Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2070

Pages:82

Published On:August 2025

By Type:The freight market can be segmented into various types, includingRoad Freight,Air Freight,Sea Freight,Rail Freight,Courier, Express, and Parcel (CEP),Freight Forwarding,Warehousing and Storage, andOthers. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different transportation needs and customer preferences. Road and sea freight remain dominant due to Qatar’s geographic positioning and the scale of bulk trade, while air freight and CEP segments are experiencing rapid growth, driven by e-commerce expansion and demand for time-sensitive deliveries. Warehousing and storage are expanding to support increased throughput, especially for temperature-controlled goods .

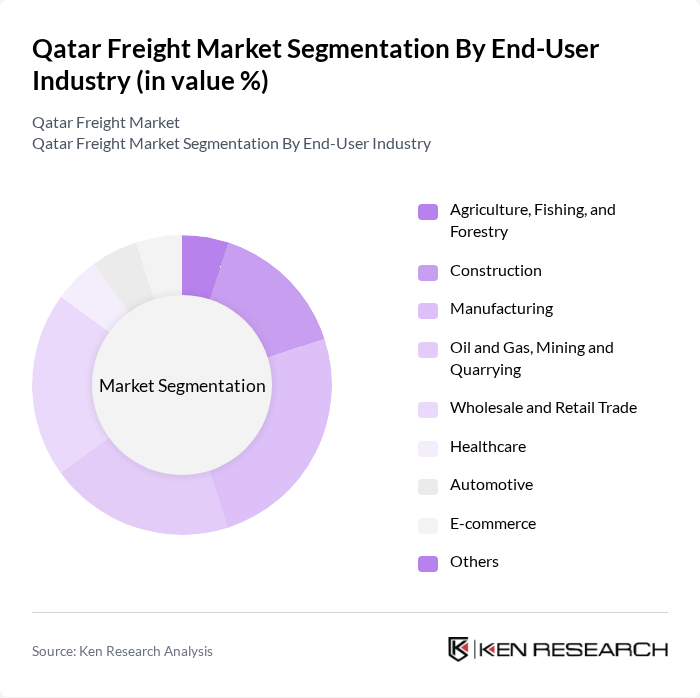

By End-User Industry:The freight market is also segmented by end-user industries, includingAgriculture, Fishing, and Forestry;Construction;Manufacturing;Oil and Gas, Mining and Quarrying;Wholesale and Retail Trade;Healthcare;Automotive;E-commerce; andOthers. Each industry has unique logistics requirements that influence the demand for various freight services. The manufacturing, oil and gas, and construction sectors are the largest contributors, while e-commerce and healthcare are driving demand for specialized and time-sensitive logistics solutions .

The Qatar Freight Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Airways Cargo, Gulf Warehousing Company (GWC), Milaha (Qatar Navigation Q.P.S.C.), Nakilat (Qatar Gas Transport Company Limited), Aero Freight, Agility Logistics, DHL Global Forwarding, DB Schenker, Kuehne + Nagel, CEVA Logistics, FedEx Express, UPS Supply Chain Solutions, Aramex, Maersk Qatar, MSC Mediterranean Shipping Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's freight market appears promising, driven by ongoing investments in infrastructure and technology. As the country continues to enhance its logistics capabilities, the integration of smart logistics solutions will likely streamline operations and improve efficiency. Additionally, the expansion of trade agreements and the establishment of free trade zones are expected to attract foreign investments, further bolstering the market. Overall, these developments will position Qatar as a key logistics hub in the region, fostering sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Air Freight Sea Freight Rail Freight Courier, Express, and Parcel (CEP) Freight Forwarding Warehousing and Storage Others |

| By End-User Industry | Agriculture, Fishing, and Forestry Construction Manufacturing Oil and Gas, Mining and Quarrying Wholesale and Retail Trade Healthcare Automotive E-commerce Others |

| By Logistics Function | Courier, Express, and Parcel (CEP) Freight Forwarding Freight Transport Warehousing and Storage Other Services |

| By Mode of Transport | Air Sea and Inland Waterways Road Pipelines Rail Others |

| By Temperature Control | Non-Temperature Controlled Temperature Controlled Others |

| By Destination Type | Domestic International Regional Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Freight Operations | 45 | Airline Cargo Managers, Freight Forwarding Executives |

| Maritime Freight Services | 40 | Port Authority Officials, Shipping Line Managers |

| Land Transportation Logistics | 40 | Logistics Coordinators, Fleet Managers |

| Customs and Regulatory Compliance | 40 | Customs Brokers, Compliance Officers |

| Warehouse and Distribution Management | 40 | Warehouse Managers, Supply Chain Analysts |

The Qatar Freight Market is valued at approximately USD 10 billion, driven by increased trade activities, strategic investments in infrastructure, and the country's position as a logistics hub. This valuation reflects a robust growth trajectory over the past five years.