Region:North America

Author(s):Shubham

Product Code:KRAA1830

Pages:88

Published On:August 2025

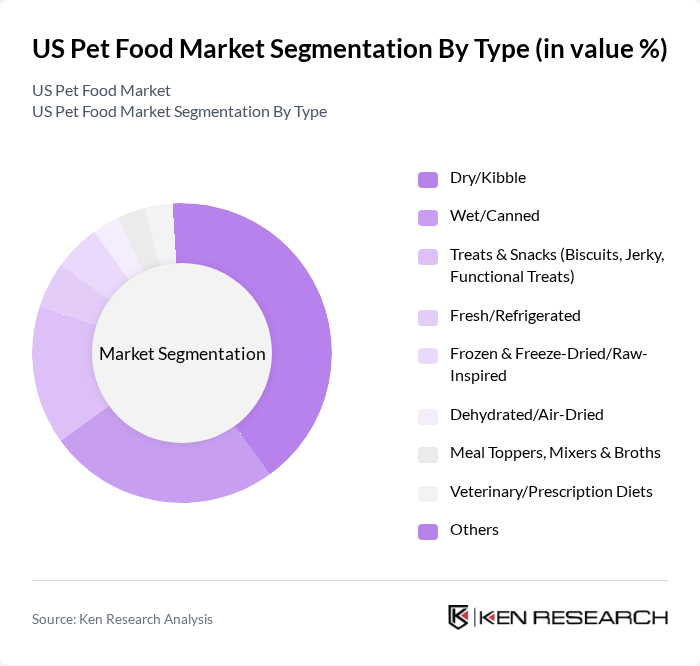

By Type:The pet food market is segmented into various types, including Dry/Kibble, Wet/Canned, Treats & Snacks, Fresh/Refrigerated, Frozen & Freeze-Dried/Raw-Inspired, Dehydrated/Air-Dried, Meal Toppers, Mixers & Broths, Veterinary/Prescription Diets, and Others. Among these, Dry/Kibble is the leading sub-segment due to its convenience, longer shelf life, and cost-effectiveness, appealing to a broad consumer base. Wet/Canned food is also gaining traction, particularly among pet owners seeking palatability and hydration for their pets. Premiumization, functional benefits (skin/coat, digestion, joint), and interest in natural/clean-label, raw-inspired, and minimally processed formats continue to shape product mix and innovation.

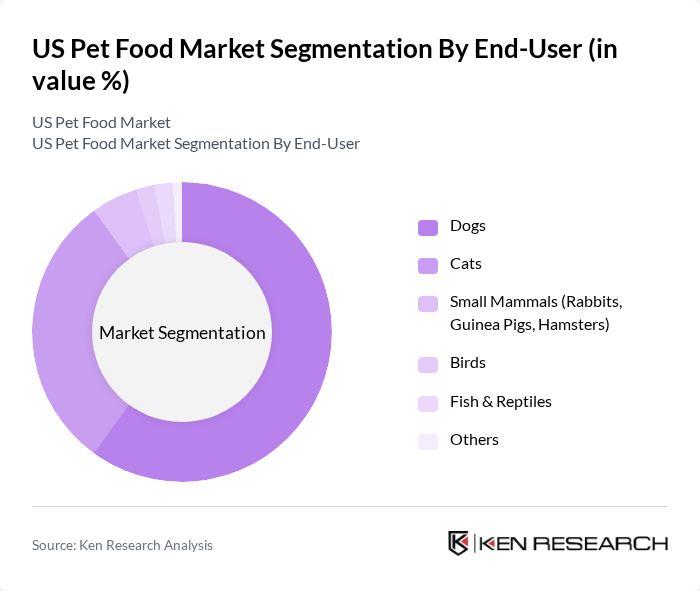

By End-User:The end-user segmentation includes Dogs, Cats, Small Mammals, Birds, Fish & Reptiles, and Others. The dog food segment dominates the market, supported by the higher share of dog ownership and spending per pet, while cat food continues to expand as owners prioritize health-forward, premium nutrition for felines.

The US Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Purina PetCare, Mars Petcare, Hill's Pet Nutrition (Colgate-Palmolive), Blue Buffalo (General Mills), Spectrum Brands Holdings, Inc. (Tetra, FURminator; includes pet consumables via subsidiary), Diamond Pet Foods, WellPet LLC (Wellness, Old Mother Hubbard), The J. M. Smucker Co. (Milk-Bone, Meow Mix, 9Lives), PetSmart, LLC, Chewy, Inc., Petco Health and Wellness Company, Inc., Freshpet, Inc., Canidae Pet Food Co., Tuffy’s Pet Foods (KLN Family Brands), Nutro (Mars Petcare), Central Garden & Pet Company (Nylabone, Cadet; pet treats), Mid America Pet Food (Victor, Eagle Mountain), Champion Petfoods (ORIJEN, ACANA), Nestlé USA – Merrick Pet Care (Merrick, Castor & Pollux), Phillips Pet Food & Supplies contribute to innovation, geographic expansion, and service delivery in this space.

The US pet food market is poised for continued growth, driven by evolving consumer preferences and increasing pet ownership. Innovations in pet nutrition, particularly in organic and natural products, are expected to gain traction as health-conscious pet owners seek better options for their pets. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer convenience and driving sales. Overall, the market is set to adapt to changing trends and consumer demands in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dry/Kibble Wet/Canned Treats & Snacks (Biscuits, Jerky, Functional Treats) Fresh/Refrigerated Frozen & Freeze-Dried/Raw-Inspired Dehydrated/Air-Dried Meal Toppers, Mixers & Broths Veterinary/Prescription Diets Others |

| By End-User | Dogs Cats Small Mammals (Rabbits, Guinea Pigs, Hamsters) Birds Fish & Reptiles Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pet Specialty (PetSmart, Petco, Independents) Online (Chewy, Amazon, DTC Brand Sites) Club & Mass Merchandisers (Costco, Walmart, Target) Veterinary Clinics Convenience & Others |

| By Price Tier | Super-Premium Premium Mid-Range Economy/Value Others |

| By Packaging Type | Multi-layer Bags (Paper/Plastic) Cans Pouches Trays & Tubs Chubs & Roll Packaging Others |

| By Ingredient/Nutrition Type | Animal Protein-Based (Chicken, Beef, Fish, etc.) Limited-Ingredient Diets Grain-Inclusive Grain-Free Functional/Condition-Specific (Digestive, Joint, Skin/Coat) Natural/Organic Plant-Based & Alternative Proteins (Insect, Vegan) Others |

| By Brand Ownership | National Brands Private Labels (Retailer Brands) DTC/Subscription Brands Regional/Independent Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Retailers | 120 | Store Managers, Category Buyers |

| Pet Owners | 150 | Dog Owners, Cat Owners, Multi-Pet Households |

| Veterinarians | 100 | Veterinary Practitioners, Animal Nutritionists |

| Pet Food Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Pet Industry Experts | 50 | Market Analysts, Industry Consultants |

The US pet food market is valued at approximately USD 43.5 billion, reflecting a robust segment within the overall pet industry. This valuation is supported by historical data and industry estimates indicating a consistent market size in the low-to-mid USD 40 billion range.