Region:Global

Author(s):Dev

Product Code:KRAA6782

Pages:81

Published On:January 2026

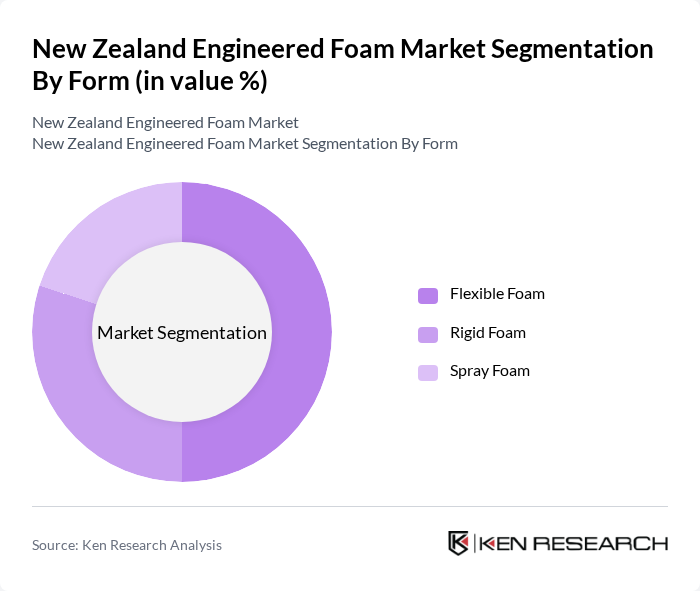

By Form:The market is segmented into three primary forms: Flexible Foam, Rigid Foam, and Spray Foam. Flexible foam is widely used in furniture and bedding applications due to its comfort and adaptability. Rigid foam is preferred in insulation and construction due to its structural integrity. Spray foam is gaining traction for its versatility in sealing and insulation applications. Among these, flexible foam dominates the market due to its extensive use in consumer products and growing demand for comfort in various applications.

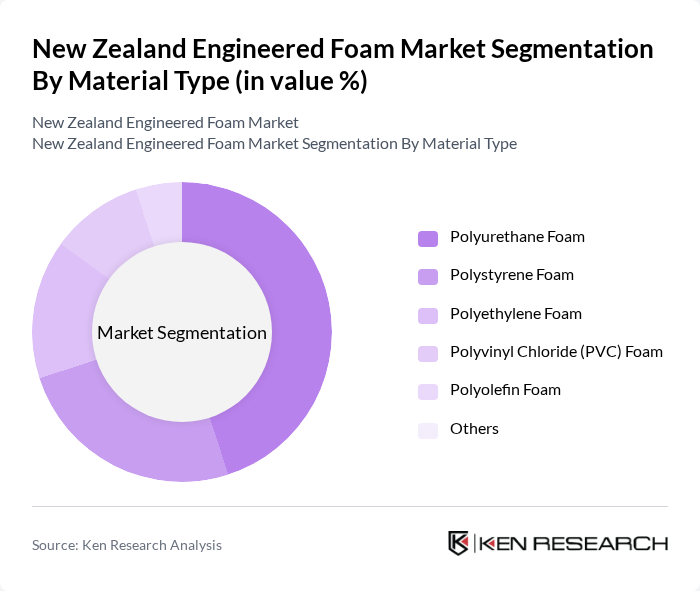

By Material Type:The market is categorized into several material types, including Polyurethane Foam, Polystyrene Foam, Polyethylene Foam, Polyvinyl Chloride (PVC) Foam, Polyolefin Foam, and Others. Polyurethane foam is the leading material type due to its versatility and superior performance in various applications, including automotive and furniture. Polystyrene foam follows closely, primarily used in packaging and insulation. The demand for eco-friendly materials is also driving growth in the polyolefin segment.

The New Zealand Engineered Foam Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sealed Air Corporation, Dunlop Foams, UFP Technologies, Foam Products Ltd., The Foam Factory, AFT Foam, Future Foam, Polyurethane Foam Solutions, Foamtech, NZ Foam, Foam & Fabric, Auralex Acoustics, AcoustaFoam, Insulfoam, Foam Innovations contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand engineered foam market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt eco-friendly practices, the demand for innovative foam solutions that meet environmental standards is expected to rise. Additionally, the integration of smart technologies into foam products will enhance functionality and appeal, positioning manufacturers to capitalize on emerging trends and consumer preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Form | Flexible Foam Rigid Foam Spray Foam |

| By Material Type | Polyurethane Foam Polystyrene Foam Polyethylene Foam Polyvinyl Chloride (PVC) Foam Polyolefin Foam Others |

| By End-User | Aerospace & Defense Medical & Healthcare Transportation Manufacturing & Construction Others |

| By Application | Cushioning Insulation Filtration Decorative and Architectural Others |

| By Region | North Island South Island Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Foam Applications | 100 | Product Engineers, Procurement Managers |

| Construction Industry Usage | 80 | Project Managers, Architects |

| Consumer Goods Packaging | 70 | Packaging Designers, Supply Chain Coordinators |

| Medical Foam Products | 60 | Quality Assurance Managers, R&D Specialists |

| Insulation and Soundproofing Solutions | 90 | Building Contractors, Acoustic Engineers |

The New Zealand Engineered Foam Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for lightweight materials across various industries, including automotive, construction, and healthcare.