Region:Global

Author(s):Geetanshi

Product Code:KRAA6242

Pages:87

Published On:January 2026

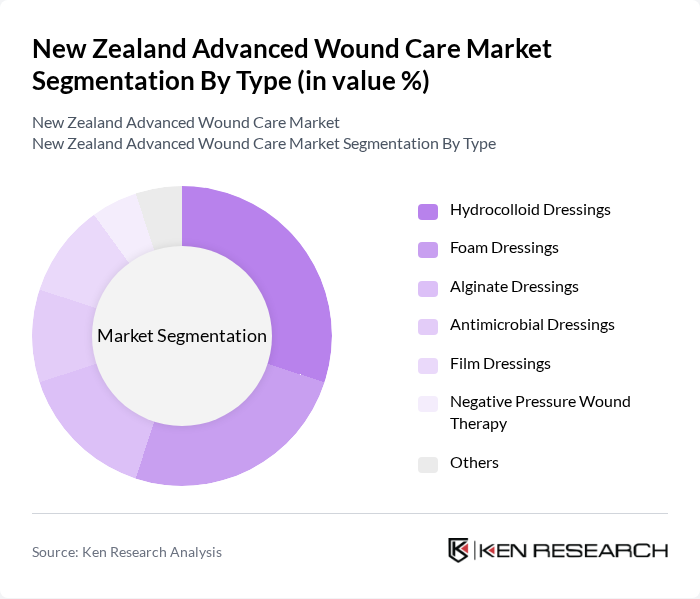

By Type:The advanced wound care market can be segmented into various types, including hydrocolloid dressings, foam dressings, alginate dressings, antimicrobial dressings, film dressings, negative pressure wound therapy, and others. Among these, hydrocolloid dressings are gaining significant traction due to their versatility and effectiveness in managing various wound types. Foam dressings are also popular for their absorbent properties, making them suitable for exudative wounds. The demand for antimicrobial dressings is rising as healthcare providers focus on preventing infections in chronic wounds.

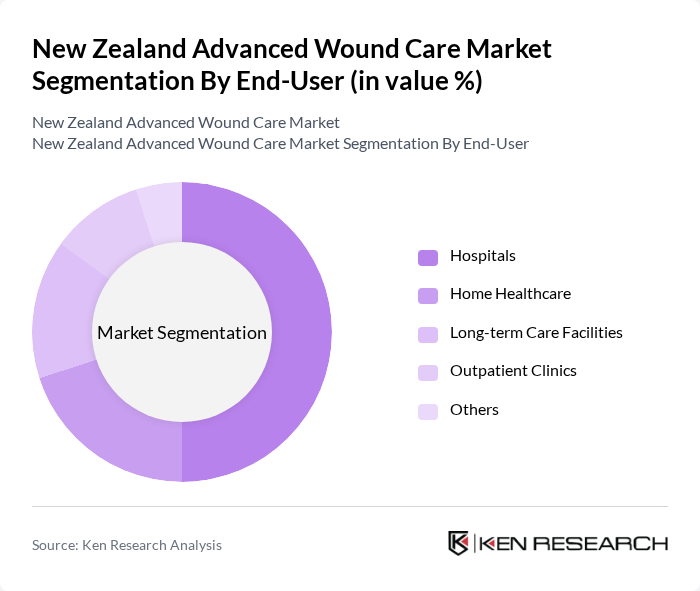

By End-User:The advanced wound care market is segmented by end-users, including hospitals, home healthcare, long-term care facilities, outpatient clinics, and others. Hospitals are the leading end-user segment due to the high volume of surgical procedures and the need for effective wound management solutions. Home healthcare is also witnessing growth as patients prefer receiving care in the comfort of their homes, leading to increased demand for advanced wound care products tailored for home use.

The New Zealand Advanced Wound Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smith & Nephew, Mölnlycke Health Care, ConvaTec, 3M Health Care, Acelity (now part of 3M), Medline Industries, Hartmann Group, Coloplast, Derma Sciences (now part of Integra LifeSciences), BSN medical (now part of Essity), KCI Medical, Ethicon (a subsidiary of Johnson & Johnson), B. Braun Melsungen AG, Cardinal Health, Hollister Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand advanced wound care market appears promising, driven by ongoing technological innovations and an increasing focus on personalized care. As healthcare providers continue to integrate digital health technologies, such as telemedicine and remote monitoring, patient engagement and treatment adherence are expected to improve. Additionally, the expansion of home healthcare services will facilitate access to advanced wound care solutions, ensuring that patients receive timely and effective treatment in their own environments.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrocolloid dressings Foam dressings Alginate dressings Antimicrobial dressings Film dressings Negative pressure wound therapy Others |

| By End-User | Hospitals Home healthcare Long-term care facilities Outpatient clinics Others |

| By Application | Surgical wounds Diabetic foot ulcers Pressure ulcers Venous leg ulcers Burn wounds Others |

| By Distribution Channel | Direct sales Online sales Retail pharmacies Hospitals and clinics Others |

| By Region | North Island South Island |

| By Product Formulation | Liquid formulations Gel formulations Powder formulations Others |

| By Patient Demographics | Pediatric patients Adult patients Geriatric patients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Wound Care Departments | 45 | Wound Care Specialists, Clinical Directors |

| Home Healthcare Providers | 38 | Nursing Managers, Home Care Coordinators |

| Medical Supply Distributors | 32 | Sales Managers, Product Line Managers |

| Research Institutions Focused on Wound Healing | 28 | Research Scientists, Clinical Researchers |

| Patient Advocacy Groups | 27 | Patient Representatives, Healthcare Advocates |

The New Zealand Advanced Wound Care Market is valued at approximately USD 55 million, reflecting a five-year historical analysis. This growth is attributed to factors such as the increasing prevalence of chronic wounds and advancements in wound care technologies.