Australia Nutritional Supplements in Sports Fitness Market Overview

- The Australia Nutritional Supplements in Sports Fitness Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing awareness of health and fitness, coupled with a rise in the number of fitness centers and gyms across the country. The growing trend of fitness among the younger population and the increasing participation in sports activities have further fueled the demand for nutritional supplements.

- Key players in this market include Sydney, Melbourne, and Brisbane, which dominate due to their large populations and vibrant fitness cultures. These cities have a high concentration of gyms, health clubs, and wellness centers, contributing to the increased consumption of nutritional supplements. Additionally, the presence of major retailers and online platforms in these urban areas facilitates easy access to a variety of products.

- In 2023, the Australian government implemented regulations requiring all nutritional supplements to undergo rigorous testing for safety and efficacy before reaching the market. This initiative aims to ensure consumer safety and enhance the credibility of the nutritional supplement industry, thereby fostering consumer trust and promoting responsible marketing practices.

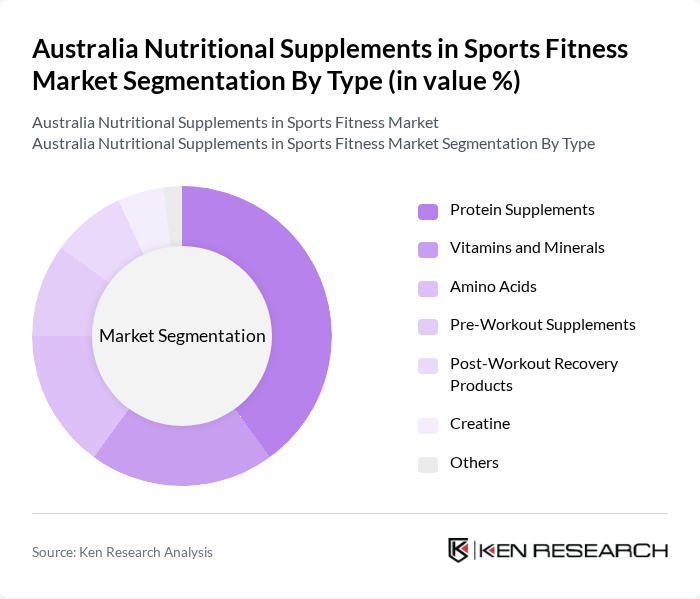

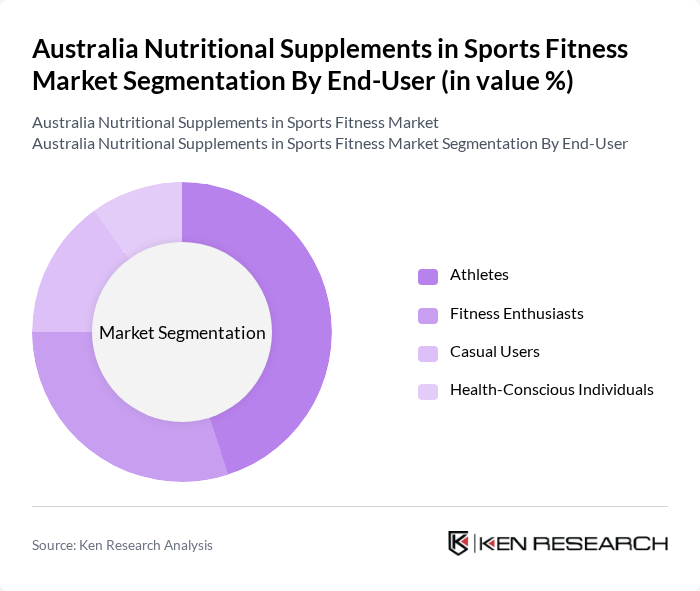

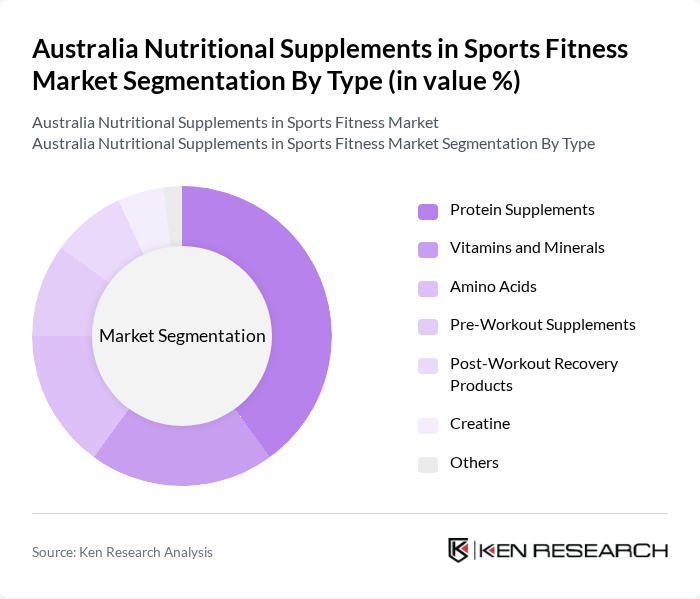

Australia Nutritional Supplements in Sports Fitness Market Segmentation

By Type:The nutritional supplements market is segmented into various types, including Protein Supplements, Vitamins and Minerals, Amino Acids, Pre-Workout Supplements, Post-Workout Recovery Products, Creatine, and Others. Among these, Protein Supplements are the most dominant due to their essential role in muscle recovery and growth, particularly among athletes and fitness enthusiasts. The increasing trend of protein consumption, driven by the rise of fitness culture and health awareness, has led to a significant market share for this sub-segment.

By End-User:The market is also segmented by end-users, which include Athletes, Fitness Enthusiasts, Casual Users, and Health-Conscious Individuals. Athletes represent the largest segment, as they require specific nutritional support to enhance performance and recovery. The growing trend of fitness and sports participation among the general population has also led to an increase in demand from Fitness Enthusiasts and Health-Conscious Individuals, further diversifying the market.

Australia Nutritional Supplements in Sports Fitness Market Competitive Landscape

The Australia Nutritional Supplements in Sports Fitness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Optimum Nutrition, MusclePharm Corporation, BSN (Bio-Engineered Supplements and Nutrition), EHP Labs, GNC Holdings, Inc., Myprotein, Bodybuilding.com, Quest Nutrition, Cellucor, JYM Supplement Science, RSP Nutrition, ProMix Nutrition, Garden of Life, True Nutrition contribute to innovation, geographic expansion, and service delivery in this space.

Australia Nutritional Supplements in Sports Fitness Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The Australian population is increasingly prioritizing health, with 61% of adults engaging in regular physical activity as of 2023. This trend is supported by a rise in health-related spending, which reached AUD 185 billion in the previous year, reflecting a 5% increase from the prior year. The growing awareness of the benefits of nutritional supplements in enhancing performance and recovery is driving demand, particularly among fitness enthusiasts and athletes.

