Region:Asia

Author(s):Rebecca

Product Code:KRAE0958

Pages:94

Published On:December 2025

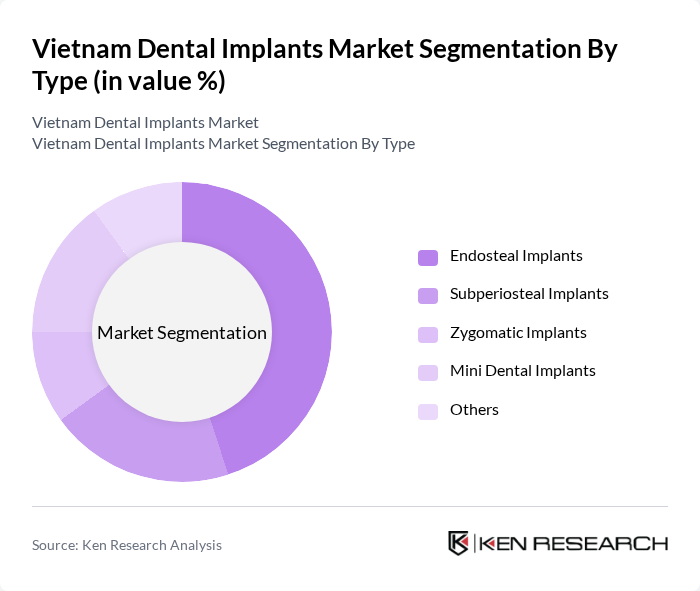

By Type:The dental implants market is segmented into various types, including Endosteal Implants, Subperiosteal Implants, Zygomatic Implants, Mini Dental Implants, and Others. Among these, Endosteal Implants are the most widely used due to their effectiveness and compatibility with the jawbone. The growing preference for minimally invasive procedures has also led to an increase in the adoption of Mini Dental Implants, which are particularly popular among patients seeking less invasive options.

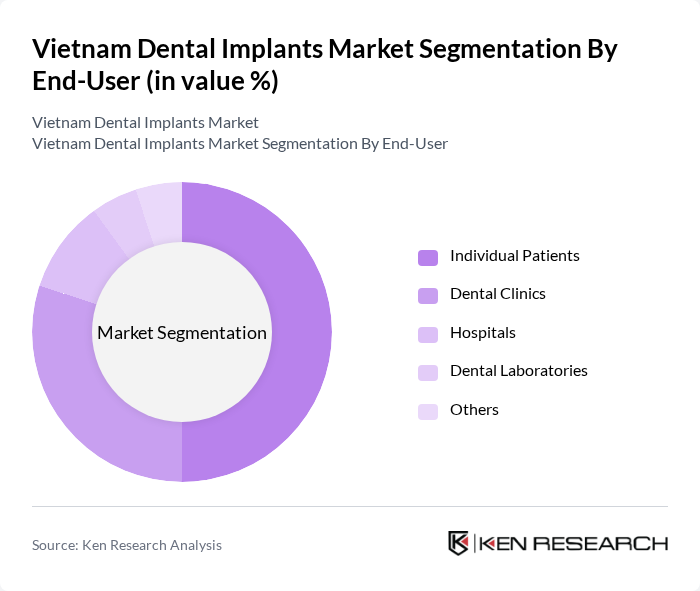

By End-User:The market is segmented by end-users, including Individual Patients, Dental Clinics, Hospitals, Dental Laboratories, and Others. Individual Patients represent the largest segment, driven by the increasing awareness of dental aesthetics and the desire for improved oral health. Dental Clinics also play a significant role, as they are the primary providers of dental implant services, catering to a growing number of patients seeking advanced dental solutions.

The Vietnam Dental Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nobel Biocare, Straumann, Dentsply Sirona, Osstem Implant, BioHorizons, Megagen, Neodent, Implant Direct, Bicon, Alpha-Bio Tec, ZimVie, Dentium, Hiossen, Southern Implants, and 3M contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam dental implants market is poised for significant growth, driven by increasing dental tourism and advancements in technology. As the government continues to invest in healthcare infrastructure, the accessibility of dental services is expected to improve, particularly in underserved areas. Additionally, the rising awareness of oral health will likely lead to a greater demand for dental implants. Overall, the market is set to evolve, with innovative solutions and enhanced patient care becoming central to its development.

| Segment | Sub-Segments |

|---|---|

| By Type | Endosteal Implants Subperiosteal Implants Zygomatic Implants Mini Dental Implants Others |

| By End-User | Individual Patients Dental Clinics Hospitals Dental Laboratories Others |

| By Material | Titanium Implants Zirconia Implants Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam |

| By Age Group | Children Adults Seniors |

| By Insurance Coverage | Private Insurance Public Insurance Out-of-Pocket Payments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics | 150 | Dentists, Clinic Managers |

| Hospitals with Dental Departments | 100 | Oral Surgeons, Department Heads |

| Dental Implant Manufacturers | 80 | Sales Managers, Product Development Leads |

| Patients who have undergone Implant Procedures | 120 | Recent Patients, Dental Care Advocates |

| Dental Supply Distributors | 70 | Distribution Managers, Sales Representatives |

The Vietnam Dental Implants Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is driven by increasing tooth loss, oral diseases, and a rising demand for cosmetic dentistry.