Region:Global

Author(s):Geetanshi

Product Code:KRAA6718

Pages:81

Published On:September 2025

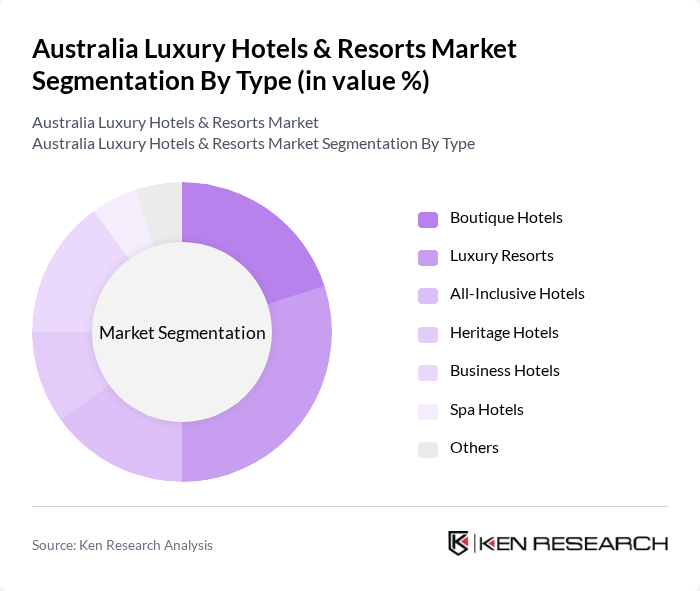

By Type:The luxury hotels and resorts market can be segmented into various types, including Boutique Hotels, Luxury Resorts, All-Inclusive Hotels, Heritage Hotels, Business Hotels, Spa Hotels, and Others. Each of these sub-segments caters to different consumer preferences and experiences. Boutique hotels are gaining popularity for their unique designs and personalized services, while luxury resorts are favored for their extensive amenities and scenic locations. All-inclusive hotels attract families and groups looking for convenience, while heritage hotels appeal to travelers seeking cultural experiences. Business hotels cater to corporate clients, and spa hotels focus on wellness and relaxation.

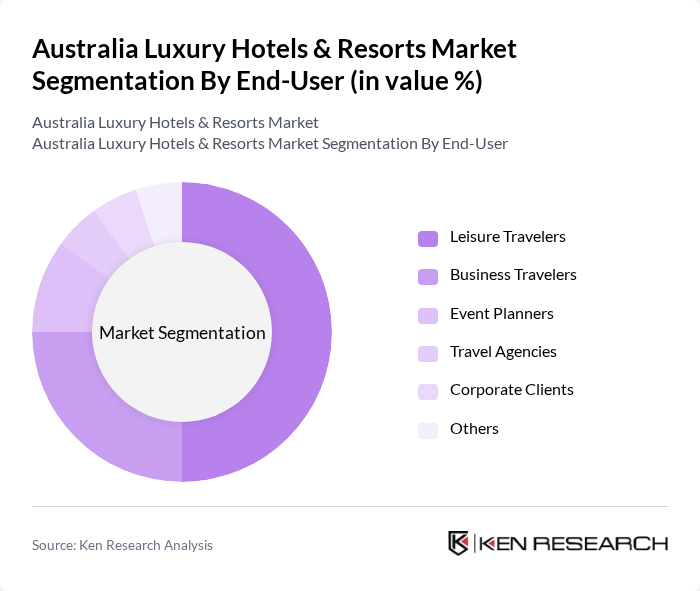

By End-User:The end-user segmentation of the luxury hotels and resorts market includes Leisure Travelers, Business Travelers, Event Planners, Travel Agencies, Corporate Clients, and Others. Leisure travelers dominate the market, driven by a growing trend of experiential travel and luxury vacations. Business travelers seek high-quality accommodations that offer convenience and amenities conducive to work. Event planners and travel agencies play a crucial role in driving group bookings, while corporate clients often have specific requirements for meetings and conferences.

The Australia Luxury Hotels & Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Crown Resorts Limited, Accor Hotels, Hilton Worldwide Holdings Inc., Marriott International Inc., InterContinental Hotels Group, Mantra Group, TFE Hotels, Peppers Retreats, Ovolo Hotels, The Star Entertainment Group, Shangri-La Hotels and Resorts, Hyatt Hotels Corporation, Langham Hospitality Group, AccorInvest, Quest Apartment Hotels contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia luxury hotels and resorts market appears promising, driven by evolving consumer preferences and technological advancements. As travelers increasingly seek personalized and sustainable experiences, luxury hotels are likely to adapt by integrating eco-friendly practices and smart technologies. Additionally, the anticipated growth in international tourism will further enhance market dynamics, providing opportunities for luxury brands to innovate and expand their offerings, ensuring they meet the demands of a discerning clientele.

| Segment | Sub-Segments |

|---|---|

| By Type | Boutique Hotels Luxury Resorts All-Inclusive Hotels Heritage Hotels Business Hotels Spa Hotels Others |

| By End-User | Leisure Travelers Business Travelers Event Planners Travel Agencies Corporate Clients Others |

| By Price Range | Premium Luxury Ultra-Luxury Budget Luxury Others |

| By Location | Urban Areas Coastal Regions Rural Retreats Tourist Attractions Others |

| By Amenities Offered | Spa and Wellness Services Fine Dining Restaurants Concierge Services Event and Conference Facilities Others |

| By Booking Channel | Direct Booking Online Travel Agencies (OTAs) Travel Agents Corporate Bookings Others |

| By Customer Segment | Families Couples Solo Travelers Groups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel General Managers | 100 | General Managers, Operations Directors |

| Travel Agents Specializing in Luxury Travel | 80 | Travel Consultants, Agency Owners |

| Affluent Travelers | 150 | High-Net-Worth Individuals, Frequent Luxury Travelers |

| Hospitality Industry Experts | 60 | Market Analysts, Hospitality Consultants |

| Luxury Resort Marketing Managers | 70 | Marketing Directors, Brand Managers |

The Australia Luxury Hotels & Resorts Market is valued at approximately USD 7 billion, reflecting significant growth driven by increased international tourism, rising disposable incomes, and a preference for premium travel experiences among consumers.