Region:Middle East

Author(s):Dev

Product Code:KRAA6888

Pages:97

Published On:January 2026

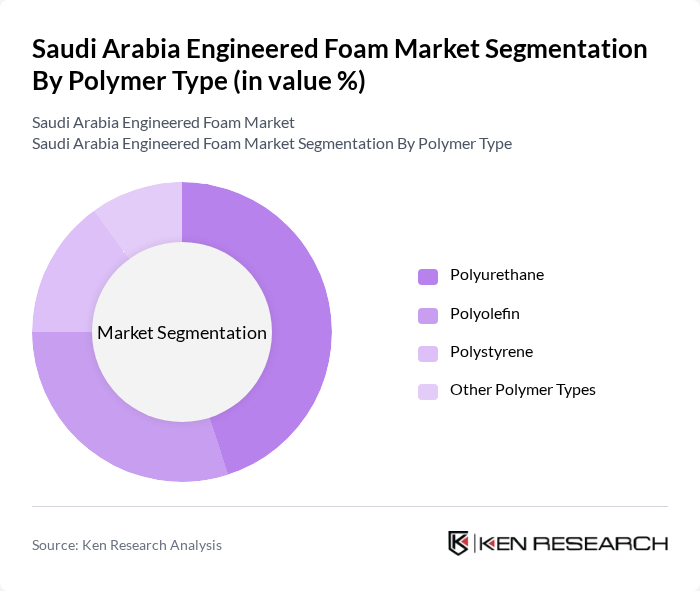

By Polymer Type:The engineered foam market can be segmented based on the type of polymer used. The primary polymer types include Polyurethane, Polyolefin, Polystyrene, and Other Polymer Types. Each of these polymers has unique properties that cater to different applications and consumer needs.

The Polyurethane segment is the leading subsegment in the engineered foam market, primarily due to its versatility and superior performance characteristics. It is widely used in applications requiring thermal insulation, cushioning, and energy absorption. The growing demand for lightweight and durable materials in the automotive and construction sectors further drives the preference for polyurethane foams, making it a dominant choice among manufacturers and consumers alike.

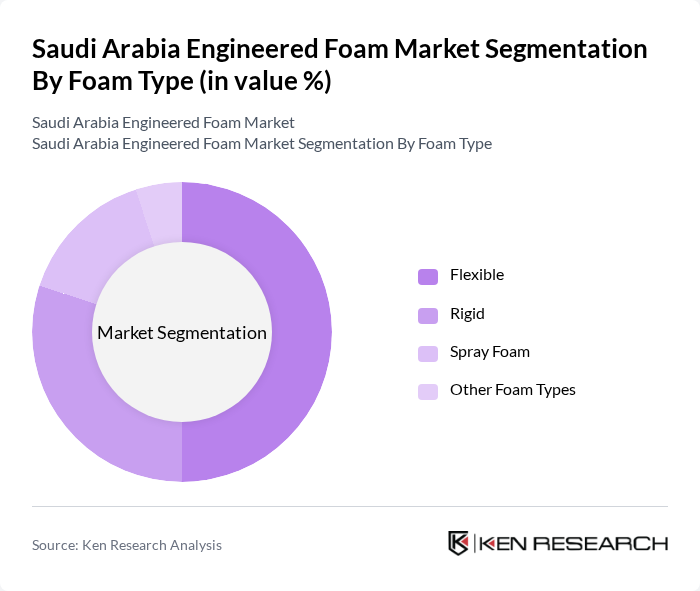

By Foam Type:The market can also be segmented based on foam types, which include Flexible, Rigid, Spray Foam, and Other Foam Types. Each foam type serves distinct applications and industries, influencing consumer preferences and market dynamics.

The Flexible foam type dominates the market due to its extensive use in various applications, including furniture, automotive interiors, and packaging. Its lightweight nature and adaptability to different shapes and sizes make it a preferred choice for manufacturers. The increasing demand for comfort and cushioning in consumer products further solidifies the position of flexible foams in the engineered foam market.

The Saudi Arabia Engineered Foam Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Huntsman Corporation, Dow Chemical Company, Recticel, Armacell International S.A., Covestro AG, Saint-Gobain, Rogers Corporation, UFP Technologies, Inc., Sealed Air Corporation, Flexible Foam Products, FoamPartner, Zotefoams plc, Future Foam, Inc., Vita Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the engineered foam market in Saudi Arabia appears promising, driven by ongoing investments in infrastructure and technological innovations. As the automotive and construction sectors continue to expand, the demand for high-performance foam products is expected to rise. Additionally, the shift towards sustainable materials and practices will likely create new avenues for growth, encouraging manufacturers to innovate and adapt to changing consumer preferences and regulatory landscapes, ensuring long-term market viability.

| Segment | Sub-Segments |

|---|---|

| By Polymer Type | Polyurethane Polyolefin Polystyrene Other Polymer Types |

| By Foam Type | Flexible Rigid Spray Foam Other Foam Types |

| By Application | Thermal Insulation Acoustic and Vibration Control Energy Absorption and Cushioning Structural Core and Lightweighting |

| By End-User Industry | Building and Construction Automotive and Transportation Packaging Furniture and Interiors Other End-user Industries |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Form | Sheets Rolls Blocks Others |

| By Market Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 100 | Project Managers, Procurement Officers |

| Automotive Sector Usage | 80 | Product Development Engineers, Quality Assurance Managers |

| Packaging Solutions | 70 | Packaging Designers, Supply Chain Managers |

| Consumer Goods Sector | 60 | Brand Managers, Product Managers |

| Research & Development Insights | 50 | R&D Directors, Innovation Managers |

The Saudi Arabia Engineered Foam Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the demand for lightweight materials in construction and automotive industries, as well as the focus on energy efficiency and insulation properties.