Region:Global

Author(s):Shubham

Product Code:KRAC0749

Pages:95

Published On:August 2025

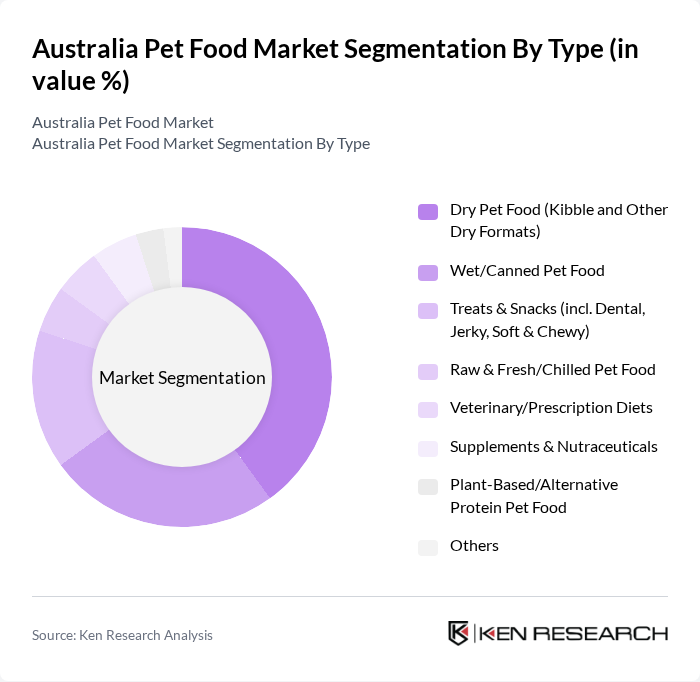

By Type:The pet food market can be segmented into various types, including Dry Pet Food, Wet/Canned Pet Food, Treats & Snacks, Raw & Fresh/Chilled Pet Food, Veterinary/Prescription Diets, Supplements & Nutraceuticals, Plant-Based/Alternative Protein Pet Food, and Others. Among these, Dry Pet Food is the most dominant segment due to its convenience, longer shelf life, and cost-effectiveness. Consumers prefer dry food for its ease of storage and feeding, which has led to its significant market share.

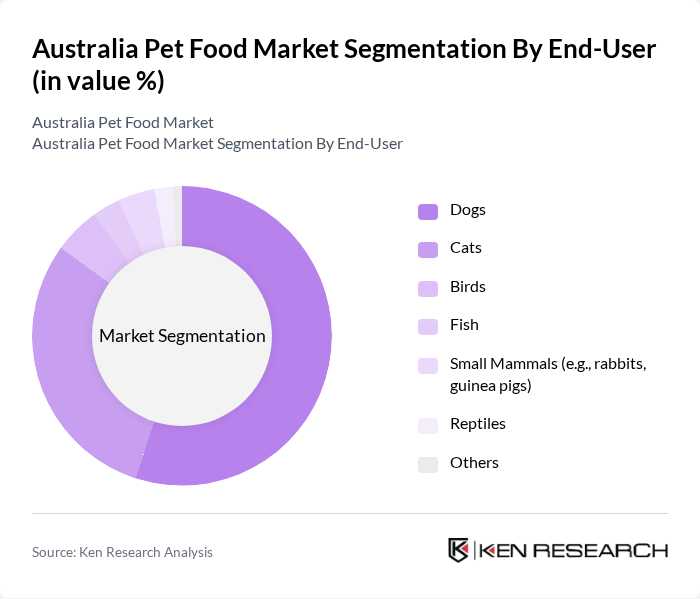

By End-User:The end-user segmentation includes Dogs, Cats, Birds, Fish, Small Mammals (e.g., rabbits, guinea pigs), Reptiles, and Others. The dog food segment is the largest due to the high number of dog owners in Australia, who often prioritize quality nutrition for their pets. This trend is supported by the increasing awareness of pet health and wellness, leading to a rise in demand for specialized dog food products.

The Australia Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Purina PetCare Australia, Mars Petcare Australia (incl. Royal Canin, ADVANCE, OPTIMUM), Coles Group Limited (private label pet food), Woolworths Group Limited (incl. Woolworths and PetCulture), Petbarn (Greencross Petbarn Pty Ltd), Black Hawk (Masterpet, an EBOS Group company), Hill's Pet Nutrition, Royal Canin Australia, ADVANCE Pet Nutrition (Mars Petcare Australia), Pet Circle, Big Dog Pet Foods, Love’em Pet Treats, Vets All Natural, OPTIMUM (Mars Petcare Australia), Ziwi Peak (ZIWI LTD) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian pet food market appears promising, driven by evolving consumer preferences and technological advancements. As pet owners increasingly prioritize health and sustainability, the demand for premium and natural products is expected to rise. Additionally, the integration of technology in pet care, such as smart feeding solutions, will likely enhance consumer engagement. Companies that adapt to these trends and invest in innovative product development will be well-positioned to capture market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dry Pet Food (Kibble and Other Dry Formats) Wet/Canned Pet Food Treats & Snacks (incl. Dental, Jerky, Soft & Chewy) Raw & Fresh/Chilled Pet Food Veterinary/Prescription Diets Supplements & Nutraceuticals Plant-Based/Alternative Protein Pet Food Others |

| By End-User | Dogs Cats Birds Fish Small Mammals (e.g., rabbits, guinea pigs) Reptiles Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pet Specialty Retail (e.g., Petbarn, independent stores) Online Retail/E-commerce (e.g., Pet Circle, marketplaces) Veterinary Clinics Convenience Stores Direct-to-Consumer Subscription Services Others |

| By Price Range | Economy Mid-Range Premium Super Premium |

| By Packaging Type | Bags Cans Pouches Trays/Tubs Chilled/Fresh Packaging Bulk Packaging |

| By Brand Type | National/International Brands Private Labels (e.g., Coles, Woolworths, ALDI) Local/Australian Brands |

| By Nutritional Content | High Protein Grain-Free Low Fat/Weight Management Functional Ingredients (e.g., probiotics, omega-3s, joint support) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Retailers | 120 | Store Managers, Category Buyers |

| Pet Owners | 150 | Dog and Cat Owners, Pet Enthusiasts |

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pet Food Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Pet Nutritionists | 50 | Nutrition Experts, Animal Dietitians |

The Australia Pet Food Market is valued at approximately USD 2.8 billion, reflecting strong demand driven by increasing pet ownership, premiumization, and health-focused formulations. The market is projected to grow further as consumers seek high-quality, nutritious options for their pets.