Region:Asia

Author(s):Geetanshi

Product Code:KRAA6240

Pages:83

Published On:January 2026

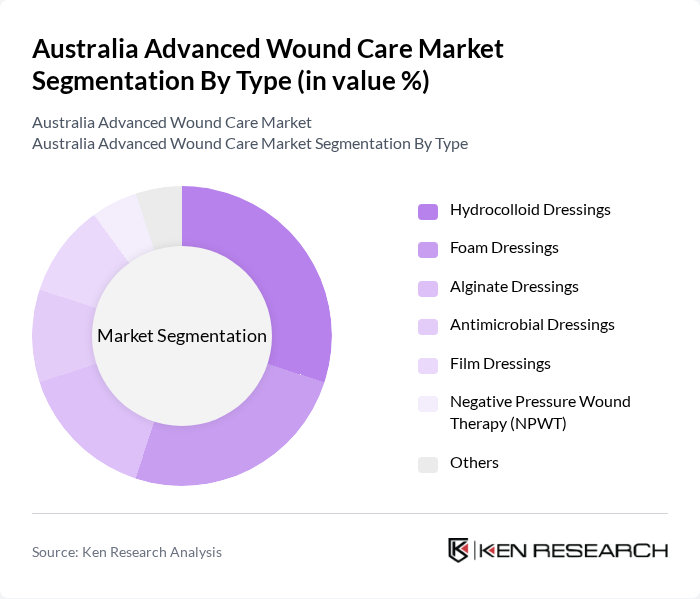

By Type:The advanced wound care market can be segmented into various types, including Hydrocolloid Dressings, Foam Dressings, Alginate Dressings, Antimicrobial Dressings, Film Dressings, Negative Pressure Wound Therapy (NPWT), and Others. Among these, Hydrocolloid Dressings are currently leading the market due to their versatility, ease of use, and effectiveness in managing various wound types. The growing preference for minimally invasive treatment options and the increasing incidence of chronic wounds are driving the demand for these dressings.

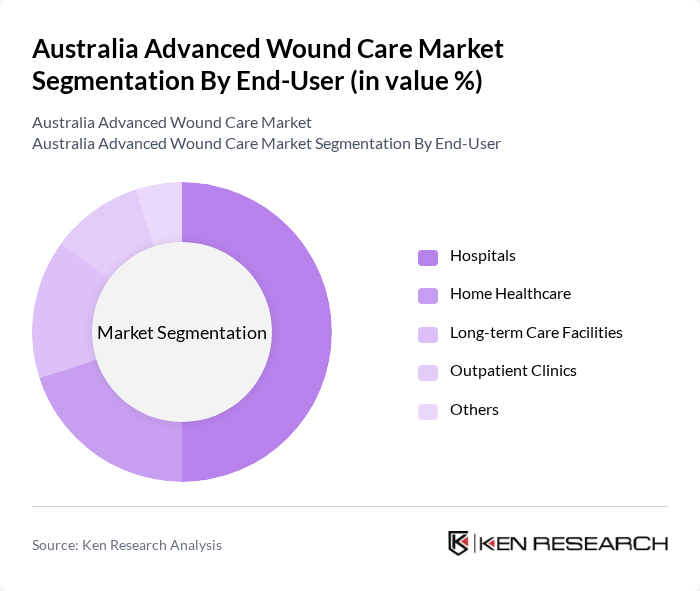

By End-User:The market can also be segmented based on end-users, which include Hospitals, Home Healthcare, Long-term Care Facilities, Outpatient Clinics, and Others. Hospitals are the dominant end-user segment, primarily due to the high volume of surgical procedures and the need for advanced wound care solutions in acute care settings. The increasing number of hospital admissions and the focus on improving patient care are key factors contributing to the growth of this segment.

The Australia Advanced Wound Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smith & Nephew, Mölnlycke Health Care, ConvaTec, 3M Health Care, Acelity (now part of 3M), Coloplast, Medtronic, Hartmann Group, Derma Sciences (now part of Acelity), BSN medical (now part of Essity), Ethicon (a subsidiary of Johnson & Johnson), Integra LifeSciences, KCI Medical, Systagenix (now part of Acelity), Cardinal Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia advanced wound care market appears promising, driven by ongoing innovations and a growing focus on personalized care. As healthcare providers increasingly adopt digital health technologies, the integration of telemedicine and remote monitoring will enhance patient outcomes. Furthermore, the emphasis on sustainability in product development is likely to shape the market landscape, encouraging manufacturers to create eco-friendly solutions that meet both clinical and environmental standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrocolloid Dressings Foam Dressings Alginate Dressings Antimicrobial Dressings Film Dressings Negative Pressure Wound Therapy (NPWT) Others |

| By End-User | Hospitals Home Healthcare Long-term Care Facilities Outpatient Clinics Others |

| By Wound Type | Chronic Wounds Acute Wounds Surgical Wounds Diabetic Foot Ulcers Pressure Ulcers Others |

| By Distribution Channel | Direct Sales Online Sales Retail Pharmacies Hospitals and Clinics Others |

| By Material | Natural Materials Synthetic Materials Biodegradable Materials Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Others |

| By Application | Surgical Procedures Trauma Care Burn Care Palliative Care Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Wound Care Departments | 120 | Wound Care Specialists, Nursing Staff |

| Home Healthcare Providers | 100 | Home Care Nurses, Care Coordinators |

| Wound Care Product Manufacturers | 80 | Product Managers, R&D Directors |

| Patient Advocacy Groups | 60 | Patient Representatives, Healthcare Advocates |

| Regulatory Bodies and Health Authorities | 50 | Regulatory Affairs Specialists, Policy Makers |

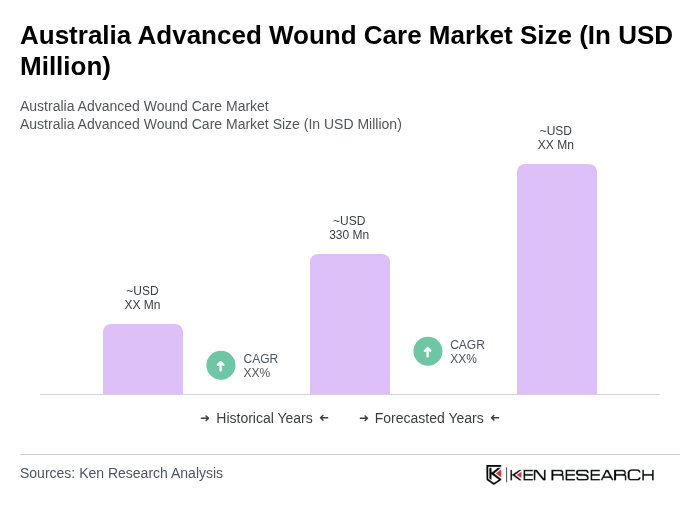

The Australia Advanced Wound Care Market is valued at approximately USD 330 million, driven by factors such as the increasing prevalence of chronic wounds, advancements in wound care technologies, and a growing aging population.