Saudi Arabia Dental Implants Market Overview

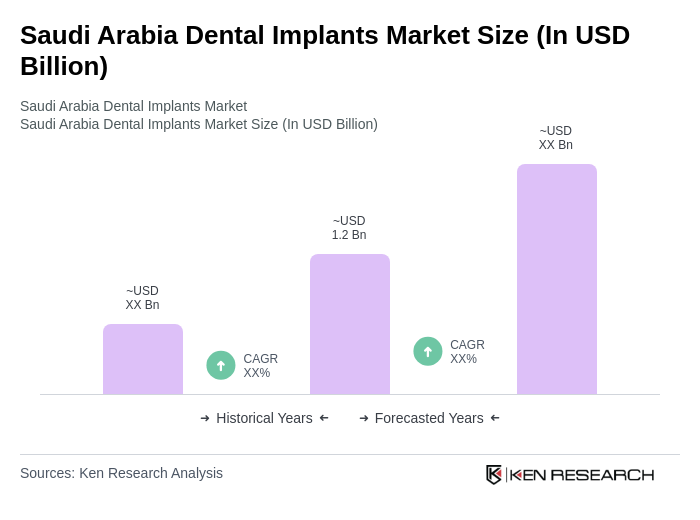

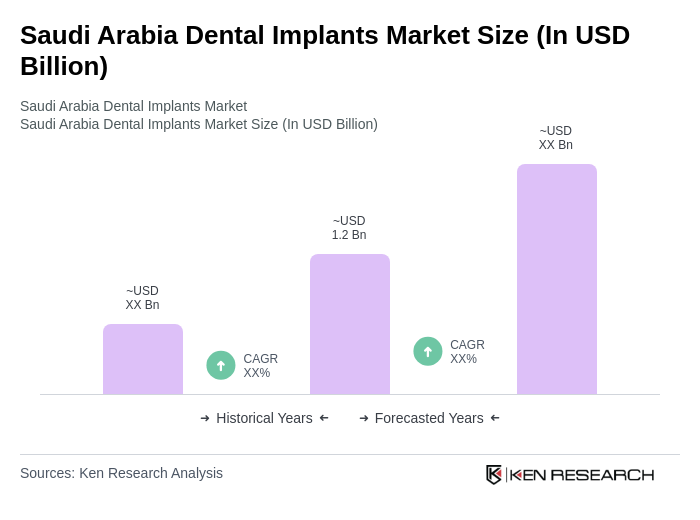

- The Saudi Arabia Dental Implants Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of dental diseases, rising disposable incomes, and advancements in dental technology. The growing awareness of oral health and the demand for cosmetic dentistry further contribute to the market's expansion.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their advanced healthcare infrastructure and concentration of dental clinics and hospitals. These urban centers are also home to a large population with higher disposable incomes, leading to increased spending on dental care and implant procedures.

- In 2023, the Saudi government implemented regulations to enhance the quality of dental care services, mandating that all dental implant procedures be performed by licensed professionals in accredited facilities. This regulation aims to ensure patient safety and improve the overall standard of dental care in the country.

Saudi Arabia Dental Implants Market Segmentation

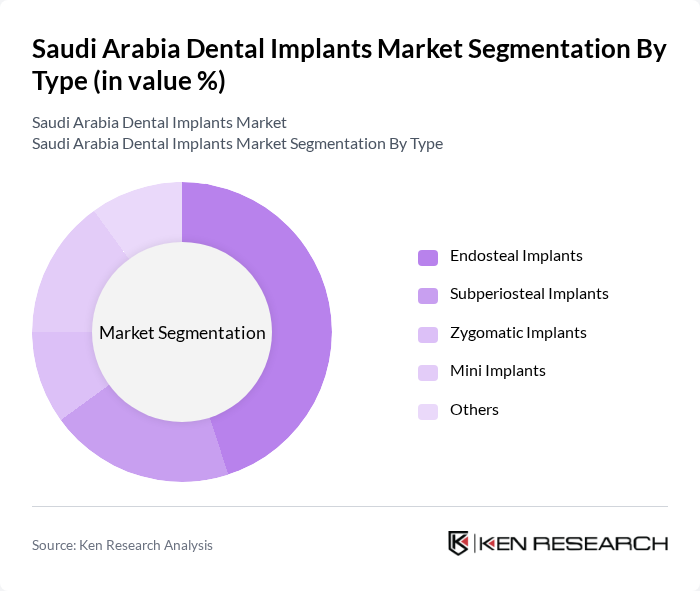

By Type:The market is segmented into various types of dental implants, including Endosteal Implants, Subperiosteal Implants, Zygomatic Implants, Mini Implants, and Others. Among these, Endosteal Implants are the most widely used due to their high success rate and compatibility with the jawbone. The increasing preference for minimally invasive procedures has also led to a rise in the adoption of Mini Implants, particularly among patients seeking cost-effective solutions.

