Region:Middle East

Author(s):Rebecca

Product Code:KRAE2915

Pages:81

Published On:February 2026

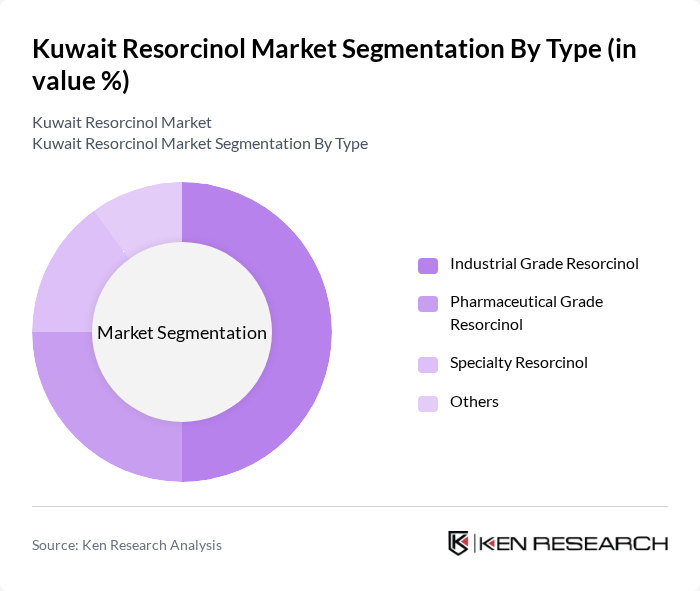

By Type:The resorcinol market can be segmented into various types, including Industrial Grade Resorcinol, Pharmaceutical Grade Resorcinol, Specialty Resorcinol, and Others. Among these, Industrial Grade Resorcinol is the leading subsegment due to its extensive use in the manufacturing of adhesives and coatings, which are critical in various industries such as automotive and construction. The demand for high-performance adhesives in these sectors has driven the growth of this subsegment significantly.

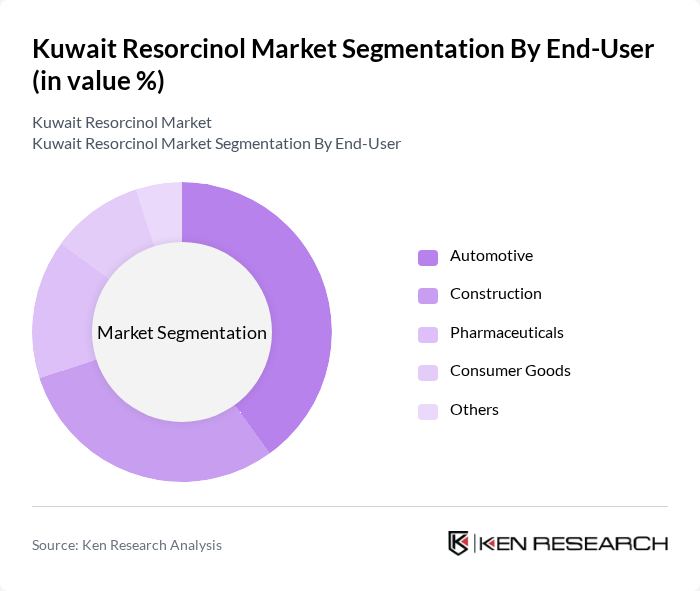

By End-User:The end-user segmentation includes Automotive, Construction, Pharmaceuticals, Consumer Goods, and Others. The Automotive sector is the dominant end-user of resorcinol, primarily due to its application in tire manufacturing and other automotive components. The increasing production of vehicles and the demand for high-performance materials in the automotive industry have significantly contributed to the growth of this segment.

The Kuwait Resorcinol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Petroleum Corporation, Gulf Chemicals and Industrial Oils Company, Al-Dhow Engineering Company, Kuwait National Petroleum Company, Al-Mansoori Specialized Engineering, Kuwait Chemical Company, Gulf Plastic Industries, Al-Babtain Group, Al-Khalij Holding Company, National Industries Group, Kuwait Industrial Company, Al-Futtaim Group, Al-Sayer Group, KGL Holding Company, Al-Mazaya Holding Company contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait resorcinol market is poised for growth, driven by increasing demand across various sectors, particularly automotive and construction. As manufacturers adapt to stringent environmental regulations, there is a notable shift towards sustainable production methods. Additionally, technological advancements in production processes are expected to enhance efficiency and reduce costs. The market is likely to witness a rise in eco-friendly product offerings, aligning with global trends towards sustainability and consumer safety awareness.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Resorcinol Pharmaceutical Grade Resorcinol Specialty Resorcinol Others |

| By End-User | Automotive Construction Pharmaceuticals Consumer Goods Others |

| By Application | Adhesives Coatings Sealants Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Central Kuwait Northern Kuwait Southern Kuwait Others |

| By Product Form | Liquid Resorcinol Solid Resorcinol Others |

| By Policy Support | Subsidies for local production Tax incentives for R&D Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Adhesives and Sealants Market | 100 | Product Managers, Technical Directors |

| Rubber and Plastics Applications | 80 | Procurement Managers, Quality Assurance Heads |

| Coatings and Paints Sector | 90 | Formulation Chemists, Sales Managers |

| Textile and Leather Industries | 70 | Production Supervisors, R&D Specialists |

| Pharmaceutical and Cosmetic Applications | 60 | Regulatory Affairs Managers, Product Development Leads |

The Kuwait Resorcinol Market is valued at approximately USD 45 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand across various applications, particularly in adhesives, coatings, and pharmaceuticals.