Region:Asia

Author(s):Shubham

Product Code:KRAA1137

Pages:92

Published On:August 2025

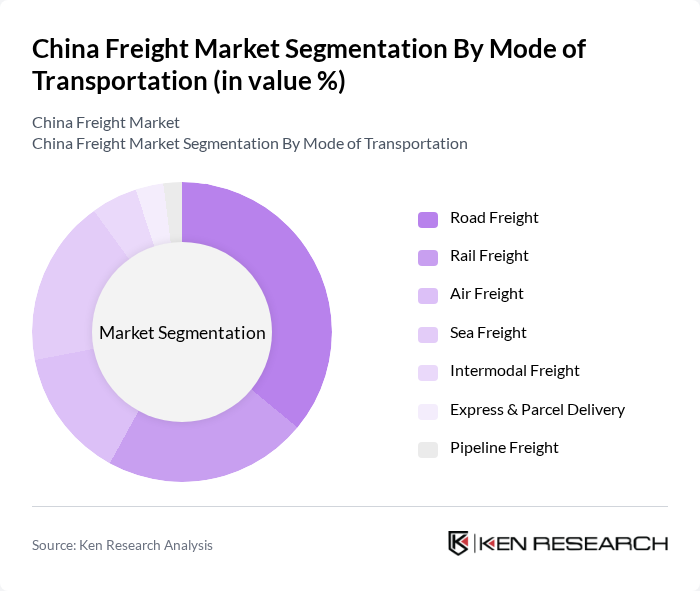

By Mode of Transportation:The freight market is segmented into various modes of transportation, including road, rail, air, sea, intermodal, express & parcel delivery, and pipeline freight. Each mode serves distinct logistical needs, with road freight being the most utilized due to its flexibility and reach. Rail freight is increasingly important for bulk and long-distance goods, supported by ongoing rail network expansion. Air freight is rapidly growing for time-sensitive and high-value shipments, driven by investments in airport infrastructure and express logistics. Sea freight remains essential for international trade, especially containerized cargo, and intermodal solutions are gaining traction for their efficiency in connecting different transport modes .

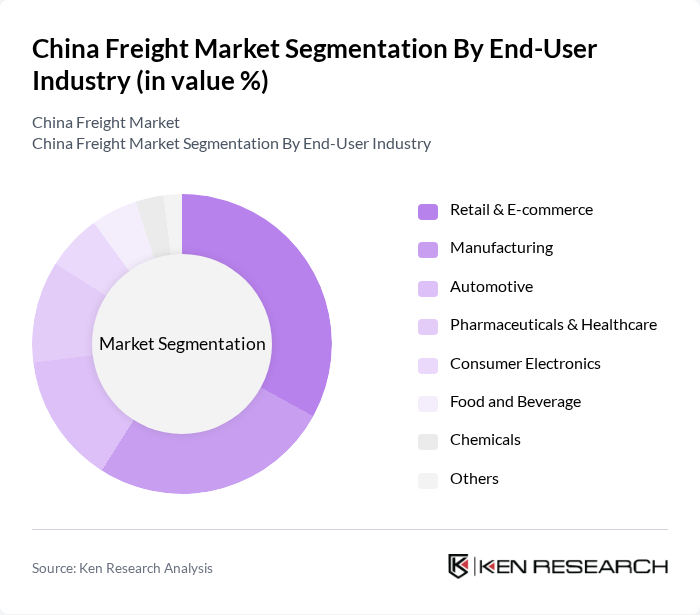

By End-User Industry:The freight market serves various end-user industries, including retail & e-commerce, manufacturing, automotive, pharmaceuticals & healthcare, consumer electronics, food and beverage, chemicals, and others. The retail and e-commerce sector is the largest consumer of freight services, driven by the surge in online shopping and the need for rapid delivery. Manufacturing and automotive industries also significantly contribute to freight demand due to their reliance on timely deliveries of raw materials and finished products. Pharmaceuticals and healthcare logistics are expanding with the growth of temperature-sensitive and high-value shipments, while food and beverage, chemicals, and electronics require specialized handling and compliance .

The China Freight Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sinotrans Limited, China COSCO Shipping Corporation, China Merchants Group, SF Express, ZTO Express, YTO Express Group, JD Logistics, Deppon Logistics Co., Ltd., CMA CGM Group (CEVA Logistics), Shanghai Aneng Juchuang Supply Chain Management Co., Ltd., Yunda Holding Co. Ltd., DHL Supply Chain, Kuehne + Nagel, DB Schenker, UPS Supply Chain Solutions, CEVA Logistics, Geodis contribute to innovation, geographic expansion, and service delivery in this space .

The future of the China freight market appears promising, driven by ongoing investments in technology and infrastructure. As e-commerce continues to expand, logistics providers are likely to enhance their capabilities to meet consumer demands. Additionally, the integration of sustainable practices and digital solutions will play a crucial role in shaping the market landscape. Companies that adapt to these trends will be better positioned to capitalize on emerging opportunities and navigate challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transportation | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Express & Parcel Delivery Pipeline Freight |

| By End-User Industry | Retail & E-commerce Manufacturing Automotive Pharmaceuticals & Healthcare Consumer Electronics Food and Beverage Chemicals Others |

| By Service Function | Freight Forwarding Warehousing & Distribution Customs Brokerage Supply Chain Management Last-Mile Delivery Cold Chain Logistics Others |

| By Cargo Type | Bulk Cargo General Cargo Liquid Cargo Hazardous Materials Perishable Goods Others |

| By Distribution Channel | Direct Distribution Indirect Distribution Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Others |

| By Pricing Model | Fixed Pricing Variable Pricing Dynamic Pricing Subscription-Based Pricing Others |

| By Contract Type | Long-Term Contracts Short-Term Contracts Spot Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| International Freight Forwarding | 100 | Logistics Managers, Freight Operations Directors |

| Domestic Freight Services | 80 | Supply Chain Managers, Transportation Coordinators |

| Cold Chain Logistics | 60 | Warehouse Managers, Quality Control Officers |

| Last-Mile Delivery Solutions | 50 | eCommerce Logistics Managers, Delivery Operations Heads |

| Freight Technology Adoption | 40 | IT Managers, Innovation Officers in Logistics |

The China Freight Market is valued at approximately USD 1,310 billion, driven by the rapid growth of e-commerce, increased manufacturing output, and the need for efficient logistics solutions. This valuation reflects a comprehensive analysis over the past five years.