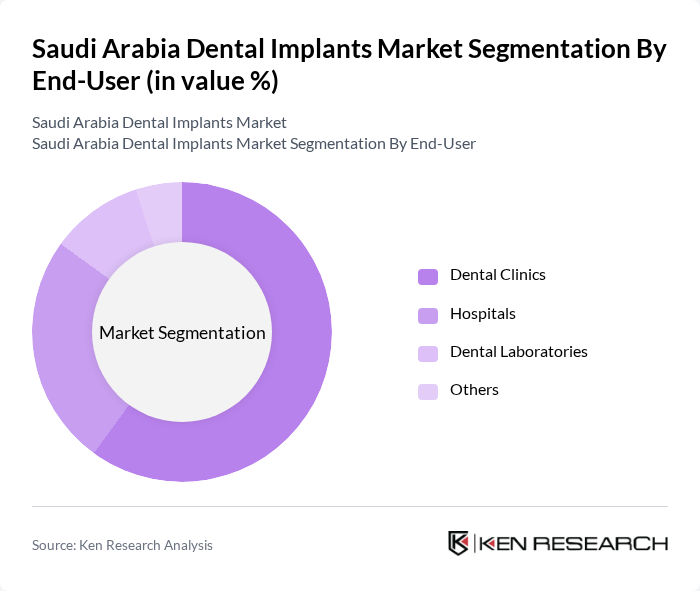

By End-User:The end-user segmentation includes Dental Clinics, Hospitals, Dental Laboratories, and Others. Dental Clinics are the leading end-users, as they are the primary providers of dental implant procedures. The increasing number of dental clinics in urban areas, coupled with the rising demand for cosmetic dental procedures, has significantly contributed to their dominance in the market.

Saudi Arabia Dental Implants Market Competitive Landscape

The Saudi Arabia Dental Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Straumann Holding AG, Nobel Biocare Services AG, Dentsply Sirona Inc., Zimmer Biomet Holdings, Inc., Osstem Implant Co., Ltd., BioHorizons Implant Systems, Inc., Megagen Implant Co., Ltd., Bicon, LLC, Implant Direct Sybron International, 3M Company, Dentium Co., Ltd., Hiossen, Inc., Neodent, Alpha-Bio Tec, Southern Implants contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Dental Implants Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Dental Diseases:The rise in dental diseases in Saudi Arabia is significant, with approximately 60% of the population experiencing some form of dental issue. According to the Saudi Ministry of Health, dental caries and periodontal diseases are prevalent, affecting over 15 million individuals. This growing health concern drives demand for dental implants, as patients seek effective solutions to restore oral health and functionality, thereby boosting the market for dental implants.

- Rising Awareness About Dental Aesthetics:The increasing focus on dental aesthetics among the Saudi population is notable, with a reported 40% of adults considering cosmetic dental procedures. The Saudi Dental Society indicates that more individuals are prioritizing their smiles, leading to a surge in demand for dental implants. This trend is further supported by social media influences and marketing campaigns that emphasize the importance of a perfect smile, driving growth in the dental implants market.

- Advancements in Dental Implant Technology:Technological innovations in dental implants have significantly improved their success rates and patient outcomes. In future, the introduction of new materials and techniques, such as 3D printing and bioactive implants, is expected to enhance the market. The Saudi Dental Association reports that these advancements have led to a 30% increase in patient satisfaction, encouraging more individuals to opt for dental implants as a reliable solution for tooth loss.

Market Challenges

- High Cost of Dental Implants:The financial burden associated with dental implants remains a significant challenge in Saudi Arabia. The average cost of a single dental implant can range from SAR 3,000 to SAR 7,000, making it unaffordable for many. According to the Saudi Arabian Monetary Authority, approximately 25% of the population has limited access to dental care due to high costs, which restricts market growth and limits patient options for treatment.

- Limited Availability of Skilled Professionals:The shortage of qualified dental professionals in Saudi Arabia poses a challenge to the dental implants market. The World Health Organization estimates that there are only 1.5 dentists per 1,000 people in the country, which is below the global average. This scarcity of skilled practitioners limits the capacity to perform dental implant procedures, thereby hindering market expansion and patient access to necessary treatments.

Saudi Arabia Dental Implants Market Future Outlook

The future of the dental implants market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer awareness. As the population ages, the demand for dental solutions will likely rise, particularly among the geriatric demographic. Additionally, the integration of digital technologies in dental practices is expected to streamline procedures and enhance patient experiences. These trends indicate a robust growth trajectory for the market, with potential for innovative solutions to address existing challenges.

Market Opportunities

- Expansion of Dental Tourism:Saudi Arabia is emerging as a dental tourism destination, attracting international patients seeking affordable and high-quality dental care. The Ministry of Tourism reported a 20% increase in dental tourists in future, indicating a growing market opportunity. This trend can significantly boost the dental implants sector, as foreign patients often require extensive dental procedures, including implants.

- Development of Innovative Implant Materials:The ongoing research and development in implant materials present a significant opportunity for market growth. Innovations such as titanium-zirconium alloys and bioactive ceramics are gaining traction, with studies showing a 25% improvement in osseointegration rates. These advancements can enhance the appeal of dental implants, attracting more patients and driving market expansion in Saudi Arabia.