Region:Central and South America

Author(s):Rebecca

Product Code:KRAA1339

Pages:98

Published On:August 2025

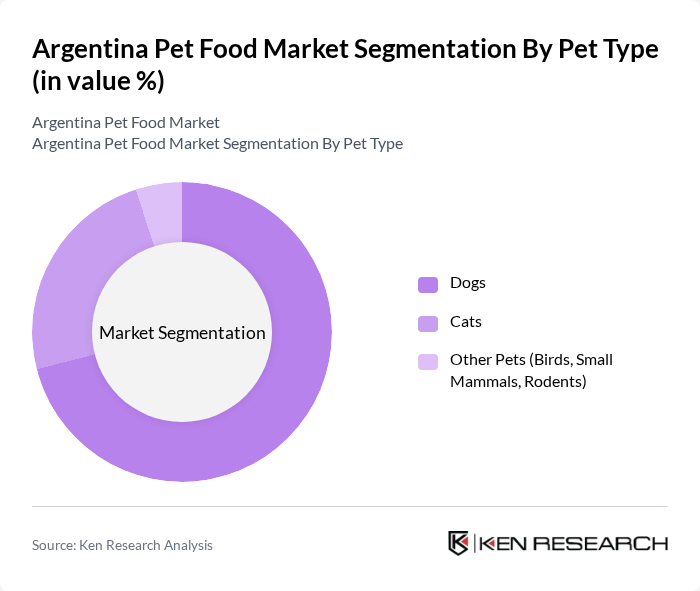

By Pet Type:The pet food market can be segmented into three main categories: Dogs, Cats, and Other Pets (Birds, Small Mammals, Rodents). Among these, the dog food segment is the largest, driven by the high number of dog owners in Argentina and the growing trend of premiumization in pet nutrition. The cat food segment follows, reflecting the rising popularity of cats due to their low maintenance requirements and changing attitudes among pet owners. The other pets segment, while smaller, is expanding as more households adopt birds and small mammals, supported by specialized nutrition products tailored to their unique dietary needs .

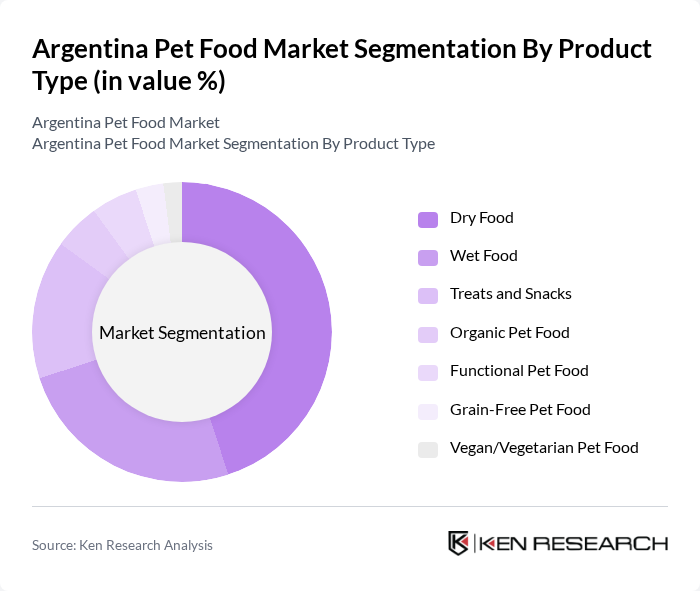

By Product Type:The product type segmentation includes Dry Food, Wet Food, Treats and Snacks, Organic Pet Food, Functional Pet Food, Grain-Free Pet Food, and Vegan/Vegetarian Pet Food. Dry food remains the most popular choice among pet owners due to its convenience, affordability, and suitability for bulk purchasing. Wet food is gaining traction, particularly among cat owners, while organic and functional pet foods are emerging trends as consumers become more health-conscious about their pets' diets. The rise of grain-free and vegan/vegetarian options reflects growing consumer interest in specialized and ethically-sourced pet nutrition .

The Argentina Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Purina PetCare, Mars Petcare (Royal Canin, Pedigree, Whiskas), Grupo Nutresa (DAN, Dogourmet), Pet Food Argentina S.A., Cargill, Inc. (Nutrena), Agrolimen S.A. (Affinity Petcare), Unicharm Corporation, Colgate-Palmolive Company (Hill's Pet Nutrition), Spectrum Brands Holdings, Inc. (United Pet Group), Total Alimentos S.A., Vitalcan S.A., Agroindustrias Baires S.A. (Excellent, Kongo), Alimentos Balanceados S.A., Nutrique (Gepsa Pet Foods), Royal Canin Argentina S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Argentina pet food market is poised for significant transformation, driven by evolving consumer preferences and economic conditions. As pet humanization trends continue, there will be a growing demand for high-quality, nutritious products. Additionally, the expansion of e-commerce platforms is expected to facilitate access to diverse pet food options, enhancing consumer convenience. Companies that adapt to these trends and invest in product innovation will likely capture a larger market share, positioning themselves for long-term success in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Pet Type | Dogs Cats Other Pets (Birds, Small Mammals, Rodents) |

| By Product Type | Dry Food Wet Food Treats and Snacks Organic Pet Food Functional Pet Food Grain-Free Pet Food Vegan/Vegetarian Pet Food |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Pet Stores E-commerce/Online Stores Veterinary Clinics Convenience Stores |

| By Price Category | Economy Mid-Range Premium |

| By Packaging Type | Bags Cans Pouches |

| By Nutritional Content | High Protein Low Carb Balanced Nutrition |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Retailers | 100 | Store Managers, Category Buyers |

| Pet Owners | 120 | Dog and Cat Owners, Pet Enthusiasts |

| Veterinary Clinics | 80 | Veterinarians, Clinic Managers |

| Pet Food Manufacturers | 60 | Product Development Managers, Marketing Directors |

| Pet Supply Distributors | 50 | Distribution Managers, Sales Representatives |

The Argentina Pet Food Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing pet ownership and a trend towards premium and specialized pet food products.