Region:Global

Author(s):Dev

Product Code:KRAA2547

Pages:81

Published On:August 2025

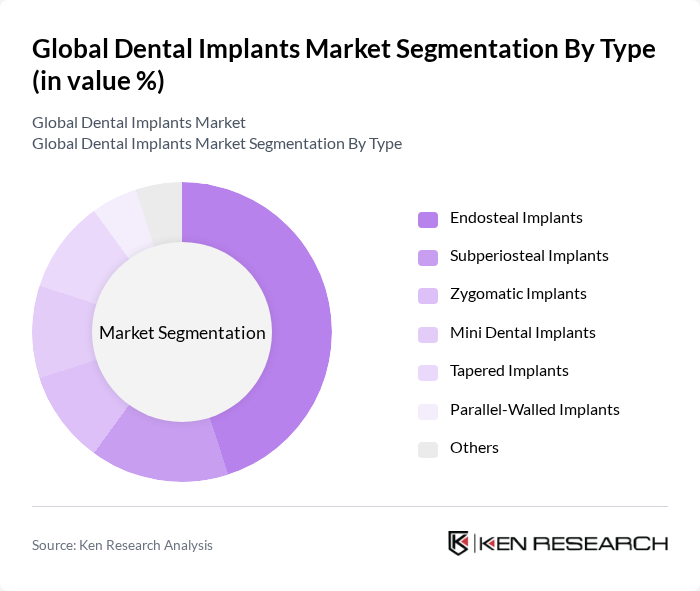

By Type:The dental implants market is segmented into various types, including Endosteal Implants, Subperiosteal Implants, Zygomatic Implants, Mini Dental Implants, Tapered Implants, Parallel-Walled Implants, and Others. Among these,Endosteal Implantsdominate the market due to their widespread acceptance, high success rates, and effectiveness in providing a stable foundation for dental prosthetics. The increasing preference for minimally invasive procedures and the growing number of dental professionals trained in implantology further bolster the demand for Endosteal Implants .

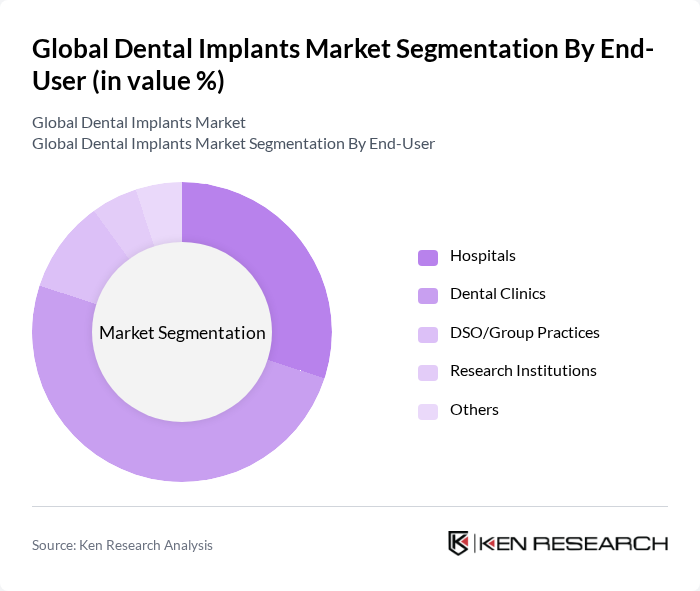

By End-User:The market is segmented by end-users, including Hospitals, Dental Clinics, DSO/Group Practices, Research Institutions, and Others.Dental Clinicsare the leading end-user segment, driven by the increasing number of dental practices, the rising demand for cosmetic dentistry, and the trend toward personalized dental care. The growing number of patients seeking dental implants for both functional and aesthetic reasons further enhances the market position of Dental Clinics .

The Global Dental Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Straumann Holding AG, Dentsply Sirona Inc., Nobel Biocare Services AG, Zimmer Biomet Holdings, Inc., Osstem Implant Co., Ltd., BioHorizons Implant Systems, Inc., Implant Direct Sybron International, Bicon, LLC, Megagen Implant Co., Ltd., Hiossen, Inc., Alpha-Bio Tec Ltd., Dentium Co., Ltd., Neodent (a Straumann Group brand), TBR Implants Group, Anthogyr SAS (Straumann Group), MIS Implants Technologies Ltd. (Dentsply Sirona), Southern Implants, Adin Dental Implant Systems Ltd., Thommen Medical AG, Camlog Biotechnologies GmbH (Straumann Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dental implants market in the None region appears promising, driven by technological advancements and demographic shifts. The integration of digital dentistry and minimally invasive techniques is expected to enhance patient experiences and outcomes. Furthermore, as awareness of oral health continues to rise, more individuals are likely to seek dental implants as a viable solution for tooth loss. This trend, coupled with the increasing geriatric population, will likely sustain market growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Endosteal Implants Subperiosteal Implants Zygomatic Implants Mini Dental Implants Tapered Implants Parallel-Walled Implants Others |

| By End-User | Hospitals Dental Clinics DSO/Group Practices Research Institutions Others |

| By Material | Titanium Implants Zirconia Implants Others |

| By Procedure | Single Tooth Replacement Multiple Teeth Replacement Full Mouth Reconstruction Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Implant Manufacturers | 100 | Product Managers, Sales Directors |

| Dental Clinics and Practices | 120 | Dentists, Clinic Owners |

| Dental Supply Distributors | 80 | Supply Chain Managers, Procurement Officers |

| Dental Research Institutions | 60 | Research Scientists, Academic Professors |

| Dental Equipment Retailers | 70 | Store Managers, Sales Representatives |

The Global Dental Implants Market is valued at approximately USD 4.9 billion, driven by factors such as the increasing prevalence of dental diseases, advancements in dental technology, and a growing geriatric population seeking dental restoration solutions.