Region:Global

Author(s):Geetanshi

Product Code:KRVN6087

Pages:85

Published On:December 2025

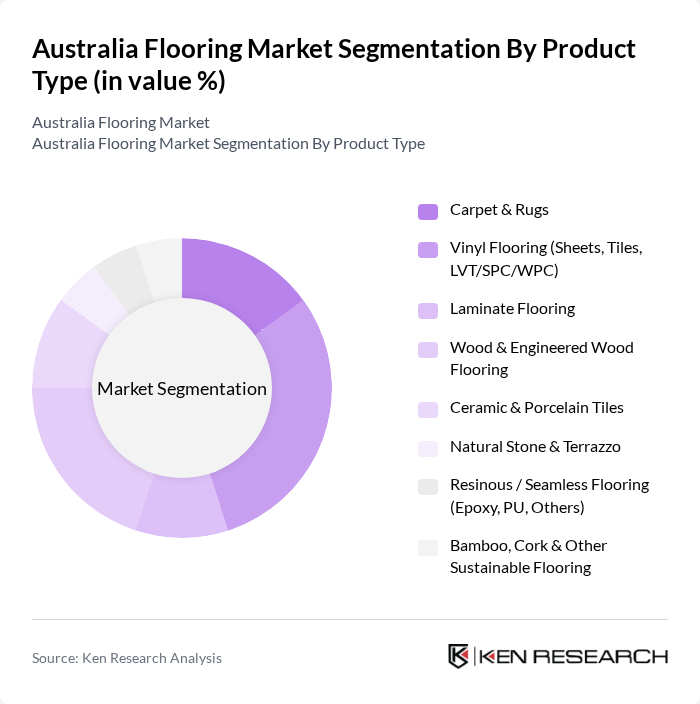

By Product Type:The product type segmentation includes various flooring materials that cater to different consumer preferences and applications. The subsegments are Carpet & Rugs, Vinyl Flooring (Sheets, Tiles, LVT/SPC/WPC), Laminate Flooring, Wood & Engineered Wood Flooring, Ceramic & Porcelain Tiles, Natural Stone & Terrazzo, Resinous / Seamless Flooring (Epoxy, PU, Others), and Bamboo, Cork & Other Sustainable Flooring. Among these, Vinyl Flooring has gained significant traction due to its versatility, durability, water resistance, and ease of maintenance, making it a preferred choice for both residential and commercial applications, particularly in luxury vinyl tiles, hybrid and SPC formats.

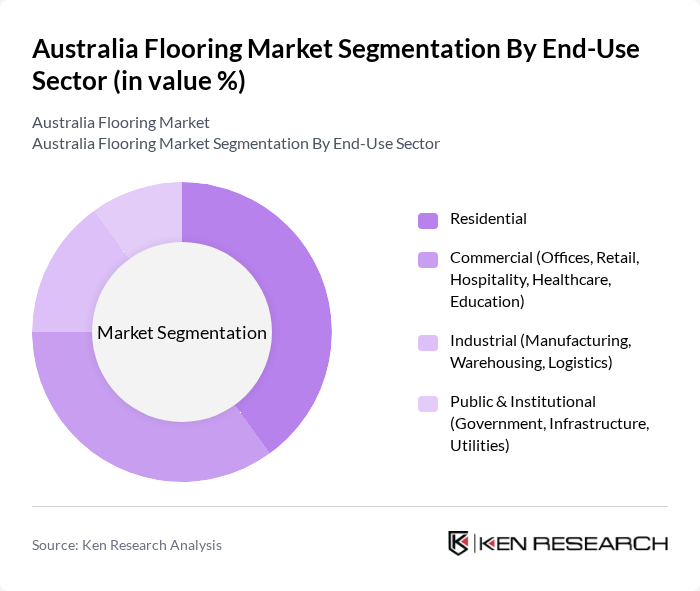

By End-Use Sector:The end-use sector segmentation encompasses various applications of flooring products across different industries. The subsegments include Residential, Commercial (Offices, Retail, Hospitality, Healthcare, Education), Industrial (Manufacturing, Warehousing, Logistics), and Public & Institutional (Government, Infrastructure, Utilities). The Residential sector is currently leading the market, supported by ongoing new housing construction, apartment developments, and a strong renovation and replacement cycle as homeowners upgrade to more durable, aesthetic, and low-maintenance flooring solutions such as hybrid, vinyl, and engineered wood.

The Australia Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boral Limited, CSR Limited, Armstrong Flooring Pty Ltd, Quick-Step (UNILIN), Karndean Designflooring, Godfrey Hirst (Mohawk Industries), Polyflor Australia Pty Ltd, Tarkett Australia Pty Ltd, Interface Australia Pty Ltd, Shaw Industries Group Inc., Laminex Australia (Fletcher Building), Dunlop Flooring, Airstep Flooring, Carpet Court Australia, Flooring Xtra contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian flooring market appears promising, driven by ongoing trends in sustainability and technological innovation. As consumer preferences shift towards eco-friendly and smart flooring solutions, companies are likely to invest more in R&D to meet these demands. Additionally, the anticipated growth in urbanization and infrastructure development will further stimulate the market. In future, the integration of digital tools for customer engagement is expected to enhance the purchasing experience, making it easier for consumers to select flooring products that align with their needs.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Carpet & Rugs Vinyl Flooring (Sheets, Tiles, LVT/SPC/WPC) Laminate Flooring Wood & Engineered Wood Flooring Ceramic & Porcelain Tiles Natural Stone & Terrazzo Resinous / Seamless Flooring (Epoxy, PU, Others) Bamboo, Cork & Other Sustainable Flooring |

| By End-Use Sector | Residential Commercial (Offices, Retail, Hospitality, Healthcare, Education) Industrial (Manufacturing, Warehousing, Logistics) Public & Institutional (Government, Infrastructure, Utilities) |

| By Application Type | New Construction Renovation & Remodeling Repair & Maintenance / Replacement |

| By Material Category | Resilient Flooring Non-Resilient / Hard Flooring Soft Coverings Hybrid & Modular Systems |

| By Distribution Channel | Specialty Floor Covering Retailers Home Improvement & DIY Stores Direct-to-Contractor / Project Sales Online & Omnichannel Platforms |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Australian Capital Territory & Northern Territory |

| By Price Range | Value / Budget Mid-Range Premium & Luxury |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Flooring Installations | 120 | Homeowners, Interior Designers |

| Commercial Flooring Projects | 100 | Facility Managers, Architects |

| Flooring Retail Sector Insights | 80 | Store Managers, Sales Representatives |

| Construction Industry Trends | 60 | Contractors, Builders |

| Consumer Preferences in Flooring | 90 | General Consumers, DIY Enthusiasts |

The Australia Flooring Market is valued at approximately USD 9 billion, reflecting a robust growth trajectory driven by increased residential and commercial construction, renovation activities, and a rising demand for sustainable flooring solutions.