Region:Global

Author(s):Dev

Product Code:KRAA6779

Pages:87

Published On:January 2026

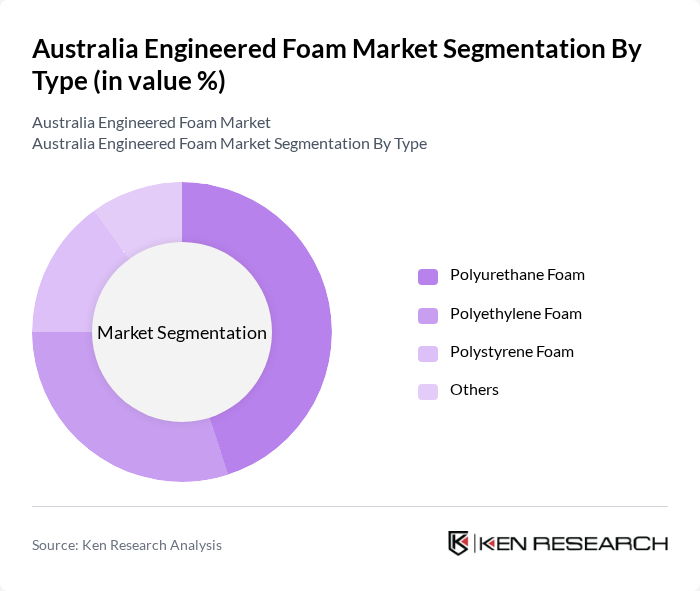

By Type:The engineered foam market can be segmented into various types, including Polyurethane Foam, Polyethylene Foam, Polystyrene Foam, and Others. Among these, Polyurethane Foam is the most dominant due to its versatility, durability, and superior insulation properties, making it a preferred choice in multiple applications such as automotive seating and construction insulation. Polyethylene Foam follows closely, favored for its lightweight and cushioning characteristics, particularly in packaging solutions.

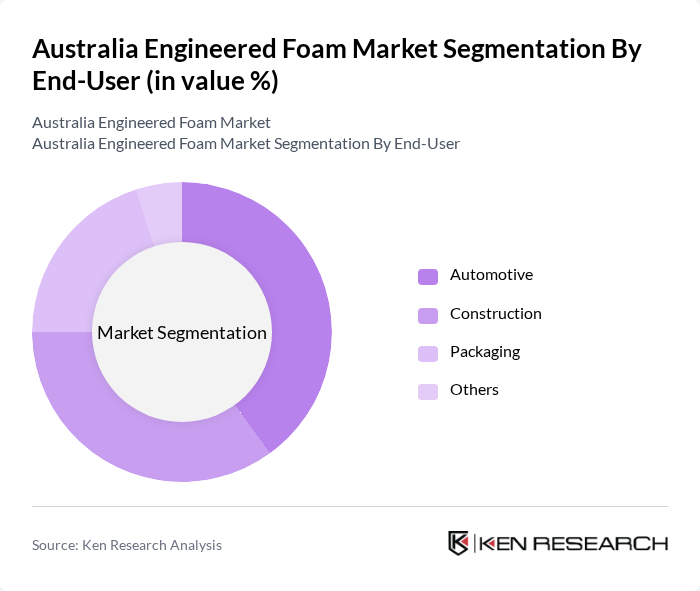

By End-User:The end-user segmentation includes Automotive, Construction, Packaging, and Others. The automotive sector is the leading end-user, driven by the demand for lightweight materials that enhance fuel efficiency and safety. The construction industry also plays a significant role, utilizing engineered foams for insulation and soundproofing applications. Packaging is another critical segment, where engineered foams provide protective cushioning for various products.

The Australia Engineered Foam Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Australia, Huntsman Corporation, Dow Chemical Company, Vita Group, Foamex, Flexible Foam Products, Australian Foam Products, ACO Polycrete, Polyurethane Foam Solutions, Kingspan Insulation, Sika Australia, Trelleborg Group, Sealed Air Corporation, Recticel, and Armacell contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia engineered foam market appears promising, driven by increasing demand for sustainable and high-performance materials. As the automotive and construction sectors continue to expand, innovations in foam technology will play a crucial role in meeting industry needs. Additionally, the shift towards eco-friendly products will likely accelerate, prompting manufacturers to invest in research and development. This evolving landscape presents opportunities for growth, particularly in emerging markets and through strategic collaborations with industry leaders.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyurethane Foam Polyethylene Foam Polystyrene Foam Others |

| By End-User | Automotive Construction Packaging Others |

| By Application | Insulation Cushioning Soundproofing Others |

| By Density | Low Density Medium Density High Density Others |

| By Region | New South Wales Victoria Queensland Others |

| By Foam Structure | Open-Cell Foam Closed-Cell Foam Others |

| By Manufacturing Process | Chemical Blowing Agent Physical Blowing Agent Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Foam Applications | 120 | Product Engineers, Procurement Managers |

| Construction Insulation Materials | 100 | Architects, Building Contractors |

| Packaging Solutions Using Foam | 90 | Logistics Coordinators, Packaging Designers |

| Consumer Goods Foam Products | 110 | Retail Buyers, Product Managers |

| Medical Foam Applications | 80 | Healthcare Product Developers, Supply Chain Managers |

The Australia Engineered Foam Market is valued at approximately USD 85 million, driven by the increasing demand for lightweight and energy-efficient materials across various industries, including automotive, construction, and packaging.