Region:Africa

Author(s):Shubham

Product Code:KRAA0965

Pages:82

Published On:August 2025

By Mode of Transport:The freight market in South Africa is segmented by mode of transport, which includes various methods of moving goods. The primary modes are road freight, rail freight, air freight, sea and inland waterways freight, and pipelines. Each mode has its unique advantages and is utilized based on the nature of the goods, distance, and urgency of delivery. Road freight is particularly dominant due to its flexibility and extensive network, while rail freight is favored for bulk goods over long distances. Road transport accounts for the largest share of freight volume, driven by its ability to provide last-mile connectivity and serve a wide range of industries. Rail remains essential for transporting mining and bulk commodities, while air freight is increasingly used for high-value and time-sensitive shipments .

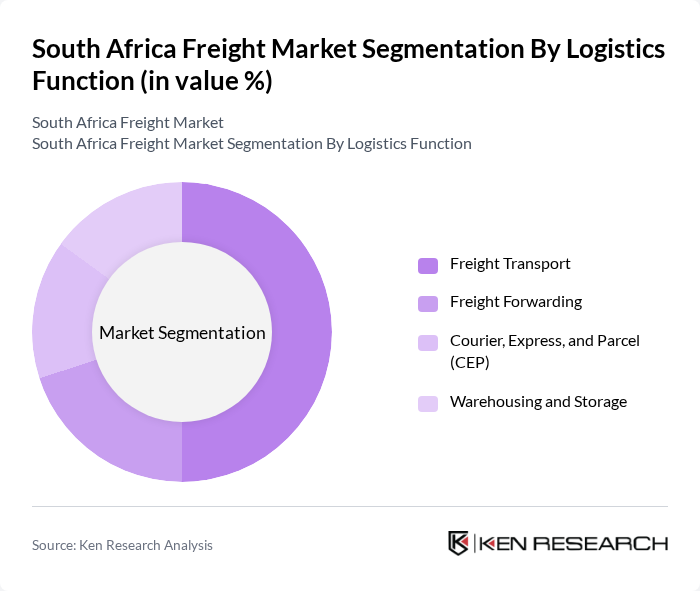

By Logistics Function:The logistics function in the South African freight market encompasses various services that facilitate the movement of goods. This includes freight transport, freight forwarding, courier, express, and parcel (CEP) services, as well as warehousing and storage. Each function plays a crucial role in ensuring that goods are delivered efficiently and on time. Freight transport is the most significant segment, driven by the growing demand for timely deliveries in the e-commerce sector. The warehousing and storage segment is also expanding, supported by investments in modern distribution centers and the adoption of digital technologies for inventory management .

The South Africa Freight Market is characterized by a dynamic mix of regional and international players. Leading participants such as Transnet Freight Rail, Imperial Logistics (now part of DP World Logistics South Africa), Bidvest International Logistics, DHL Global Forwarding South Africa, Grindrod Limited, Kuehne + Nagel South Africa, Barloworld Logistics, DSV South Africa, Rhenus Logistics South Africa, Cargo Carriers, Aramex South Africa, Safmarine (integrated into Maersk Line), TFG Logistics, Onelogix Group, Value Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The South African freight market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt digital solutions for freight management, operational efficiencies are expected to improve. Additionally, sustainability initiatives will likely shape logistics strategies, with a focus on reducing carbon footprints. The expansion into African markets presents further growth potential, as regional trade agreements facilitate cross-border logistics and enhance market accessibility for South African freight providers.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Road Freight Rail Freight Air Freight Sea and Inland Waterways Freight Pipelines |

| By Logistics Function | Freight Transport Freight Forwarding Courier, Express, and Parcel (CEP) Warehousing and Storage |

| By End-User Industry | Agriculture, Fishing, and Forestry Construction Manufacturing Oil and Gas, Mining and Quarrying Wholesale and Retail Trade Others |

| By Destination Type | Domestic International |

| By Temperature Control (Warehousing) | Non-Temperature Controlled Temperature Controlled |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 120 | Logistics Managers, Fleet Supervisors |

| Rail Freight Services | 60 | Operations Directors, Rail Network Planners |

| Air Cargo Management | 40 | Air Freight Managers, Cargo Operations Managers |

| Maritime Freight Logistics | 40 | Port Authority Officials, Shipping Line Executives |

| Cold Chain Logistics | 40 | Supply Chain Managers, Temperature-Controlled Logistics Specialists |

The South Africa Freight Market is valued at approximately USD 15 billion, reflecting significant growth driven by increased demand for logistics services, particularly due to the expansion of e-commerce, industrial activities, and infrastructure development.