Region:Asia

Author(s):Geetanshi

Product Code:KRAA3301

Pages:95

Published On:September 2025

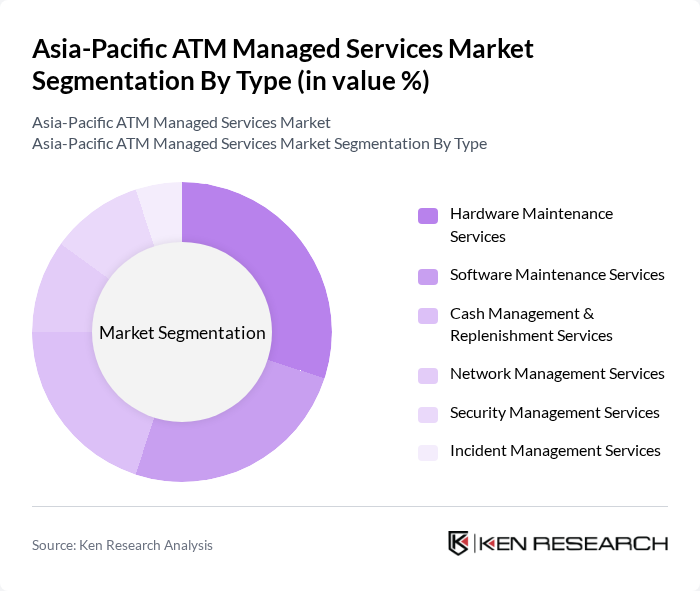

By Type:The market is segmented into various types of services that cater to the operational needs of ATMs. The dominant sub-segment is ATM Replenishment and Currency Management services, which ensure efficient cash stocking and currency handling operations, followed by Network Management Services that focus on maintaining connectivity and operational software of these machines. Security Management Services are increasingly critical due to rising cybersecurity threats and fraud activities in the banking sector. Incident Management Services further enhance the operational reliability and security of ATM networks by providing rapid response capabilities for technical issues and security breaches.

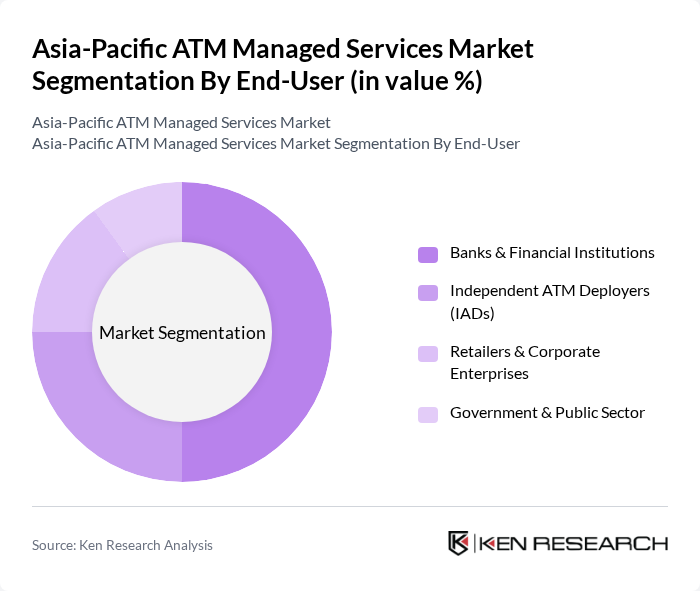

By End-User:The end-user segment includes various categories such as Banks & Financial Institutions, Independent ATM Deployers (IADs), Retailers & Corporate Enterprises, and Government & Public Sector. Among these, Banks & Financial Institutions dominate the market due to their extensive ATM networks and the need for reliable managed services to ensure operational efficiency. Over 55% of mid-sized banks in the Philippines have transitioned to managed ATM services, citing cost-efficiency and improved uptime as primary benefits. Independent ATM Deployers are also significant players, as they focus on providing ATM services in locations where banks may not have a presence. Retailers and the Government sector are increasingly adopting managed services to enhance customer service and operational efficiency, with government agencies mandating ATM expansion in rural areas which increases demand for managed services.

The Asia-Pacific ATM Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as NCR Corporation, Diebold Nixdorf, GRG Banking Equipment Co., Ltd., Hitachi-Omron Terminal Solutions, Corp., Fujitsu Limited, Euronet Worldwide, Inc., Fiserv, Inc., Cardtronics (now part of NCR Atleos), Cennox Group, KAL ATM Software, ACI Worldwide, S1 Corporation, Tata Communications Payment Solutions Limited (TCPSL), and Vakrangee Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Asia-Pacific ATM managed services market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As banks increasingly adopt integrated ATM solutions, the focus will shift towards enhancing customer experience through personalized services. Additionally, the rise of contactless transactions and the implementation of AI and machine learning will further streamline operations, making ATMs more efficient and secure. This evolution will create a dynamic environment for service providers to innovate and meet the changing demands of the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Maintenance Services Software Maintenance Services Cash Management & Replenishment Services Network Management Services Security Management Services Incident Management Services |

| By End-User | Banks & Financial Institutions Independent ATM Deployers (IADs) Retailers & Corporate Enterprises Government & Public Sector |

| By Region | China India Japan Southeast Asia Australia & New Zealand Rest of Asia-Pacific |

| By Service Model | Full-Service ATM Management Transaction Processing Services Maintenance and Support Services Remote Monitoring Services |

| By Deployment Mode | On-Premises Solutions Cloud-Based Solutions |

| By Pricing Model | Subscription-Based Pricing Pay-Per-Use Pricing |

| By Customer Segment | Large Enterprises Small and Medium Enterprises Individual Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Managed ATM Services for Airports | 120 | Airport Operations Managers, ATM Service Providers |

| ATM Software Solutions | 85 | IT Managers, Software Development Leads |

| Regulatory Compliance in ATM | 65 | Regulatory Affairs Specialists, Compliance Officers |

| Technological Innovations in ATM | 55 | R&D Managers, Technology Strategists |

| Market Trends and Forecasting | 75 | Market Analysts, Business Development Managers |

The Asia-Pacific ATM Managed Services Market is valued at approximately USD 3.5 billion, driven by the increasing adoption of ATMs and the demand for efficient cash management solutions. This market is expected to grow significantly due to technological advancements and outsourcing trends.