Region:Asia

Author(s):Geetanshi

Product Code:KRAA2037

Pages:99

Published On:August 2025

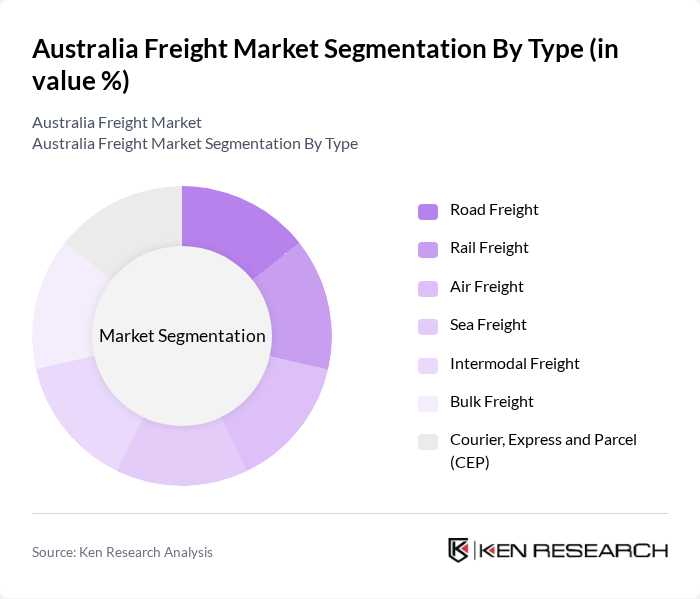

By Type:The freight market can be segmented into various types, including Road Freight, Rail Freight, Air Freight, Sea Freight, Intermodal Freight, Bulk Freight, and Courier, Express and Parcel (CEP). Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different transportation needs and customer preferences. Road freight remains the dominant mode for domestic logistics, while rail and sea freight are essential for bulk and long-haul transport. The CEP segment is experiencing rapid growth due to e-commerce expansion and rising demand for last-mile delivery solutions .

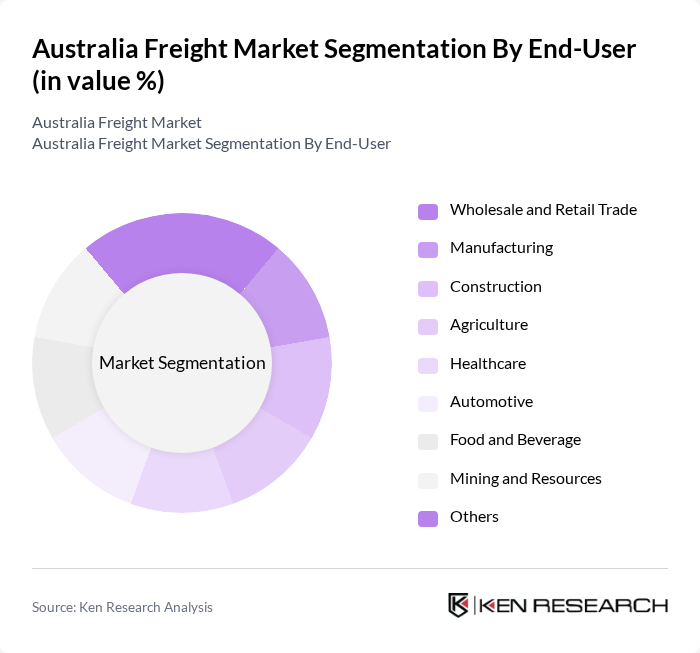

By End-User:The freight market serves various end-user segments, including Wholesale and Retail Trade, Manufacturing, Construction, Agriculture, Healthcare, Automotive, Food and Beverage, Mining and Resources, and Others. Each segment has unique logistics requirements, influencing the demand for different freight services. Wholesale and retail trade, along with manufacturing, are the largest end-users, driven by high volumes of goods movement and supply chain complexity. The food and beverage, healthcare, and automotive sectors are also significant contributors due to their specific logistics needs and regulatory compliance requirements .

The Australia Freight Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toll Group, Linfox, Qube Holdings, DB Schenker Australia, StarTrack, Aurizon, CEVA Logistics, Kuehne + Nagel Australia, Mainfreight Limited, C.H. Robinson Australia, DSV Australia, XPO Logistics, Hapag-Lloyd, MSC Mediterranean Shipping Company, Platinum Freight Management, CTS Australia, Deutsche Post DHL Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia freight market appears promising, driven by ongoing investments in infrastructure and technology. As e-commerce continues to thrive, logistics companies are expected to enhance their capabilities to meet rising demand. Additionally, the focus on sustainability will likely lead to increased adoption of green logistics practices. Companies that embrace digital transformation and innovative solutions will be better positioned to navigate challenges and capitalize on emerging opportunities in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Bulk Freight Courier, Express and Parcel (CEP) |

| By End-User | Wholesale and Retail Trade Manufacturing Construction Agriculture Healthcare Automotive Food and Beverage Mining and Resources Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) Freight Forwarding Contract Logistics Warehousing and Storage Others |

| By Service Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Expedited Freight Specialized Freight Others |

| By Payload Capacity | Light Duty Medium Duty Heavy Duty Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Northern Territory Australian Capital Territory Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 100 | Fleet Managers, Operations Directors |

| Rail Freight Services | 60 | Logistics Coordinators, Rail Operations Managers |

| Air Cargo Management | 40 | Air Freight Managers, Cargo Operations Supervisors |

| Maritime Freight Logistics | 50 | Shipping Line Executives, Port Authority Officials |

| Intermodal Freight Solutions | 45 | Supply Chain Analysts, Intermodal Operations Managers |

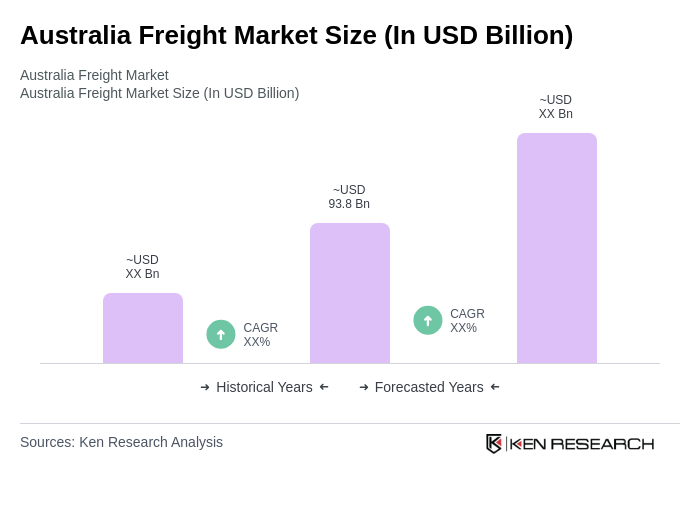

The Australia Freight Market is valued at approximately USD 93.8 billion, reflecting significant growth driven by increased demand for logistics services, e-commerce expansion, and infrastructure development.