Australia OTT Gaming and Entertainment Market Overview

- The Australia OTT Gaming and Entertainment Market is valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of smartphones, high-speed internet access, and a growing preference for on-demand content among consumers. The rise in disposable income and the popularity of gaming and streaming services have further fueled market expansion.

- Key cities such as Sydney, Melbourne, and Brisbane dominate the market due to their high population density, technological infrastructure, and vibrant entertainment culture. These urban centers are hubs for both gaming and streaming services, attracting major companies and fostering a competitive environment that enhances consumer choice and innovation.

- In 2023, the Australian government implemented the Interactive Gambling Amendment Act, which aims to regulate online gambling and ensure consumer protection. This legislation mandates that all online gambling operators must hold a valid license and adhere to strict advertising guidelines, thereby promoting responsible gaming practices and safeguarding players' interests.

Australia OTT Gaming and Entertainment Market Segmentation

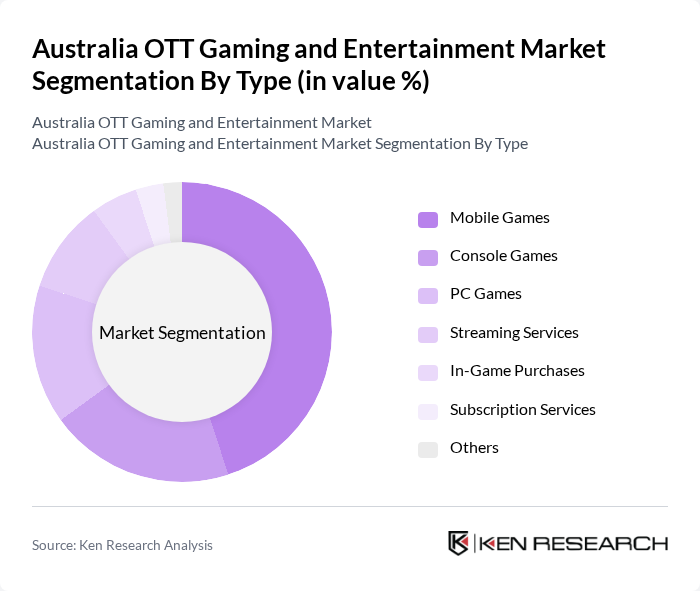

By Type:The market is segmented into various types, including Mobile Games, Console Games, PC Games, Streaming Services, In-Game Purchases, Subscription Services, and Others. Among these, mobile games have emerged as the leading segment due to the widespread adoption of smartphones and the increasing availability of high-quality gaming applications. The convenience of mobile gaming allows users to engage anytime and anywhere, significantly driving user engagement and revenue.

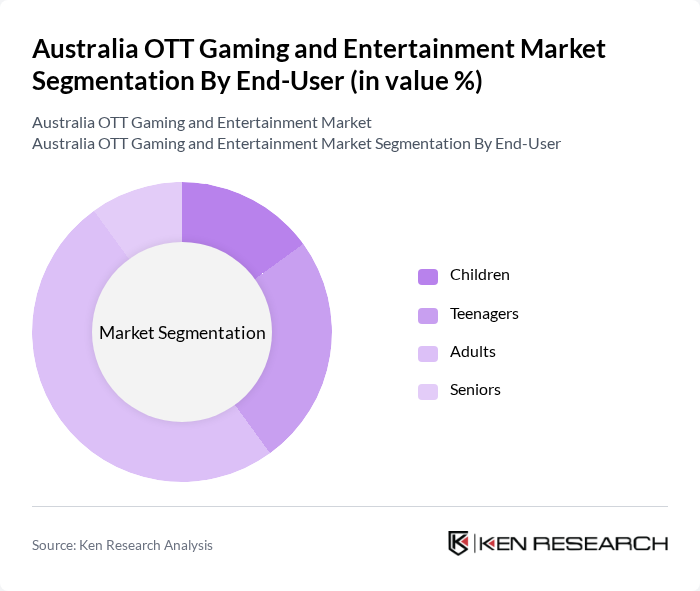

By End-User:The end-user segmentation includes Children, Teenagers, Adults, and Seniors. The adult segment dominates the market, driven by the increasing trend of gaming and streaming among working professionals seeking entertainment and relaxation. This demographic is also more likely to invest in premium gaming experiences and subscriptions, further enhancing their engagement with OTT platforms.

