Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2013

Pages:92

Published On:August 2025

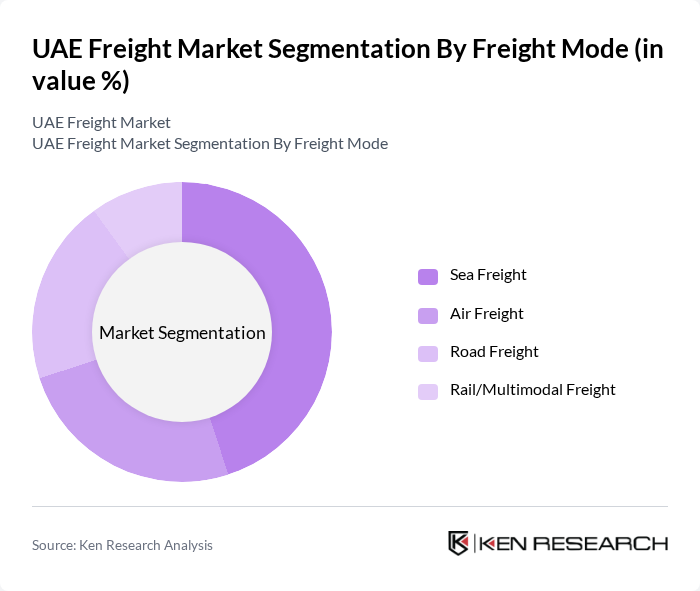

By Freight Mode:The freight market is segmented into various modes, including Sea Freight, Air Freight, Road Freight, and Rail/Multimodal Freight. Each mode serves distinct logistical needs, with sea freight being the most utilized due to the UAE's extensive coastline and world-class port facilities. Air freight is favored for high-value and time-sensitive goods, supported by major international airports. Road freight remains essential for domestic and GCC distribution, with recent adoption of electric and autonomous vehicles. Rail and multimodal freight are gaining traction as efficient, sustainable alternatives, especially following the inauguration of the Etihad Rail network .

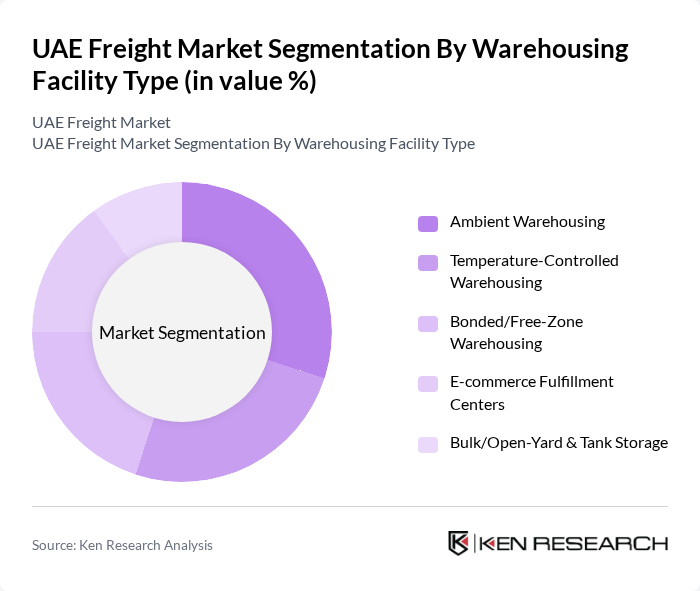

By Warehousing Facility Type:The warehousing segment includes Ambient Warehousing, Temperature-Controlled Warehousing, Bonded/Free-Zone Warehousing, E-commerce Fulfillment Centers, and Bulk/Open-Yard & Tank Storage. The demand for temperature-controlled warehousing is increasing due to the growth of the food and pharmaceutical sectors, while e-commerce fulfillment centers are rapidly expanding to meet the needs of online retailers. Bonded and free-zone warehousing continues to attract international shippers due to customs advantages and proximity to ports .

The UAE Freight Market is characterized by a dynamic mix of regional and international players. Leading participants such as DP World, Emirates Logistics LLC, Agility Logistics, Aramex, Abu Dhabi Ports Group, Gulf Agency Company (GAC), Kuehne + Nagel, DHL Global Forwarding, FedEx Express, Maersk Line, DB Schenker, CEVA Logistics, Hellmann Worldwide Logistics, Emirates SkyCargo, Etihad Rail contribute to innovation, geographic expansion, and service delivery in this space.

The UAE freight market is poised for significant transformation, driven by advancements in technology and evolving consumer preferences. As digital transformation accelerates, logistics companies are expected to adopt innovative solutions, enhancing operational efficiency and customer experience. Furthermore, the increasing emphasis on sustainability will likely lead to the adoption of eco-friendly practices, positioning the UAE as a leader in sustainable logistics. These trends will shape the future landscape of the freight market, fostering growth and resilience in the face of challenges.

| Segment | Sub-Segments |

|---|---|

| By Freight Mode | Sea Freight Air Freight Road Freight Rail/Multimodal Freight |

| By Warehousing Facility Type | Ambient Warehousing Temperature-Controlled Warehousing Bonded/Free-Zone Warehousing E-commerce Fulfillment Centers Bulk/Open-Yard & Tank Storage |

| By End-User Industry | Retail & Wholesale Trade Manufacturing Construction Automotive Pharmaceuticals Oil & Gas Agriculture, Fishing, and Forestry Mining and Quarrying Others |

| By Logistics Function | Freight Forwarding (Air, Sea, Road, Rail) Courier, Express, and Parcel (CEP) Warehousing and Storage Customs Brokerage Supply Chain Management Last-Mile Delivery Others |

| By Cargo Type | Containerized Cargo Bulk Cargo Breakbulk Cargo Liquid Cargo Hazardous Materials Others |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Logistics (3PL) Freight Brokers Others |

| By Geographic Coverage | Domestic Regional (GCC/MENA) International Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Freight Operations | 50 | Airline Logistics Managers, Freight Forwarding Executives |

| Maritime Freight Services | 45 | Port Authority Officials, Shipping Line Managers |

| Land Transport Logistics | 40 | Fleet Managers, Transportation Coordinators |

| Cold Chain Logistics | 40 | Supply Chain Directors, Temperature-Controlled Logistics Managers |

| Freight Technology Solutions | 45 | IT Managers, Logistics Technology Providers |

The UAE Freight Market is valued at approximately USD 21.6 billion, driven by its strategic location, increased trade activities, and significant investments in infrastructure development, including ports and airports.