Region:Africa

Author(s):Shubham

Product Code:KRAA1105

Pages:94

Published On:August 2025

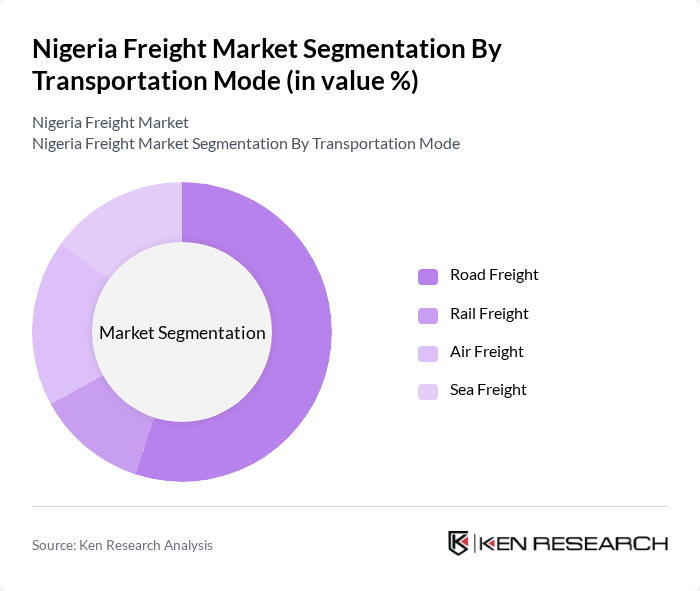

By Transportation Mode:The transportation mode segment includes various methods of freight transport, such as road, rail, air, and sea. Each mode has its unique advantages and is utilized based on the nature of goods, distance, and urgency of delivery. Road freight is the most widely used due to its flexibility and Nigeria's extensive road network, while rail freight is gaining traction for bulk and heavy goods, especially with recent investments in rail infrastructure. Air freight is preferred for high-value and time-sensitive shipments, and sea freight remains essential for international trade, particularly for containerized and bulk commodities .

By Service Type:The service type segment encompasses various logistics services, including freight forwarding, warehousing and distribution, value-added services, customs brokerage, and others. Freight forwarding remains a dominant service due to the complexity of international shipping and the need for expert handling, especially in customs clearance and multimodal transport. Warehousing and distribution services are critical for inventory management and timely delivery, particularly with the growth of e-commerce and retail. Value-added services, such as packaging and labeling, are increasingly important for customer satisfaction, while customs brokerage ensures compliance with evolving trade regulations .

The Nigeria Freight Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maersk Nigeria, DHL International GmbH (Nigeria), Bolloré Transport & Logistics Nigeria, Sifax Group, UPS Supply Chain Solutions (Nigeria), Red Star Express Plc, GIG Logistics, CourierPlus Services Limited, JOF Nigeria Limited, CMA CGM Nigeria, Nigerian Ports Authority, Nigerian Railway Corporation, Africa Access 3PL Limited, FedEx Nigeria, Cargo Services Nigeria contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Nigerian freight market appears promising, driven by ongoing infrastructure improvements and the increasing integration of technology in logistics operations. As the government continues to invest in transportation networks, the efficiency of freight services is expected to improve significantly. Additionally, the rise of e-commerce will further fuel demand for innovative logistics solutions, creating a dynamic environment for growth. Companies that adapt to these trends will likely thrive in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Transportation Mode | Road Freight Rail Freight Air Freight Sea Freight |

| By Service Type | Freight Forwarding Warehousing and Distribution Value-Added Services Customs Brokerage Others |

| By End-Use Industry | Manufacturing Retail and E-commerce Oil and Gas Pharmaceuticals and Healthcare Agriculture Construction Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 120 | Logistics Managers, Fleet Operators |

| Maritime Freight Services | 60 | Port Authorities, Shipping Line Executives |

| Air Cargo Logistics | 40 | Airline Cargo Managers, Freight Forwarders |

| Rail Freight Transportation | 50 | Railway Operations Managers, Supply Chain Analysts |

| Customs and Regulatory Compliance | 45 | Customs Officers, Compliance Managers |

The Nigeria Freight Market is valued at approximately USD 11 billion, driven by the growth of e-commerce, industrial activities, and infrastructure development. This valuation reflects a five-year historical analysis of the market's expansion and increasing demand for logistics services.