Qatar Pet Food Market Overview

- The Qatar Pet Food Market is valued at USD 170 million, based on a five-year historical analysis. This growth is primarily driven by increasing pet ownership, rising disposable incomes, and a growing awareness of pet nutrition among consumers. The demand for high-quality pet food products has surged, reflecting a shift towards premium offerings that cater to the health and wellness of pets. Recent trends highlight a preference for natural ingredients, functional diets, and products tailored to specific health needs, such as digestive health and weight management, reflecting the humanization of pets and a focus on their well-being .

- Key cities dominating the market include Doha and Al Rayyan, where urbanization and a high standard of living contribute to increased pet ownership. The affluent population in these areas is more inclined to spend on premium pet food products, driving market growth. Additionally, the presence of various international and local brands enhances competition and product availability .

- The Qatari government regulates the safety and quality of pet food products through the “Gulf Standardization Organization (GSO) Technical Regulation for Animal Feed, GSO 2059:2021,” which mandates labeling requirements specifying ingredients and nutritional information. This regulation, enforced by the Ministry of Public Health, aims to protect consumer interests and promote transparency in the pet food industry by requiring clear labeling, ingredient disclosure, and adherence to safety standards .

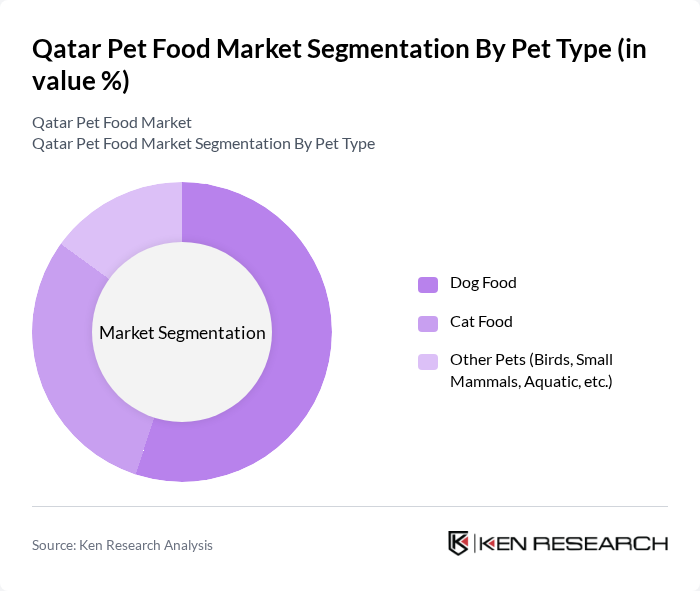

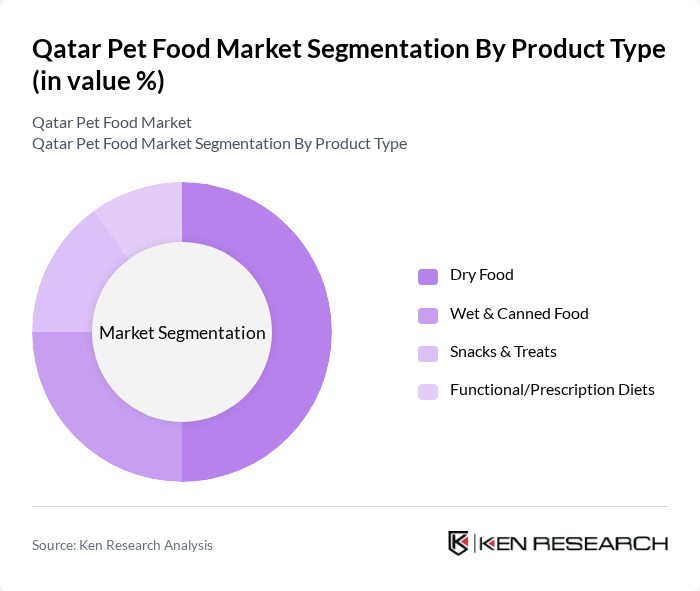

Qatar Pet Food Market Segmentation

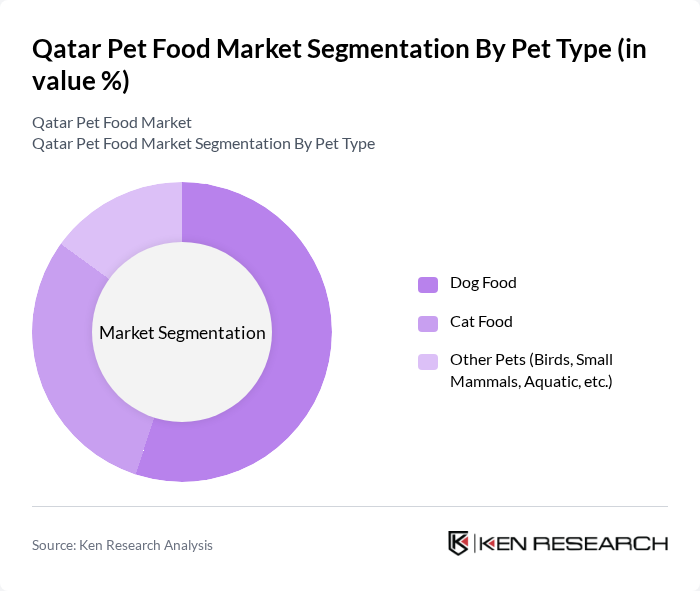

By Pet Type:The pet food market can be segmented into three main categories: Dog Food, Cat Food, and Other Pets (Birds, Small Mammals, Aquatic, etc.). Dog food is the leading segment, driven by the high number of dog owners in Qatar and the dominance of dog food sales in value terms. Cat food follows closely, reflecting the growing popularity of cats as pets. The segment for other pets is smaller but includes a variety of products catering to birds, small mammals, and aquatic pets .

By Product Type:The product type segmentation includes Dry Food, Wet & Canned Food, Snacks & Treats, and Functional/Prescription Diets. Dry food dominates the market due to its convenience, affordability, and longer shelf life, while wet and canned food is popular for its palatability and suitability for pets with specific dietary needs. Snacks and treats are increasingly favored as pet owners seek to reward their pets and promote dental health, and functional diets are gaining traction as consumers become more health-conscious about their pets' nutrition, especially for pets with allergies or chronic conditions .

Qatar Pet Food Market Competitive Landscape

The Qatar Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars Petcare (Pedigree, Whiskas, Royal Canin), Nestlé Purina PetCare (Purina, Friskies, Pro Plan), Hill's Pet Nutrition, Spectrum Brands (Tetra, FURminator), Blue Buffalo (General Mills), Diamond Pet Foods, WellPet (Wellness, Holistic Select), Canidae Pet Foods, Farmina Pet Foods, Monge & C. S.p.A., Al Rawdah (Emirates Modern Poultry Co.), Petzone (Qatar-based Retailer & Distributor), Eurovets Veterinary Suppliers, Petland Qatar, Almuftah Group (Qatar-based Distributor) contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Pet Food Market Industry Analysis

Growth Drivers

