Region:Middle East

Author(s):Dev

Product Code:KRAA6778

Pages:96

Published On:January 2026

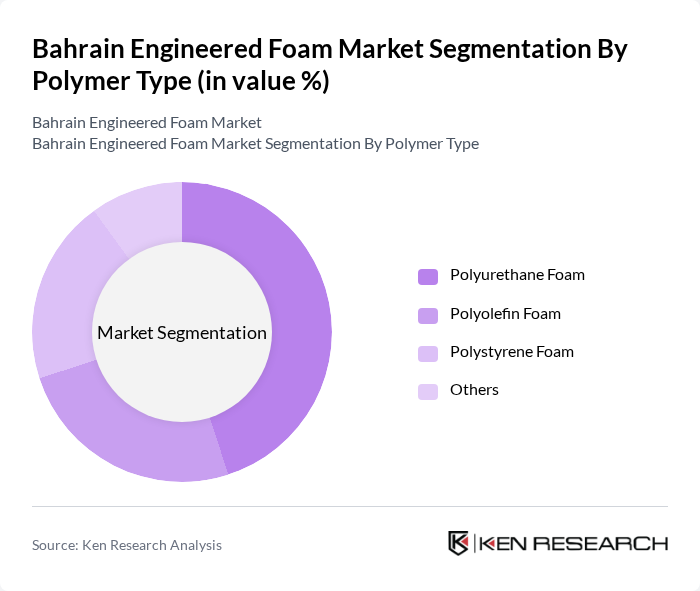

By Polymer Type:The polymer type segmentation includes various subsegments such as Polyurethane Foam, Polyolefin Foam, Polystyrene Foam, and Others. Among these, Polyurethane Foam is the leading subsegment due to its versatility, durability, and superior insulation properties, making it highly sought after in the construction and automotive sectors. The increasing focus on energy efficiency and comfort in buildings further drives the demand for this type of foam.

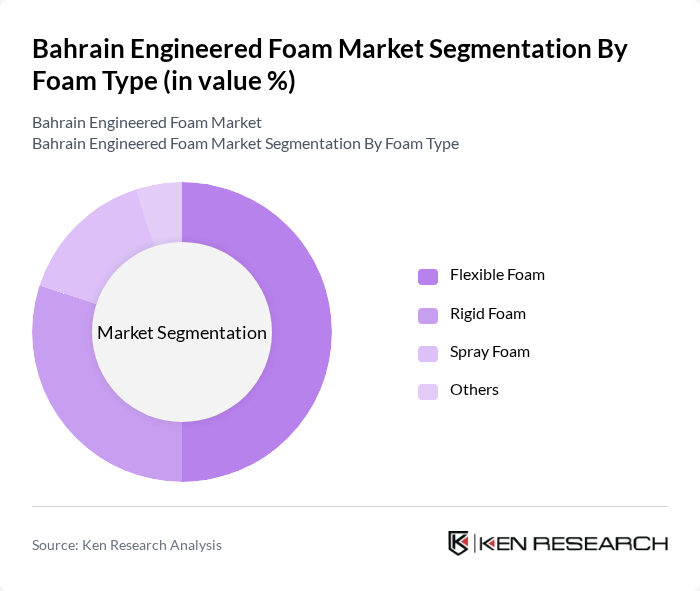

By Foam Type:The foam type segmentation encompasses Flexible Foam, Rigid Foam, Spray Foam, and Others. Flexible Foam is the dominant subsegment, primarily due to its widespread application in furniture, bedding, and automotive interiors. The growing consumer preference for comfort and customization in these sectors has significantly boosted the demand for flexible foam products, making it a key player in the market.

The Bahrain Engineered Foam Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Foam Manufacturing Company, Gulf Foam Factory, Al-Ahlia Group, Al-Moayyed Group, Foamtech, Al-Hilal Foam, Bahrain Polystyrene Company, Al-Muharraq Foam Factory, Al-Salam Foam, Bahrain National Gas Company, Al-Fateh Foam, Al-Mahroos Group, Al-Bahrain Foam, Al-Mansoori Foam, Al-Jazeera Foam contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain engineered foam market appears promising, driven by technological advancements and a shift towards sustainable practices. As manufacturers invest in innovative production techniques, the development of bio-based foams is expected to gain traction, aligning with global sustainability trends. Additionally, the integration of smart technologies in foam applications will enhance product functionality, catering to evolving consumer preferences. These trends indicate a dynamic market landscape, poised for growth and adaptation in response to emerging demands and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Polymer Type | Polyurethane Foam Polyolefin Foam Polystyrene Foam Others |

| By Foam Type | Flexible Foam Rigid Foam Spray Foam Others |

| By End-User Industry | Building and Construction Automotive and Transportation Packaging Furniture and Interiors Others |

| By Application | Thermal Insulation Sound Insulation Cushioning and Comfort Others |

| By Density | Low Density Medium Density High Density |

| By Product Form | Sheets Rolls Blocks Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 100 | Project Managers, Architects, Material Suppliers |

| Automotive Sector Usage | 80 | Product Development Engineers, Quality Assurance Managers |

| Packaging Solutions | 70 | Packaging Designers, Supply Chain Managers |

| Consumer Goods Sector | 60 | Brand Managers, Product Managers |

| Research & Development Insights | 50 | R&D Directors, Innovation Managers |

The Bahrain Engineered Foam Market is valued at approximately USD 145 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for lightweight and energy-efficient materials across various industries.