Region:Global

Author(s):Geetanshi

Product Code:KRAE5583

Pages:83

Published On:December 2025

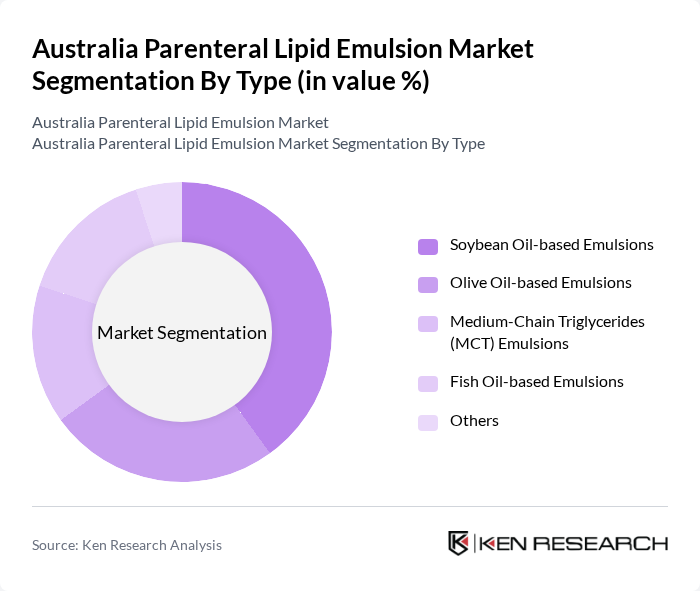

By Type:The market is segmented into various types of emulsions, including Soybean Oil-based Emulsions, Olive Oil-based Emulsions, Medium-Chain Triglycerides (MCT) Emulsions, Fish Oil-based Emulsions, and Others. Among these, Soybean Oil-based Emulsions are the most widely used due to their cost-effectiveness and availability. Olive Oil-based Emulsions are gaining traction due to their favorable fatty acid profile, while MCT Emulsions are preferred for patients requiring rapid energy sources. Fish Oil-based Emulsions are increasingly recognized for their anti-inflammatory properties, making them popular in clinical settings.

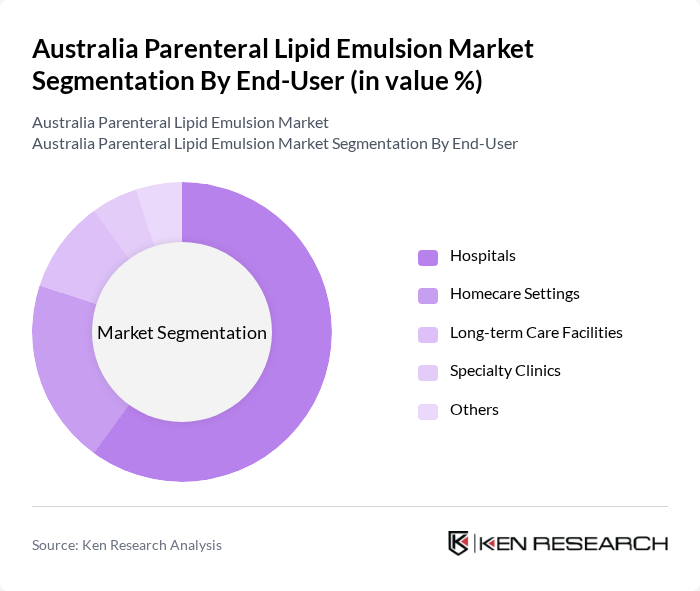

By End-User:The end-user segmentation includes Hospitals, Homecare Settings, Long-term Care Facilities, Specialty Clinics, and Others. Hospitals are the dominant end-user segment, driven by the high demand for parenteral nutrition in critical care units. Homecare settings are witnessing growth due to the increasing trend of at-home healthcare services. Long-term care facilities also contribute significantly as they cater to elderly patients requiring ongoing nutritional support.

The Australia Parenteral Lipid Emulsion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baxter International Inc., Fresenius Kabi AG, B. Braun Melsungen AG, Otsuka Pharmaceutical Co., Ltd., Clinigen Group plc, AFT Pharmaceuticals, Pfizer Inc., Merck & Co., Inc., Grifols S.A., Epsilon Healthcare Limited, Amgen Inc., Hikma Pharmaceuticals PLC, Sandoz International GmbH, Takeda Pharmaceutical Company Limited, Sanofi S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia parenteral lipid emulsion market appears promising, driven by increasing healthcare investments and a growing focus on personalized nutrition. As the healthcare landscape evolves, there is a notable shift towards tailored nutritional solutions that cater to individual patient needs. Additionally, advancements in digital health technologies are expected to enhance patient monitoring and adherence to nutritional therapies, further supporting market growth and innovation in lipid formulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Soybean Oil-based Emulsions Olive Oil-based Emulsions Medium-Chain Triglycerides (MCT) Emulsions Fish Oil-based Emulsions Others |

| By End-User | Hospitals Homecare Settings Long-term Care Facilities Specialty Clinics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Pharmacies Others |

| By Formulation Type | Ready-to-Use Emulsions Compounded Emulsions Pre-mixed Emulsions Others |

| By Packaging Type | Bottles Bags Vials Others |

| By End-User Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Region | New South Wales Victoria Queensland Western Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Clinical Nutrition Specialists | 80 | Dietitians, Clinical Pharmacists |

| Manufacturers of Lipid Emulsions | 45 | Product Managers, R&D Directors |

| Healthcare Policy Makers | 40 | Health Economists, Policy Analysts |

| End-Users in Home Healthcare | 70 | Patients, Caregivers, Home Health Aides |

The Australia Parenteral Lipid Emulsion market is valued at approximately USD 10 million, driven by factors such as the increasing prevalence of chronic diseases, a growing geriatric population, and advancements in healthcare infrastructure.