Region:Middle East

Author(s):Dev

Product Code:KRAA6777

Pages:97

Published On:January 2026

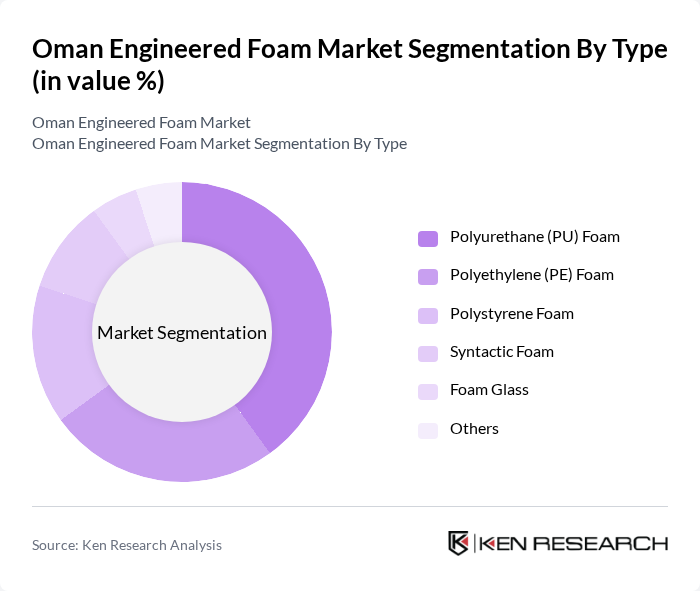

By Type:The engineered foam market can be segmented into various types, including Polyurethane (PU) Foam, Polyethylene (PE) Foam, Polystyrene Foam, Syntactic Foam, Foam Glass, and Others. Each type serves distinct applications across industries, with specific characteristics that cater to different consumer needs.

The Polyurethane (PU) Foam segment is currently dominating the market due to its versatility and superior performance characteristics. It is widely used in furniture, automotive seating, and insulation applications, making it a preferred choice among manufacturers. The growing trend towards lightweight and energy-efficient materials has further solidified PU foam's position as a market leader, as it offers excellent durability and comfort.

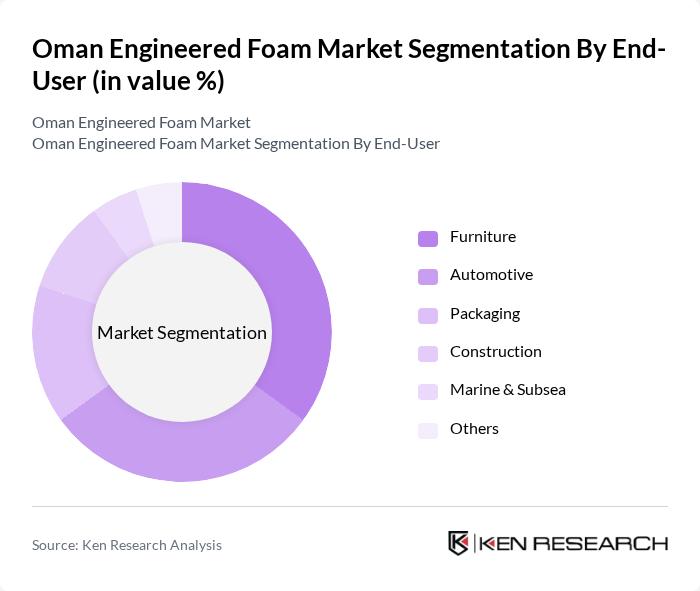

By End-User:The engineered foam market is segmented by end-user industries, including Furniture, Automotive, Packaging, Construction, Marine & Subsea, and Others. Each segment has unique requirements and applications, influencing the demand for specific types of engineered foam.

The Furniture segment leads the market, driven by the increasing demand for comfortable and durable seating solutions. The trend towards customization and aesthetic appeal in furniture design has further boosted the use of engineered foam, particularly PU foam, which offers excellent cushioning and support. Additionally, the automotive sector is also a significant contributor, as manufacturers seek lightweight materials to enhance fuel efficiency and support the growing adoption of electric vehicles.

The Oman Engineered Foam Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Foam Products Company, Al Sulaimi Group, Gulf Foam Factory, National Foam Factory, Al Jazeera Foam Factory, Al Mufeed Foam Factory, Oman Polystyrene Company, Al Batinah Foam Factory, Al Harthy Foam Factory, Al Muna Foam Factory, Al Mufeed Group, Al Shanfari Group, Al Mufeed Industrial Group, Al Mufeed Trading Company, Al Mufeed Manufacturing Company contribute to innovation, geographic expansion, and service delivery in this space.

The Oman engineered foam market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As manufacturers adopt eco-friendly production methods, the demand for bio-based foams is expected to rise, aligning with global sustainability trends. Additionally, the integration of smart technologies in foam applications will enhance product functionality, catering to evolving consumer preferences. The growth of online sales channels will further facilitate market access, enabling manufacturers to reach a broader customer base and adapt to changing market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyurethane (PU) Foam Polyethylene (PE) Foam Polystyrene Foam Syntactic Foam Foam Glass Others |

| By End-User | Furniture Automotive Packaging Construction Marine & Subsea Others |

| By Density | Low Density Medium Density High Density Others |

| By Application | Insulation Soundproofing Cushioning Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Product Form | Sheets Rolls Blocks Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Foam Applications | 100 | Product Managers, Design Engineers |

| Construction Industry Usage | 80 | Project Managers, Architects |

| Packaging Solutions | 70 | Supply Chain Managers, Packaging Engineers |

| Consumer Goods Sector | 60 | Brand Managers, Product Development Specialists |

| Research and Development Insights | 50 | R&D Directors, Innovation Managers |

The Oman Engineered Foam Market is valued at approximately USD 160 million, driven by the increasing demand for lightweight and durable materials across various industries, including automotive, construction, and packaging.