Japan Engineered Foam Market Overview

- The Japan Engineered Foam Market is valued at approximately USD 1.3 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for lightweight and energy-efficient materials across various industries, including automotive, construction, and packaging. The rising awareness of environmental sustainability and the need for innovative solutions in insulation and cushioning applications further propel market expansion. Japan's engineered foam market demonstrates meticulous deployment with documented operational excellence in structural applications and automotive manufacturing, leveraging advanced engineering expertise in material processing and cell control to maintain market leadership.

- Key cities such as Tokyo, Osaka, and Nagoya dominate the market due to their robust industrial base and high consumer demand. Tokyo, being the capital, serves as a hub for technological advancements and innovation, while Osaka and Nagoya are known for their strong manufacturing sectors, particularly in automotive and electronics, which significantly contribute to the engineered foam market. Manufacturing centers, including Tokyo, Nagoya, and Hiroshima, showcase advanced installations where foam systems integrate with comprehensive production platforms and quality systems to optimize structural performance and manufacturing efficiency.

- Japan has implemented comprehensive regulatory frameworks promoting sustainable material practices and eco-friendly foam development. The Plastic Resource Circulation Strategy and related environmental policies encourage manufacturers to adopt sustainable practices and invest in the development of biodegradable and recyclable foam products, aligning with global environmental goals and supporting the transition toward circular economy principles.

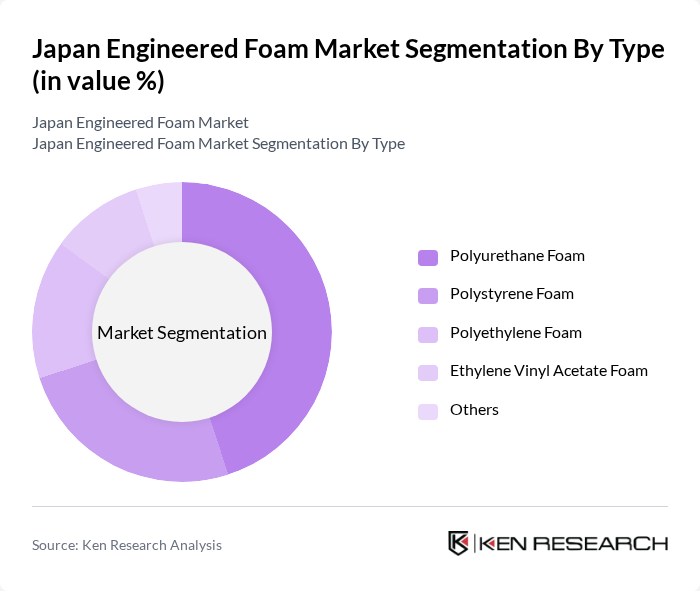

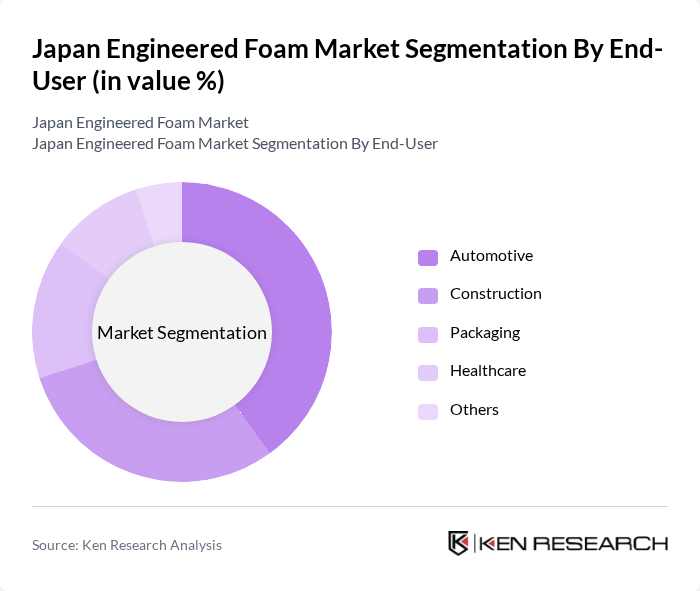

Japan Engineered Foam Market Segmentation

By Type:The engineered foam market can be segmented into various types, including Polyurethane Foam, Polystyrene Foam, Polyethylene Foam, Ethylene Vinyl Acetate Foam, and Others. Among these, Polyurethane Foam is the leading subsegment due to its versatility, durability, and superior insulation properties, making it highly sought after in the automotive and construction sectors. The demand for Polystyrene Foam is also significant, particularly in packaging applications, where its lightweight and cushioning characteristics are essential.

