Region:Europe

Author(s):Dev

Product Code:KRAB0626

Pages:97

Published On:August 2025

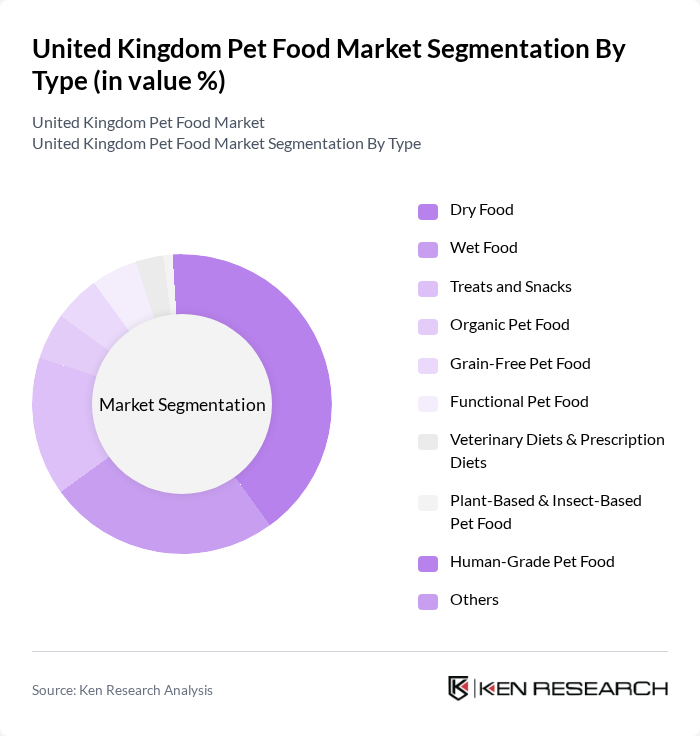

By Type:The pet food market is segmented into Dry Food, Wet Food, Treats and Snacks, Organic Pet Food, Grain-Free Pet Food, Functional Pet Food, Veterinary Diets & Prescription Diets, Plant-Based & Insect-Based Pet Food, Human-Grade Pet Food, and Others. Dry Food remains the most dominant segment due to its convenience, longer shelf life, and cost-effectiveness, appealing to a wide range of pet owners. Wet Food is gaining traction, especially among cat owners, who often prefer it for its palatability and moisture content. The trend towards organic, functional, and plant-based pet foods is accelerating, driven by health-conscious consumers seeking improved nutrition and sustainability for their pets .

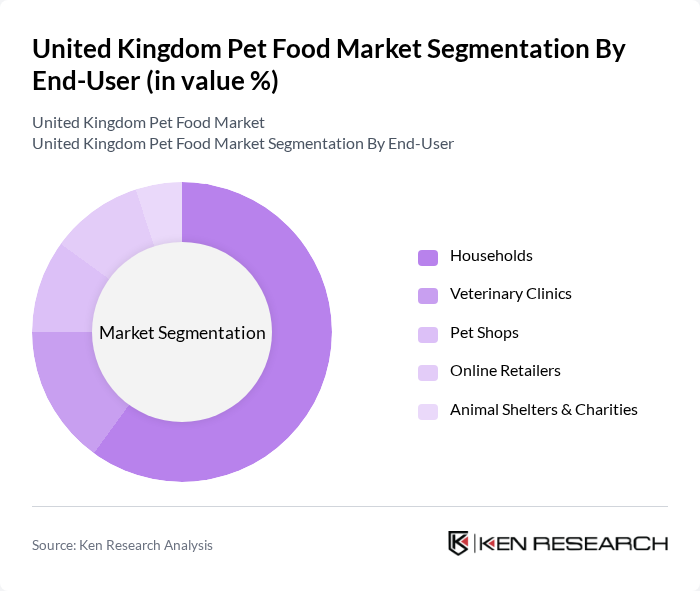

By End-User:The end-user segmentation includes Households, Veterinary Clinics, Pet Shops, Online Retailers, and Animal Shelters & Charities. Households represent the largest segment, driven by the increasing number of pet owners prioritizing their pets' nutrition and well-being. Online Retailers are rapidly gaining popularity, particularly post-pandemic, as consumers embrace the convenience of home delivery and a wider product selection. Veterinary Clinics play a crucial role in recommending specialized and prescription diets, while Pet Shops offer a variety of options for pet owners. Animal Shelters & Charities contribute to the market by purchasing pet food for rescued animals .

The United Kingdom Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars Petcare (Whiskas, Pedigree, James Wellbeloved, Royal Canin UK), Nestlé Purina PetCare (Purina, Felix, Bakers, Winalot), Colgate-Palmolive (Hill's Pet Nutrition), Spectrum Brands (IAMS, Eukanuba UK), Lily’s Kitchen, Pets at Home Group plc, Arden Grange, Butcher’s Pet Care Ltd, Forthglade Foods Ltd, Yora Pet Foods, Burns Pet Nutrition Ltd, Naturediet Pet Foods Ltd, Harringtons (Inspired Pet Nutrition Ltd), McAdams Pet Foods, Edgard & Cooper contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United Kingdom pet food market appears promising, driven by evolving consumer preferences and technological advancements. As pet owners increasingly seek high-quality, nutritious options, the demand for premium and organic products is expected to rise. Additionally, the integration of technology in pet care, such as smart feeding solutions, will likely enhance customer engagement and streamline purchasing processes, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dry Food Wet Food Treats and Snacks Organic Pet Food Grain-Free Pet Food Functional Pet Food Veterinary Diets & Prescription Diets Plant-Based & Insect-Based Pet Food Human-Grade Pet Food Others |

| By End-User | Households Veterinary Clinics Pet Shops Online Retailers Animal Shelters & Charities |

| By Distribution Channel | Supermarkets and Hypermarkets Specialty Pet Stores E-commerce Convenience Stores Veterinary Clinics |

| By Price Range | Economy Mid-Range Premium Super-Premium |

| By Brand Type | National Brands Private Labels Specialist/Local Brands |

| By Pet Type | Dogs Cats Small Animals (Rabbits, Guinea Pigs, etc.) Birds Fish Reptiles |

| By Packaging Type | Bags Cans Pouches Trays Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Retailers | 100 | Store Managers, Category Buyers |

| Pet Owners | 150 | Dog and Cat Owners, Pet Enthusiasts |

| Veterinary Professionals | 80 | Veterinarians, Veterinary Technicians |

| Pet Food Manufacturers | 60 | Product Development Managers, Marketing Directors |

| Pet Industry Experts | 40 | Market Analysts, Industry Consultants |

The United Kingdom pet food market is valued at approximately USD 3.0 billion, reflecting a significant growth trend driven by increasing pet ownership, a shift towards premium and organic products, and heightened consumer awareness regarding pet health and nutrition.