Austria Protein Supplements Market Overview

- The Austria Protein Supplements Market is valued at USD 320 million, based on a five-year historical analysis. This growth is primarily driven by increasing health and wellness consciousness among consumers, the rise in fitness and sports activities, and the growing trend of protein-rich and plant-based diets. Demand for protein supplements has surged as more individuals seek to enhance physical performance, support muscle recovery, and manage weight, with innovation in product formulations and flavors further fueling market expansion .

- Key cities such as Vienna, Graz, and Linz continue to dominate the market due to high population density and a strong culture of fitness and wellness. These urban centers have seen a notable increase in gyms, health food stores, and wellness centers, contributing to the greater availability and consumption of protein supplements among health-conscious consumers .

- In 2023, the Austrian government implemented regulations to ensure the safety and quality of protein supplements. The Food Supplements Regulation (Verordnung über Nahrungsergänzungsmittel, BGBl. II Nr. 88/2004) issued by the Federal Ministry of Social Affairs, Health, Care and Consumer Protection, mandates comprehensive labeling requirements, including nutritional information and ingredient sourcing, to protect consumers and promote transparency in the health supplement industry .

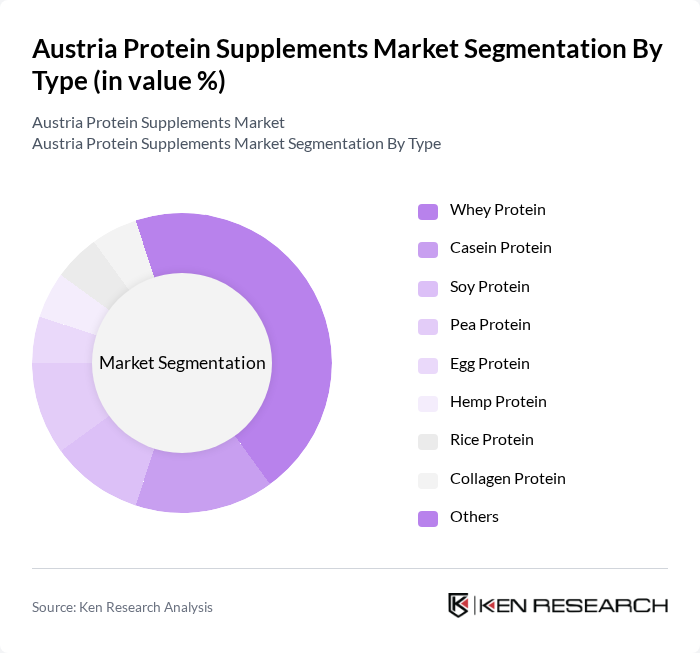

Austria Protein Supplements Market Segmentation

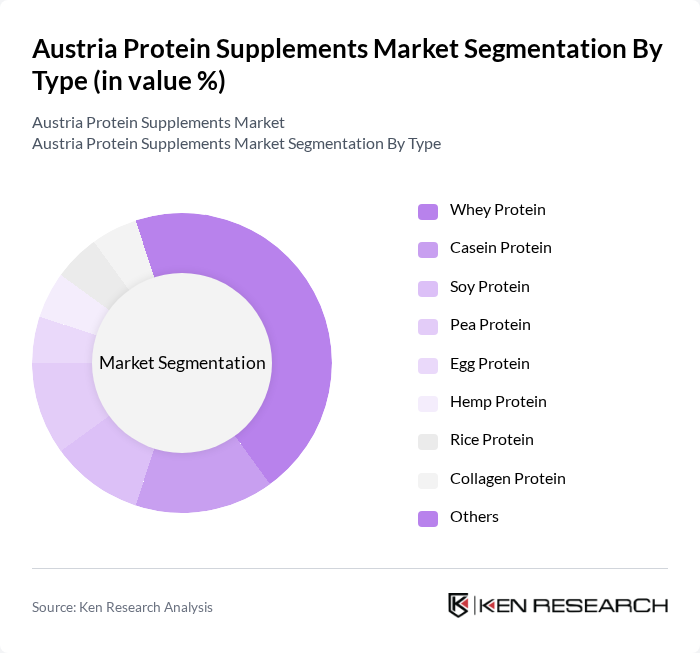

By Type:The protein supplements market is segmented into Whey Protein, Casein Protein, Soy Protein, Pea Protein, Egg Protein, Hemp Protein, Rice Protein, Blended/Multisource Protein, and Others. Whey Protein remains the most dominant segment due to its high bioavailability and proven effectiveness in muscle recovery, making it the preferred choice among athletes, bodybuilders, and fitness enthusiasts. Plant-based proteins, such as pea and soy, are experiencing rapid growth driven by the increasing adoption of vegan and vegetarian diets and demand for allergen-free alternatives .

