Region:Africa

Author(s):Dev

Product Code:KRAA1499

Pages:100

Published On:August 2025

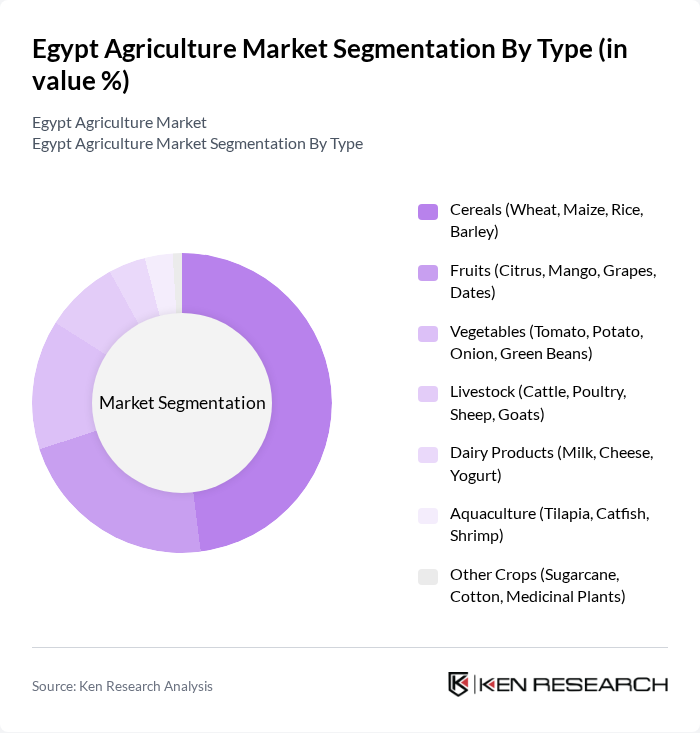

By Type:The market is segmented into various types, including cereals, fruits, vegetables, livestock, dairy products, aquaculture, and other crops. Among these, cereals—particularly wheat and maize—dominate the market due to their essential role in the Egyptian diet and their high demand for both domestic consumption and export. Cereals and grains account for the largest market share, supported by Egypt’s wheat-security strategy and significant investments in grain production. Fruits and vegetables also hold significant market shares, driven by both local consumption and export opportunities. Livestock and dairy products are crucial for meeting the protein needs of the population, while aquaculture is gaining traction due to the increasing demand for fish and the expansion of tilapia and catfish farming .

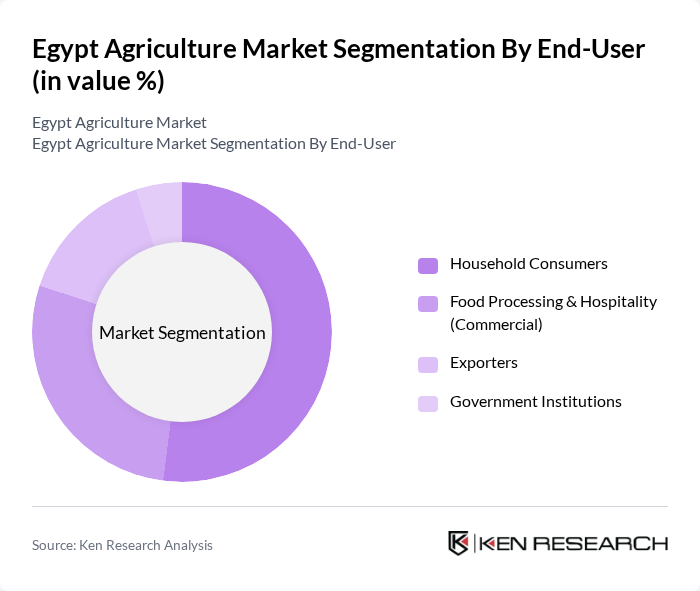

By End-User:The end-user segmentation includes household consumers, food processing and hospitality sectors, exporters, and government institutions. Household consumers represent the largest segment, driven by the increasing population and demand for fresh produce. The food processing sector is also significant, as it requires a steady supply of raw materials for various products. Exporters play a crucial role in the market by tapping into international demand, while government institutions focus on agricultural policies, support, and food security programs .

The Egypt Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ministry of Agriculture and Land Reclamation, Juhayna Food Industries, El-Wahy Group, Arab Dairy Products Co. (Panda), Delta Company for Fertilizers and Chemical Industries, Al-Ahram Beverages Company, Cairo Poultry Company, Misr for Land Reclamation, National Company for Agro Industries, Al-Mansour Agricultural Development Company, Green Land for Food Industries, International Company for Agricultural Production & Processing (ICAPP), Egyptian Food Company (EFC), Al-Fayoum Agricultural Development Company, Nile Valley for Agricultural Development contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's agriculture market appears promising, driven by technological advancements and a growing focus on sustainability. The government’s commitment to enhancing agricultural productivity through innovation and research is expected to yield positive results. Additionally, the increasing consumer preference for organic and locally sourced products will likely stimulate growth. As the sector adapts to challenges such as water scarcity and land degradation, investments in sustainable practices will be crucial for long-term viability and competitiveness in global markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Cereals (Wheat, Maize, Rice, Barley) Fruits (Citrus, Mango, Grapes, Dates) Vegetables (Tomato, Potato, Onion, Green Beans) Livestock (Cattle, Poultry, Sheep, Goats) Dairy Products (Milk, Cheese, Yogurt) Aquaculture (Tilapia, Catfish, Shrimp) Other Crops (Sugarcane, Cotton, Medicinal Plants) |

| By End-User | Household Consumers Food Processing & Hospitality (Commercial) Exporters Government Institutions |

| By Distribution Channel | Direct Sales (Farm Gate) Wholesale Markets Online Retail Platforms Supermarkets & Hypermarkets |

| By Region | Nile Delta Upper Egypt Coastal Regions Western Desert Reclamation Projects |

| By Crop Type | Cash Crops (Cotton, Sugarcane) Food Crops (Wheat, Maize, Rice, Vegetables) Industrial Crops (Medicinal & Aromatic Plants) |

| By Farming Method | Conventional Farming Organic Farming Hydroponics & Controlled Environment Agriculture |

| By Investment Source | Private Investments Government Funding International Aid & Grants Crowdfunding & Cooperative Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 120 | Farm Owners, Agricultural Managers |

| Livestock Farmers | 90 | Livestock Breeders, Veterinary Officers |

| Agrochemical Distributors | 60 | Sales Managers, Product Specialists |

| Exporters of Agricultural Products | 50 | Export Managers, Trade Compliance Officers |

| Research Institutions in Agriculture | 40 | Agricultural Researchers, Policy Analysts |

The Egypt Agriculture Market is valued at approximately USD 43 billion, reflecting significant growth driven by food security demands, government initiatives, urbanization, and export market expansion.