Region:Central and South America

Author(s):Shubham

Product Code:KRAA0947

Pages:90

Published On:August 2025

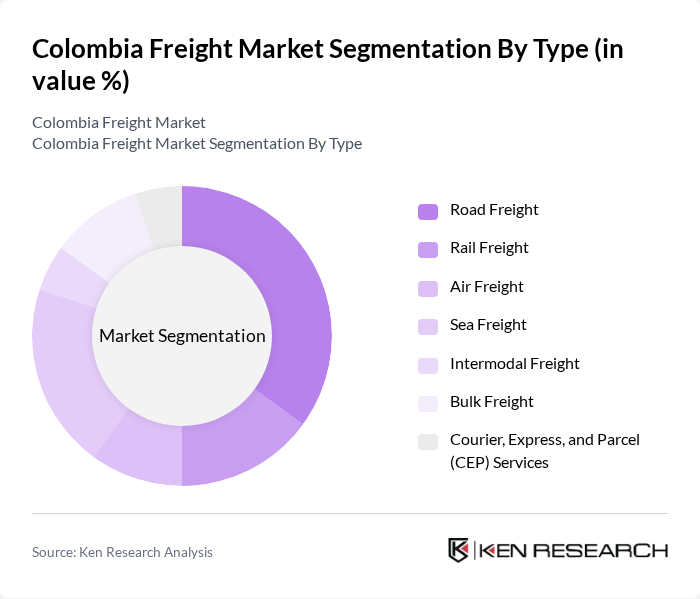

By Type:The freight market can be segmented into Road Freight, Rail Freight, Air Freight, Sea Freight, Intermodal Freight, Bulk Freight, and Courier, Express, and Parcel (CEP) Services. Road Freight remains the dominant mode, supported by Colombia’s extensive road network and the need for last-mile delivery. Rail and sea freight are gaining relevance for bulk and international shipments, while air freight is preferred for time-sensitive goods. The rise of e-commerce continues to drive demand for CEP services.

The Road Freight segment is the largest in the market, driven by the extensive road network and the increasing demand for last-mile delivery services. The convenience and flexibility offered by road transport make it the preferred choice for many businesses, especially in urban areas. Rail Freight, while smaller, is gaining traction due to its cost-effectiveness for bulk goods, while Air Freight is favored for time-sensitive deliveries. The growth of e-commerce has also significantly boosted the demand for Courier, Express, and Parcel services.

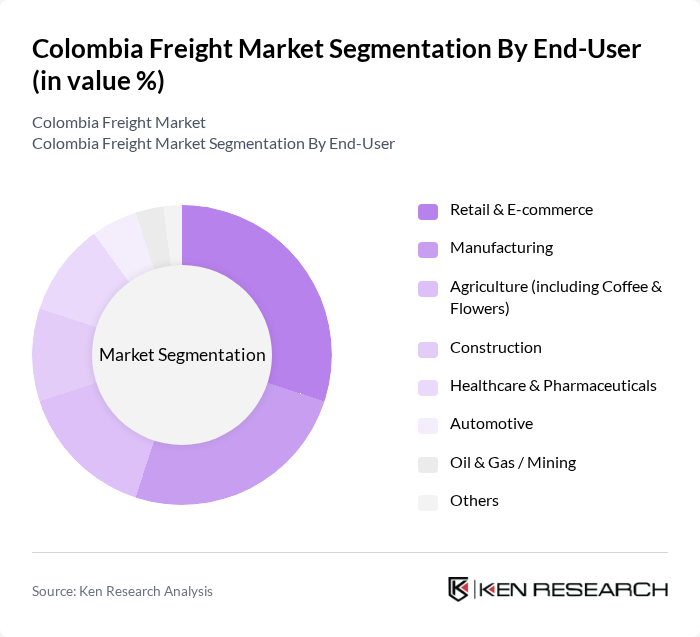

By End-User:The freight market is segmented by end-user industries, including Retail & E-commerce, Manufacturing, Agriculture (including Coffee & Flowers), Construction, Healthcare & Pharmaceuticals, Automotive, Oil & Gas / Mining, and Others. Retail & E-commerce is the largest segment, reflecting the rapid expansion of online shopping and the need for agile logistics. Manufacturing and agriculture are also significant, with Colombia’s exports of coffee and flowers playing a major role. Construction and healthcare require specialized logistics for heavy and sensitive cargo, respectively.

The Retail & E-commerce sector is the leading end-user, reflecting the rapid growth of online shopping and the need for efficient logistics solutions. Manufacturing follows closely, driven by the need for raw materials and finished goods transportation. Agriculture remains significant, particularly for coffee and flowers, which are key exports. The construction and healthcare sectors also contribute notably, with specific logistics needs for heavy materials and sensitive pharmaceuticals, respectively.

The Colombia Freight Market is characterized by a dynamic mix of regional and international players. Leading participants such as Servientrega, Coordinadora Mercantil S.A., TCC S.A.S., Inter Rapidísimo S.A., DHL Express Colombia, FedEx Express Colombia, UPS Colombia, Deprisa (Avianca Cargo), Ditransa S.A., Carga Express S.A.S., Logística de Colombia S.A.S., Transportes M y M, Grupo Logístico Andreani Colombia, OPL Carga S.A.S., Envía Colvanes S.A.S. contribute to innovation, geographic expansion, and service delivery in this space.

The Colombia freight market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As logistics providers increasingly adopt digital solutions, such as automated tracking and data analytics, operational efficiencies are expected to improve. Furthermore, the emphasis on sustainability will likely lead to the adoption of greener practices, enhancing the market's resilience. Overall, the freight sector is set to adapt to these changes, positioning itself for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Bulk Freight Courier, Express, and Parcel (CEP) Services |

| By End-User | Retail & E-commerce Manufacturing Agriculture (including Coffee & Flowers) Construction Healthcare & Pharmaceuticals Automotive Oil & Gas / Mining Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) Freight Forwarding Contract Logistics Others |

| By Service Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Expedited Freight Specialized Freight Services (e.g., Cold Chain, Hazardous Materials) Warehousing & Value-Added Services Others |

| By Payload Capacity | Light Duty Medium Duty Heavy Duty Others |

| By Pricing Model | Fixed Pricing Variable Pricing Dynamic Pricing Others |

| By Customer Segment | Small Enterprises Medium Enterprises Large Enterprises Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 120 | Logistics Coordinators, Fleet Managers |

| Maritime Freight Services | 60 | Port Managers, Shipping Line Executives |

| Air Cargo Logistics | 40 | Air Freight Managers, Customs Brokers |

| Rail Freight Transportation | 45 | Railway Operations Managers, Supply Chain Analysts |

| Cold Chain Logistics | 40 | Temperature-Controlled Logistics Managers, Quality Assurance Officers |

The Colombia Freight Market is valued at approximately USD 22 billion, driven by the growing demand for logistics services, particularly due to the expansion of e-commerce and improvements in infrastructure such as roads and ports.