By End-User:The end-user segmentation includes Automotive, Construction, Packaging, Healthcare, and Others. The Automotive sector is the dominant end-user, driven by the increasing demand for lightweight materials that enhance fuel efficiency and reduce emissions. The Construction industry also plays a significant role, utilizing engineered foams for insulation and soundproofing applications, which are critical for energy-efficient buildings.

Japan Engineered Foam Market Competitive Landscape

The Japan Engineered Foam Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Japan Ltd., Sekisui Chemical Co., Ltd., Mitsui Chemicals, Inc., Toyobo Co., Ltd., Kaneka Corporation, Nitto Denko Corporation, Daikin Industries, Ltd., Asahi Kasei Corporation, Sumitomo Riko Company Limited, 3M Japan Limited, Armacell Japan K.K., JSP Corporation, Ube Industries, Ltd., DIC Corporation, Toray Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Japan Engineered Foam Market Industry Analysis

Growth Drivers

- Increasing Demand from Automotive Industry:The automotive sector in Japan is projected to produce approximately 8.7 million vehicles in future, driving the demand for engineered foam used in seating, insulation, and soundproofing. This growth is supported by a 4% increase in vehicle production compared to previous years, as manufacturers seek lightweight materials to enhance fuel efficiency. The integration of engineered foam contributes to weight reduction, aligning with the industry's focus on sustainability and performance enhancement.

- Rising Construction Activities:Japan's construction industry is expected to reach a value of ¥19 trillion (approximately $175 billion) in future, fueled by urban development and infrastructure projects. The demand for engineered foam in insulation and soundproofing applications is increasing, as builders prioritize energy efficiency and comfort. With the government investing ¥6.5 trillion in public works, the construction sector's growth directly correlates with the rising need for advanced foam materials in various building applications.

- Technological Advancements in Foam Production:The engineered foam production sector is witnessing significant technological innovations, with investments in advanced manufacturing processes projected to exceed ¥22 billion in future. These advancements enhance the quality and performance of foam products, enabling manufacturers to meet stringent industry standards. The introduction of automated production lines and improved material formulations is expected to increase production efficiency by 16%, further driving market growth and product diversification.

Market Challenges

- Fluctuating Raw Material Prices:The engineered foam market faces challenges due to volatile raw material prices, particularly for petrochemical-based components. In future, the price of key materials like polyol and isocyanate is projected to fluctuate by up to 12%, impacting production costs. This instability can lead to increased prices for end products, potentially reducing demand as manufacturers seek cost-effective alternatives, thereby affecting overall market growth.

- Stringent Environmental Regulations:Japan's commitment to environmental sustainability has led to stringent regulations on chemical usage in foam production. Compliance with these regulations requires significant investment in cleaner technologies, estimated at ¥5.5 billion for future. While these regulations aim to reduce environmental impact, they pose challenges for manufacturers in terms of operational costs and the need for continuous innovation to meet compliance standards without sacrificing product quality.

Japan Engineered Foam Market Future Outlook

The Japan engineered foam market is poised for significant transformation, driven by increasing consumer demand for eco-friendly products and innovative applications. As the automotive and construction sectors continue to expand, manufacturers are likely to invest in sustainable materials and advanced production technologies. The integration of smart technologies into foam products will also enhance functionality, catering to evolving consumer preferences. Overall, the market is expected to adapt to these trends, fostering growth and innovation in the coming years.

Market Opportunities

- Expansion in Emerging Markets:The growing demand for engineered foam in emerging markets, particularly in Southeast Asia, presents a significant opportunity. With an expected market growth of 14% in these regions, Japanese manufacturers can leverage their expertise to capture new customer bases and expand their global footprint, enhancing revenue streams and market share.

- Innovations in Foam Applications:The development of new applications for engineered foam, such as in medical devices and packaging, offers substantial growth potential. With the healthcare sector projected to grow by 9% in future, manufacturers can explore collaborations to create specialized foam products, tapping into high-demand niches and diversifying their product offerings.