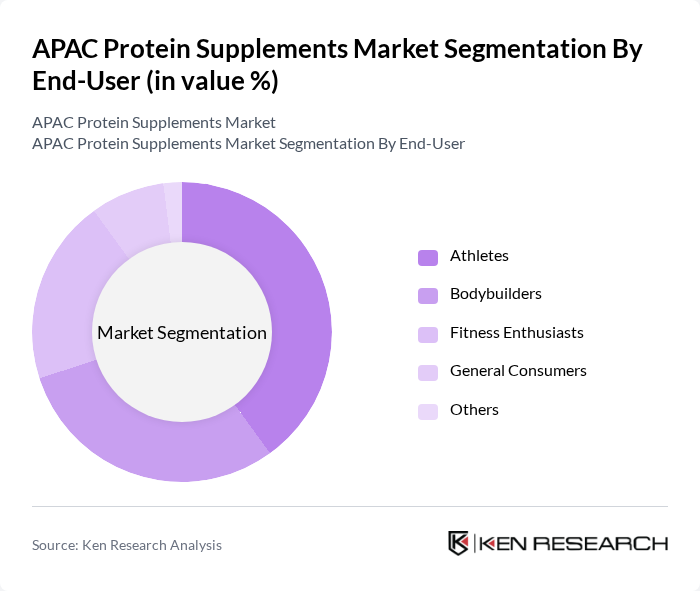

By End-User:The end-user segmentation includes athletes, bodybuilders, fitness enthusiasts, general consumers, and others. Athletes and bodybuilders represent the largest segments, driven by their need for high protein intake to support muscle recovery and growth. The rising trend of fitness among the general population is also contributing to the growth of protein supplements, as more individuals seek to enhance their health and fitness levels.

The APAC Protein Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Glanbia, Abbott, Herbalife, Nestlé, MuscleBlaze, Oziva, and MyProtein contribute to innovation, geographic expansion, and service delivery in this space.

The APAC protein supplements market is poised for significant growth, driven by evolving consumer preferences towards health and wellness. Innovations in product formulations, particularly in plant-based proteins, are expected to attract a broader consumer base. Additionally, the rise of personalized nutrition solutions will cater to individual dietary needs, enhancing customer loyalty. As e-commerce continues to expand, brands that leverage digital marketing and influencer partnerships will likely gain a competitive edge in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Whey Protein Casein Protein Soy Protein Pea Protein Egg Protein Hemp Protein Others |

| By End-User | Athletes Bodybuilders Fitness Enthusiasts General Consumers Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Health and Wellness Stores Others |

| By Formulation | Powder Bars Ready-to-Drink Capsules/Tablets Others |

| By Age Group | Children Adults Seniors Others |

| By Region | North Asia Southeast Asia South Asia Oceania Others |

| By Packaging Type | Bags Tubs Sachets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Protein Supplement Sales | 150 | Store Managers, Sales Executives |

| Fitness Center Clientele | 100 | Gym Owners, Personal Trainers |

| Online Protein Supplement Purchases | 120 | E-commerce Managers, Digital Marketing Specialists |

| Health and Wellness Influencers | 80 | Nutritionists, Fitness Bloggers |

| Consumer Preferences in Protein Types | 200 | End-users, Health-conscious Consumers |

The APAC Protein Supplements Market is currently valued at approximately USD 1.7 billion. This growth is driven by increasing health consciousness, urbanization, and a strong fitness culture across urban and semi-urban populations in the region.