Region:Asia

Author(s):Dev

Product Code:KRAA6892

Pages:86

Published On:January 2026

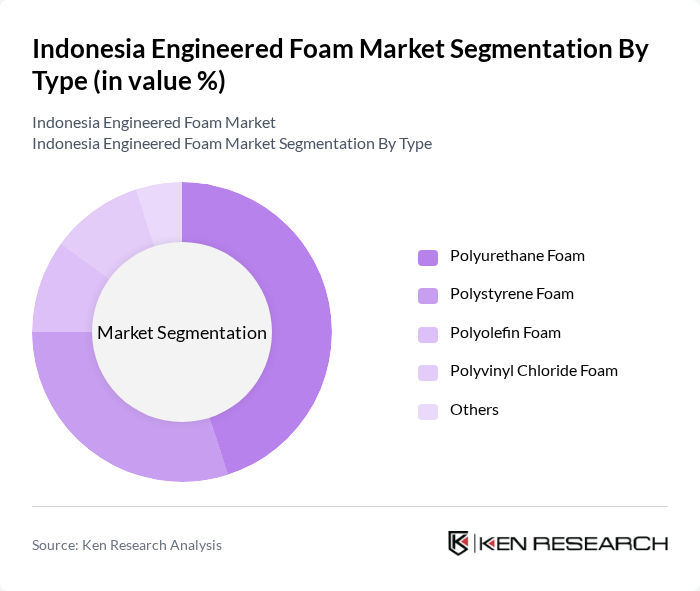

By Type:The engineered foam market can be segmented into several types, including Polyurethane Foam, Polystyrene Foam, Polyolefin Foam, Polyvinyl Chloride Foam, and Others. Among these, Polyurethane Foam is the most widely used due to its excellent insulation properties and versatility in applications ranging from furniture to automotive components. Polystyrene Foam follows closely, particularly in packaging and construction applications, due to its lightweight and cost-effective nature.

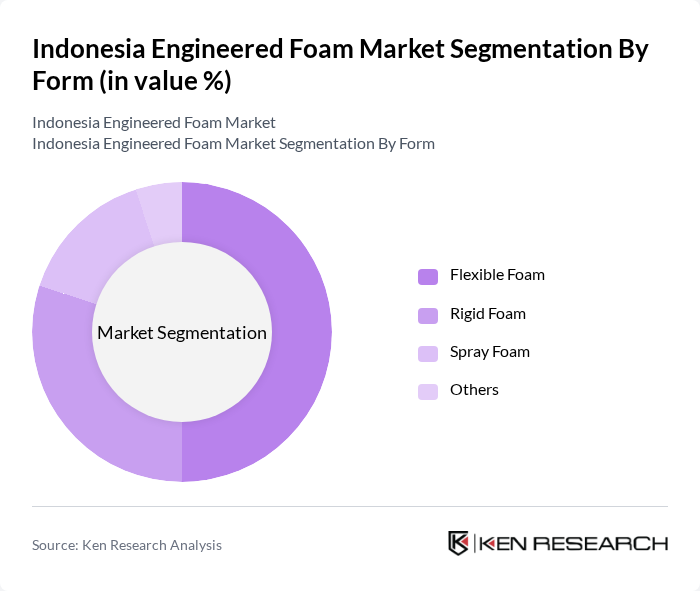

By Form:The market can also be categorized based on the form of engineered foams, which includes Flexible Foam, Rigid Foam, Spray Foam, and Others. Flexible Foam is predominantly used in furniture and bedding applications due to its comfort and adaptability, while Rigid Foam is favored in construction for its superior insulation properties. Spray Foam is gaining traction for its ease of application and effectiveness in sealing gaps and providing insulation.

The Indonesia Engineered Foam Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Indonesia, Dow Chemical Indonesia, Armacell Indonesia, Recticel Indonesia, Sealed Air Corporation Indonesia, Huntsman Corporation Indonesia, Covestro Indonesia, Foamtech Indonesia, Sika Indonesia, ArcelorMittal Indonesia, Kingspan Group Indonesia, Trelleborg Indonesia, UFP Technologies Indonesia, Zotefoams Indonesia, INOAC Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia engineered foam market appears promising, driven by technological advancements and a shift towards sustainable practices. As manufacturers invest in innovative production techniques, the market is likely to see an increase in the availability of eco-friendly foam products. Additionally, the growing demand for customized solutions across various industries will further enhance market dynamics, creating opportunities for companies to differentiate themselves and capture a larger share of the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyurethane Foam Polystyrene Foam Polyolefin Foam Polyvinyl Chloride Foam Others |

| By Form | Flexible Foam Rigid Foam Spray Foam Others |

| By End-User | Building & Construction Automotive & Transportation Furniture & Bedding Packaging Medical & Healthcare Others |

| By Region | Java Sumatra Bali & Nusa Tenggara Kalimantan Sulawesi Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Foam Applications | 100 | Product Managers, Design Engineers |

| Construction Insulation Materials | 80 | Architects, Project Managers |

| Packaging Solutions for Consumer Goods | 90 | Supply Chain Managers, Packaging Engineers |

| Medical Foam Products | 70 | Healthcare Product Developers, Quality Assurance Managers |

| Sports and Leisure Foam Products | 60 | Product Development Managers, Marketing Executives |

The Indonesia Engineered Foam Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by demand from sectors such as automotive, construction, and packaging, alongside increasing consumer awareness of sustainable materials.