Australia OTT Gaming and Entertainment Market Competitive Landscape

The Australia OTT Gaming and Entertainment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Activision Blizzard, Inc., Electronic Arts Inc., Ubisoft Entertainment S.A., Tencent Holdings Limited, Sony Interactive Entertainment LLC, Microsoft Corporation, Nintendo Co., Ltd., Riot Games, Inc., Epic Games, Inc., Take-Two Interactive Software, Inc., Bandai Namco Entertainment Inc., Square Enix Holdings Co., Ltd., Valve Corporation, NetEase, Inc., Zynga Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Australia OTT Gaming and Entertainment Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, Australia boasts an internet penetration rate of approximately 89%, with around 25 million active internet users. This widespread access facilitates the growth of OTT gaming and entertainment platforms, allowing more consumers to engage with digital content. The Australian Communications and Media Authority reported that the number of households with internet access has increased by 3% annually, indicating a robust infrastructure that supports the expansion of online gaming and streaming services.

- Rise in Mobile Gaming:The mobile gaming sector in Australia is projected to generate over AUD 1.5 billion in revenue in future, driven by the increasing ownership of smartphones, which reached 97% among Australians aged 18-34. This demographic shift towards mobile devices has led to a surge in mobile gaming downloads, with over 1.7 billion downloads recorded in the previous year alone. The convenience and accessibility of mobile gaming are key factors contributing to the overall growth of the OTT gaming market.

- Demand for Interactive Content:The Australian OTT gaming market is witnessing a significant shift towards interactive content, with an estimated 65% of gamers preferring games that offer immersive experiences. This trend is supported by the rise of platforms like Twitch, which reported over 1.6 million average concurrent viewers in the previous year. The demand for interactive and engaging content is driving developers to innovate, leading to a diverse range of gaming options that cater to various consumer preferences.

Market Challenges

- Regulatory Compliance Issues:The Australian gaming industry faces stringent regulatory compliance challenges, particularly concerning age restrictions and content ratings. The Australian Classification Board reported that over 35% of games submitted for classification in the previous year faced delays due to compliance issues. This regulatory landscape can hinder the timely release of new titles, impacting revenue generation and market competitiveness for OTT gaming companies.

- Intense Competition:The OTT gaming market in Australia is characterized by intense competition, with over 250 gaming companies vying for market share. Major players like Activision Blizzard and Electronic Arts dominate, but numerous indie developers are emerging, creating a saturated market. This competition drives up customer acquisition costs, which reached an average of AUD 55 per user in the previous year, making it challenging for new entrants to establish a foothold in the industry.

Australia OTT Gaming and Entertainment Market Future Outlook

The future of the Australia OTT gaming and entertainment market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in game development is expected to enhance user experiences, while the growth of cloud gaming platforms will provide gamers with more accessible options. Additionally, the increasing popularity of esports is likely to attract a broader audience, further fueling market expansion. As these trends continue, the industry is poised for significant transformation and growth in the coming years.

Market Opportunities

- Expansion of Cloud Gaming:The cloud gaming market in Australia is projected to reach AUD 350 million in future, driven by advancements in internet speeds and infrastructure. This growth presents opportunities for OTT platforms to offer subscription-based services, allowing users to access high-quality games without the need for expensive hardware, thus broadening their customer base.

- Partnerships with Telecom Providers:Collaborations between OTT gaming companies and telecom providers can enhance service delivery and customer reach. With over 85% of Australians using mobile data plans, partnerships can facilitate bundled services, improving user engagement and retention. Such strategic alliances can also lead to innovative marketing campaigns that leverage the strengths of both sectors.