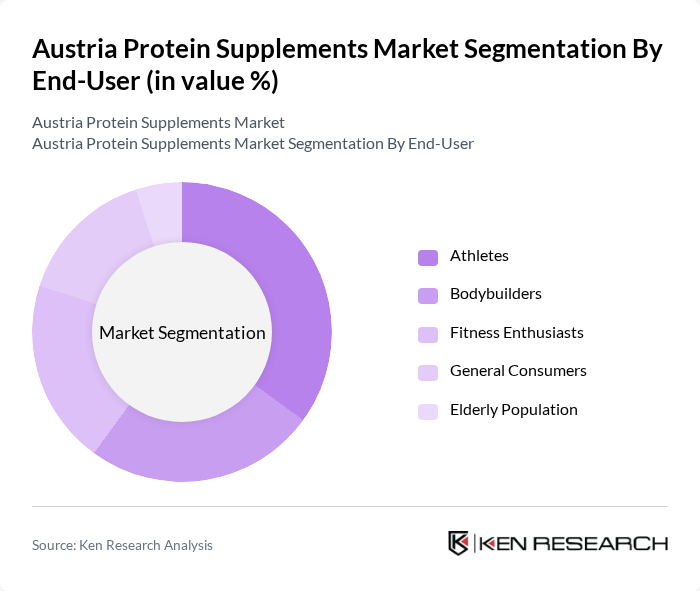

By End-User:The market is segmented by end-users including Athletes, Bodybuilders, Fitness Enthusiasts, General Consumers, and the Elderly Population. Athletes and bodybuilders represent the largest consumer segments, driven by their need for high protein intake to support muscle growth and recovery. Fitness enthusiasts and general consumers are increasingly adopting protein supplements for overall wellness, weight management, and dietary supplementation .

Austria Protein Supplements Market Competitive Landscape

The Austria Protein Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Myprotein (The Hut Group), Peeroton GmbH, Glanbia PLC (Optimum Nutrition), Bulk Powders, Scitec Nutrition, Weider Global Nutrition, Clif Bar & Company, Quest Nutrition, Protein World, Herbalife Nutrition, Isagenix International, GNC Holdings, MusclePharm Corporation, Foodspring GmbH, All Stars Fitness Products GmbH contribute to innovation, geographic expansion, and service delivery in this space .

Austria Protein Supplements Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The Austrian population is increasingly prioritizing health, with 65% of adults actively seeking healthier dietary options. This trend is supported by a recent report from the Austrian Health Ministry, which noted a 20% rise in health-related product consumption over the past five years. The growing awareness of the benefits of protein supplements, particularly among millennials and Gen Z, is driving demand, as these demographics are more inclined to invest in health and wellness products.

- Rise in Fitness and Sports Activities:Austria has seen a significant increase in fitness participation, with over 3.5 million individuals regularly engaging in sports activities. The Austrian Sports Federation reported a 25% increase in gym memberships since 2020, indicating a robust market for protein supplements. This surge in fitness culture is fostering a greater demand for protein products, as consumers seek to enhance their performance and recovery through nutritional supplementation.

- Expansion of E-commerce Platforms:The e-commerce sector in Austria has experienced remarkable growth, with online sales of health and wellness products increasing by 30%. According to the Austrian E-commerce Association, protein supplements are among the top-selling categories, driven by convenience and accessibility. This shift towards online shopping is enabling consumers to explore a wider range of products, thus boosting overall market growth and encouraging brand competition.

Market Challenges

- Regulatory Compliance Issues:The protein supplements market in Austria faces stringent regulatory compliance challenges, particularly concerning food safety standards. The Austrian Agency for Health and Food Safety reported that 35% of protein supplement brands struggled to meet the latest regulations. This compliance burden can hinder market entry for new brands and increase operational costs for existing players, impacting overall market dynamics.

- High Competition Among Brands:The protein supplements market in Austria is characterized by intense competition, with over 160 brands vying for market share. This saturation leads to aggressive pricing strategies, which can erode profit margins. According to industry reports, 45% of brands reported declining sales due to competitive pressures, making it challenging for companies to differentiate their products and maintain customer loyalty.

Austria Protein Supplements Market Future Outlook

The future of the protein supplements market in Austria appears promising, driven by evolving consumer preferences and innovative product developments. As health consciousness continues to rise, brands are likely to focus on natural ingredients and personalized nutrition solutions. Additionally, the expansion of e-commerce will facilitate greater access to diverse product offerings, enhancing consumer engagement. Companies that adapt to these trends and invest in sustainable practices are expected to thrive in this competitive landscape, positioning themselves for long-term success.

Market Opportunities

- Growth in Vegan and Plant-Based Products:The demand for vegan and plant-based protein supplements is surging, with a 35% increase in sales reported. This trend is driven by a growing number of consumers adopting plant-based diets, presenting a significant opportunity for brands to innovate and cater to this expanding market segment.

- Increasing Demand for Personalized Nutrition:Personalized nutrition is gaining traction, with 30% of consumers expressing interest in tailored protein supplements. This shift presents an opportunity for brands to develop customized products that meet individual dietary needs, enhancing customer satisfaction and loyalty while tapping into a lucrative market niche.