- Rise in Fitness Activities:The fitness industry in Australia has seen significant growth, with gym memberships increasing to over 4.5 million in 2023, a 10% rise from the previous year. This surge in fitness activities correlates with a heightened interest in nutritional supplements, as individuals seek to optimize their performance. Additionally, the Australian Bureau of Statistics reported that 30% of Australians participate in organized sports, further fueling the demand for sports nutrition products.

- Expansion of E-commerce Platforms:E-commerce sales of nutritional supplements in Australia reached AUD 1.2 billion in 2023, marking a 15% increase from the previous year. The convenience of online shopping and the proliferation of digital marketing strategies have made it easier for consumers to access a wide range of products. This shift is particularly evident among younger demographics, with 70% of millennials preferring to purchase health products online, thus driving market growth.

Market Challenges

- Regulatory Compliance Issues:The nutritional supplements market in Australia faces stringent regulations, with the Therapeutic Goods Administration (TGA) overseeing product safety and efficacy. In 2023, over 1,000 products were recalled due to non-compliance with TGA standards, highlighting the challenges companies face in maintaining regulatory adherence. This can lead to increased operational costs and potential market entry barriers for new players.

- Market Saturation:The Australian nutritional supplements market is becoming increasingly saturated, with over 1,500 brands competing for consumer attention as of 2023. This saturation leads to intense competition, driving down profit margins and making it difficult for new entrants to establish a foothold. Additionally, established brands are investing heavily in marketing, further complicating the landscape for smaller companies trying to differentiate themselves.

Australia Nutritional Supplements in Sports Fitness Market Future Outlook

The future of the nutritional supplements market in Australia appears promising, driven by ongoing trends in health and wellness. As consumers increasingly seek personalized nutrition solutions, companies are likely to invest in tailored products that meet specific dietary needs. Furthermore, the integration of technology in fitness, such as wearable devices and mobile apps, will enhance consumer engagement and product utilization, creating new avenues for growth in the sector.

Market Opportunities

- Growth in Online Sales Channels:The shift towards online shopping presents a significant opportunity, with e-commerce projected to account for 30% of total sales in the nutritional supplements market in future. This trend is driven by the convenience of online platforms and the increasing use of mobile devices for shopping, allowing brands to reach a broader audience and enhance customer engagement.

- Increasing Demand for Plant-Based Supplements:The plant-based supplement segment is experiencing rapid growth, with sales expected to reach AUD 500 million in future. This demand is fueled by a growing consumer preference for vegan and vegetarian products, as well as the perceived health benefits associated with plant-based nutrition. Companies that innovate in this space can capture a significant share of the market.