Region:Asia

Author(s):Rebecca

Product Code:KRAE2918

Pages:80

Published On:February 2026

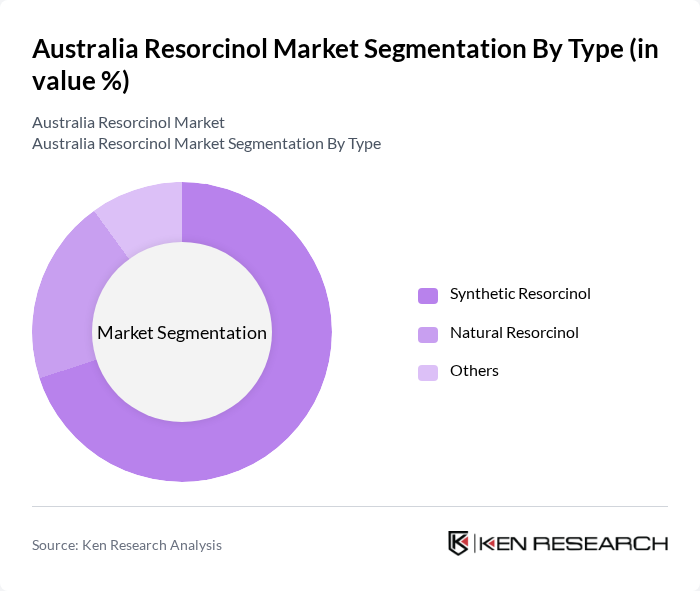

By Type:The market is segmented into Synthetic Resorcinol, Natural Resorcinol, and Others. Synthetic Resorcinol is the most widely used type due to its cost-effectiveness and consistent quality, making it the preferred choice for manufacturers. Natural Resorcinol, while gaining traction due to increasing consumer preference for eco-friendly products, still holds a smaller market share. The "Others" category includes various niche products that cater to specific industrial needs.

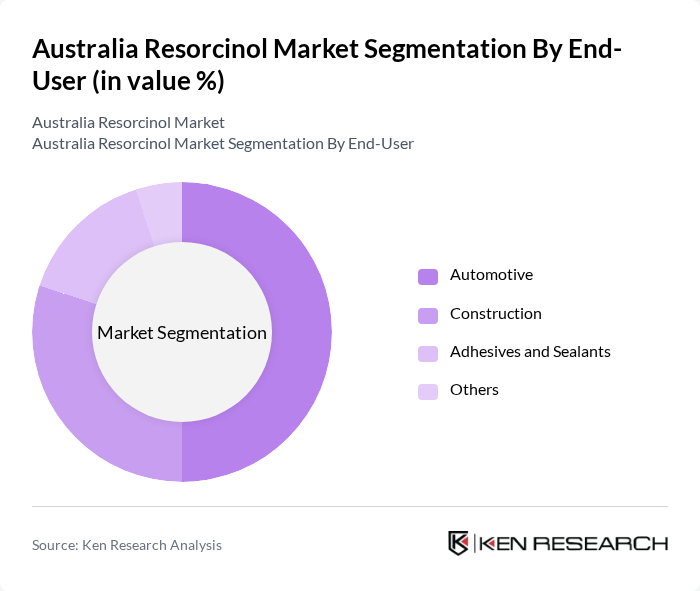

By End-User:The end-user segmentation includes Automotive, Construction, Adhesives and Sealants, and Others. The Automotive sector is the leading end-user, driven by the increasing demand for high-performance materials in vehicle manufacturing. The Construction industry follows closely, utilizing resorcinol in various applications such as adhesives and coatings. The "Others" category encompasses diverse industries that utilize resorcinol for specialized applications.

The Australia Resorcinol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Koppers Holdings Inc., Sumitomo Chemical Co., Ltd., Hexion Inc., SI Group, Inc., Eastman Chemical Company, BASF SE, Mitsubishi Gas Chemical Company, Inc., DIC Corporation, AECI Limited, Resorcinol Chemical Company, Shandong Yanggu Huatai Chemical Co., Ltd., Jiangshan Chemical Co., Ltd., Hubei Greenhome Chemical Co., Ltd., Zhejiang Jianye Chemical Co., Ltd., Hubei Yihua Chemical Industry Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia resorcinol market appears promising, driven by increasing demand from key sectors such as automotive and construction. As sustainability becomes a priority, the shift towards bio-based resorcinol and eco-friendly production methods is expected to gain momentum. Additionally, advancements in manufacturing technologies will likely enhance efficiency and reduce costs. Collaborations with research institutions will further foster innovation, ensuring that the market remains competitive and responsive to evolving consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Resorcinol Natural Resorcinol Others |

| By End-User | Automotive Construction Adhesives and Sealants Others |

| By Application | Coatings Textiles Rubber Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | New South Wales Victoria Queensland Others |

| By Product Form | Liquid Resorcinol Powdered Resorcinol Others |

| By End-User Industry | Pharmaceuticals Agriculture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 100 | Product Development Managers, Procurement Specialists |

| Construction Material Usage | 80 | Construction Project Managers, Material Suppliers |

| Adhesives and Sealants Sector | 90 | Manufacturing Engineers, Quality Control Managers |

| Cosmetics and Personal Care Products | 70 | Formulation Chemists, Brand Managers |

| Textile and Rubber Industries | 60 | Production Managers, R&D Directors |

The Australia Resorcinol Market is valued at approximately USD 150 million, reflecting a robust growth trajectory driven by increasing demand in sectors such as automotive, construction, and adhesives.