Region:Europe

Author(s):Dev

Product Code:KRAB0636

Pages:96

Published On:August 2025

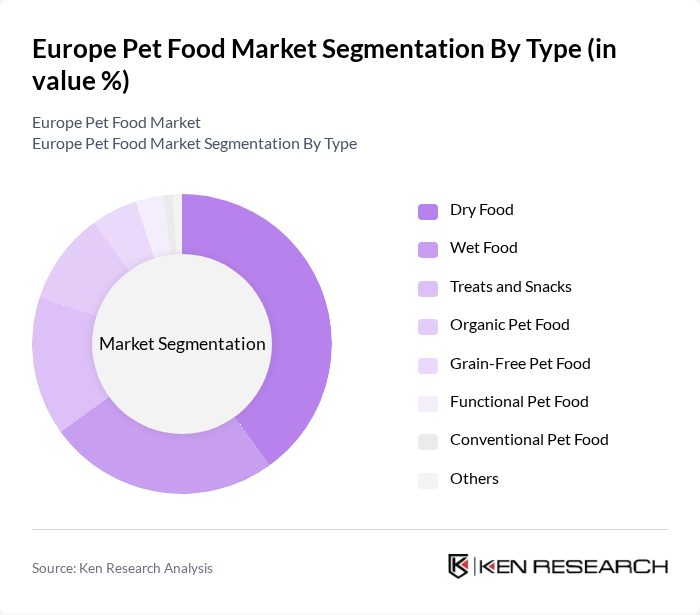

By Type:The pet food market is segmented into Dry Food, Wet Food, Treats and Snacks, Organic Pet Food, Grain-Free Pet Food, Functional Pet Food, Conventional Pet Food, and Others. Dry Food remains the most popular choice among pet owners due to its convenience, extended shelf life, and cost-effectiveness. Wet Food is gaining traction, particularly among cat owners, as it provides hydration and is perceived as more palatable. The market is witnessing a notable rise in organic and functional pet food, driven by health-conscious consumers seeking advanced nutrition and products with added vitamins, probiotics, and high protein content.

By Species:The market is also segmented by species, including Dog Food, Cat Food, Small Animal Food (e.g., rabbits, guinea pigs), Bird Food, and Fish Food. Dog Food holds the largest share, supported by high numbers of dog owners and a strong trend toward premium and specialized dog food products. Cat Food is also significant, with increasing demand for wet and functional formulas tailored to feline health. The market for food for small animals, birds, and fish is smaller but steadily expanding, reflecting the diversification of pet ownership and the availability of specialized nutrition solutions for these species.

The Europe Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Purina PetCare, Mars Petcare, Hill's Pet Nutrition (Colgate-Palmolive), Royal Canin (Mars Inc.), Affinity Petcare, Dechra Pharmaceuticals, United Petfood, Butcher's Pet Care, Fressnapf, Spectrum Brands Holdings, Inc., Blue Buffalo (General Mills), WellPet LLC, The J.M. Smucker Company, Canidae Pet Foods, Champion Petfoods contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European pet food market appears promising, driven by evolving consumer preferences and technological advancements. As pet owners increasingly seek high-quality, nutritious options, the demand for premium and organic products is expected to rise. Additionally, innovations in pet food technology, such as personalized nutrition and sustainable packaging solutions, will likely shape the market landscape. Companies that adapt to these trends will be well-positioned to capture market share and meet the growing expectations of health-conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Dry Food Wet Food Treats and Snacks Organic Pet Food Grain-Free Pet Food Functional Pet Food Conventional Pet Food Others |

| By Species | Dog Food Cat Food Small Animal Food (e.g., rabbits, guinea pigs) Bird Food Fish Food |

| By Distribution Channel | Supermarkets/Hypermarkets Pet Specialty Stores Online Retail Veterinary Clinics Other Retail Channels |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bags Cans Pouches Single-Serve Packs |

| By Ingredient Type | Meat-Based Fish-Based Plant-Based Mixed Ingredients |

| By Region | Western Europe (UK, France, Germany, etc.) Eastern Europe (Poland, Russia, etc.) Northern Europe (Sweden, Denmark, etc.) Southern Europe (Italy, Spain, etc.) Rest of Europe (Netherlands, Belgium, Switzerland, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Retailers | 100 | Store Managers, Category Buyers |

| Pet Food Manufacturers | 80 | Product Managers, Marketing Directors |

| Veterinary Clinics | 60 | Veterinarians, Clinic Managers |

| Pet Owners | 120 | Pet Owners, Pet Care Enthusiasts |

| Pet Nutrition Experts | 40 | Nutritionists, Animal Dieticians |

The Europe Pet Food Market is valued at approximately USD 36 billion, driven by increasing pet ownership, rising disposable incomes, and a growing demand for premium and organic pet food products.