Region:Middle East

Author(s):Geetanshi

Product Code:KRAA6239

Pages:91

Published On:January 2026

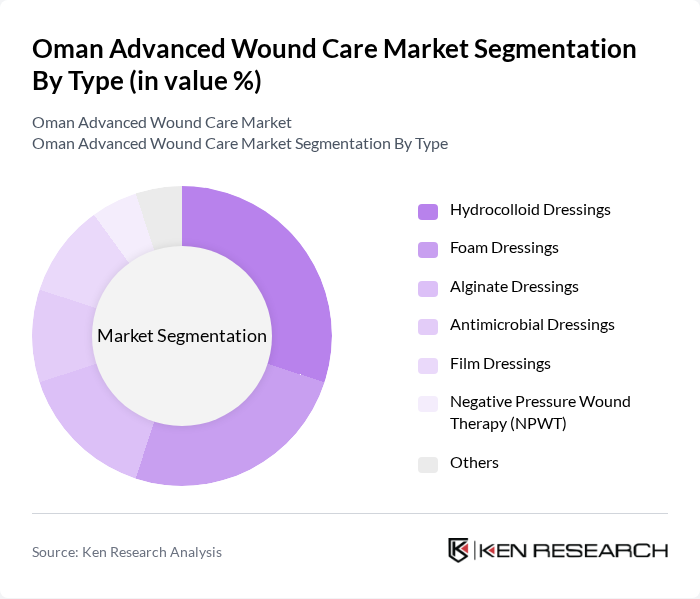

By Type:The segmentation by type includes Hydrocolloid Dressings, Foam Dressings, Alginate Dressings, Antimicrobial Dressings, Film Dressings, Negative Pressure Wound Therapy (NPWT), and Others. Among these, Hydrocolloid Dressings are leading the market due to their versatility and effectiveness in managing various wound types. They provide a moist healing environment, which is crucial for wound healing, and are favored by both healthcare professionals and patients for their ease of use and comfort.

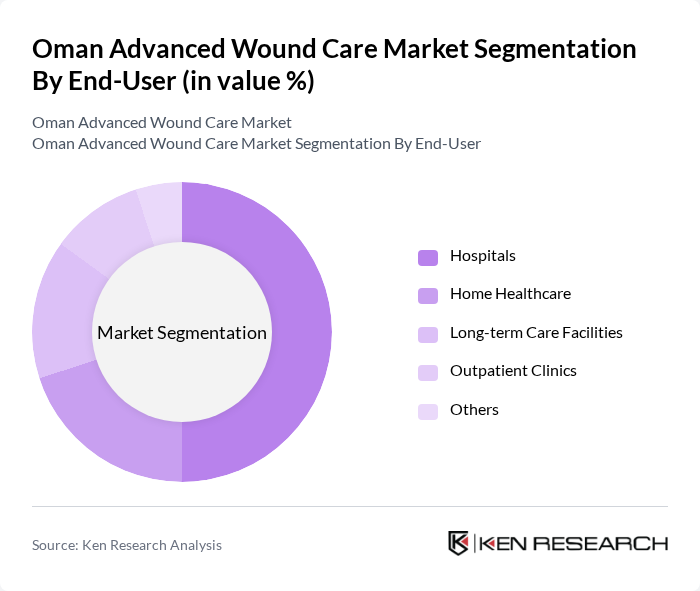

By End-User:The end-user segmentation includes Hospitals, Home Healthcare, Long-term Care Facilities, Outpatient Clinics, and Others. Hospitals dominate this segment due to their advanced facilities and access to specialized wound care products. The increasing number of surgical procedures and the rising incidence of chronic wounds in hospital settings drive the demand for advanced wound care solutions, making hospitals the primary consumers of these products.

The Oman Advanced Wound Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smith & Nephew, Mölnlycke Health Care, 3M Health Care, ConvaTec, Acelity, Medtronic, Coloplast, Baxter International, B. Braun Melsungen AG, Derma Sciences, Hartmann Group, Ethicon (Johnson & Johnson), KCI Medical, Integra LifeSciences, Organogenesis contribute to innovation, geographic expansion, and service delivery in this space.

The future of the advanced wound care market in Oman appears promising, driven by ongoing healthcare reforms and increased government investment in medical infrastructure. As the population ages and chronic diseases become more prevalent, the demand for innovative wound care solutions will likely rise. Additionally, the integration of digital health technologies and telemedicine is expected to enhance patient management, making advanced wound care more accessible and efficient across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrocolloid Dressings Foam Dressings Alginate Dressings Antimicrobial Dressings Film Dressings Negative Pressure Wound Therapy (NPWT) Others |

| By End-User | Hospitals Home Healthcare Long-term Care Facilities Outpatient Clinics Others |

| By Wound Type | Surgical Wounds Diabetic Foot Ulcers Pressure Ulcers Venous Leg Ulcers Others |

| By Distribution Channel | Direct Sales Online Retail Pharmacies Medical Supply Stores Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Product Formulation | Biologics Synthetic Products Combination Products Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Wound Care Departments | 100 | Wound Care Specialists, Nursing Staff |

| Private Clinics and Practices | 80 | General Practitioners, Dermatologists |

| Healthcare Distributors and Suppliers | 60 | Sales Managers, Product Managers |

| Insurance Providers | 50 | Claims Adjusters, Policy Analysts |

| Patient Advocacy Groups | 40 | Patient Representatives, Healthcare Advocates |

The Oman Advanced Wound Care Market is valued at approximately USD 12 million, reflecting a five-year historical analysis. This growth is driven by the increasing prevalence of chronic wounds and heightened awareness of advanced wound care products among healthcare professionals and patients.