- Increasing Pet Ownership:The pet ownership rate in Qatar has surged, with approximately 50% of households owning at least one pet as of future. This translates to around 1.2 million pets in the country, driven by a cultural shift towards pet companionship. The growing trend of adopting pets, particularly dogs and cats, is expected to continue, further boosting the demand for pet food products. This increase in pet ownership is a significant driver for the pet food market, creating a robust consumer base.

- Rising Disposable Income:Qatar's GDP per capita reached approximately $83,000 in future, reflecting a steady increase in disposable income among its residents. This economic growth allows pet owners to spend more on premium pet food products, enhancing their pets' nutrition and overall health. As disposable income rises, consumers are more inclined to invest in high-quality pet food, which is expected to drive market growth significantly in the coming years, aligning with global trends in pet care spending.

- Growing Awareness of Pet Nutrition:There is an increasing awareness among Qatari pet owners regarding the importance of proper nutrition for their pets. Educational campaigns and veterinary advice have highlighted the benefits of high-quality pet food, leading to a shift towards specialized diets. In future, the demand for premium and organic pet food products rose by 15%, indicating a strong trend towards health-conscious choices. This growing awareness is a crucial driver for the pet food market, influencing purchasing decisions significantly.

Market Challenges

- High Import Tariffs:Qatar imposes high import tariffs on pet food products, which can reach up to 15% for certain categories. This significantly increases the cost of imported pet food, making it less competitive against locally produced alternatives. The reliance on imports for over 70% of pet food supplies creates a challenging environment for market players, as they must navigate these tariffs while maintaining profitability and competitive pricing in a price-sensitive market.

- Limited Local Production:The local production of pet food in Qatar is minimal, with only a few manufacturers operating in the market. This limitation results in a heavy reliance on imports, which can lead to supply chain vulnerabilities. In future, local production accounted for less than 25% of the total pet food market, creating challenges in meeting the growing demand. This lack of local manufacturing capacity can hinder market growth and increase dependency on foreign suppliers.

Qatar Pet Food Market Future Outlook

The future of the Qatar pet food market appears promising, driven by increasing pet ownership and rising disposable incomes. As consumers become more health-conscious, the demand for premium and organic pet food products is expected to grow. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing market dynamics. Companies that adapt to these trends and invest in local production capabilities will likely gain a competitive edge in this evolving landscape.

Market Opportunities

- Growth of E-commerce Platforms:The rise of e-commerce in Qatar presents a significant opportunity for pet food brands. With online sales projected to increase by 25% in future, companies can leverage digital channels to reach a broader audience. This shift allows for better customer engagement and convenience, catering to the growing preference for online shopping among pet owners.

- Introduction of Premium Pet Food Products:There is a notable opportunity for introducing premium pet food products in Qatar, as consumer preferences shift towards higher-quality options. The premium segment is expected to grow by 15% in future, driven by increased awareness of pet nutrition. Brands that focus on quality ingredients and health benefits can capitalize on this trend, appealing to discerning pet owners seeking the best for their pets.