Region:Asia

Author(s):Rebecca

Product Code:KRAA6485

Pages:89

Published On:January 2026

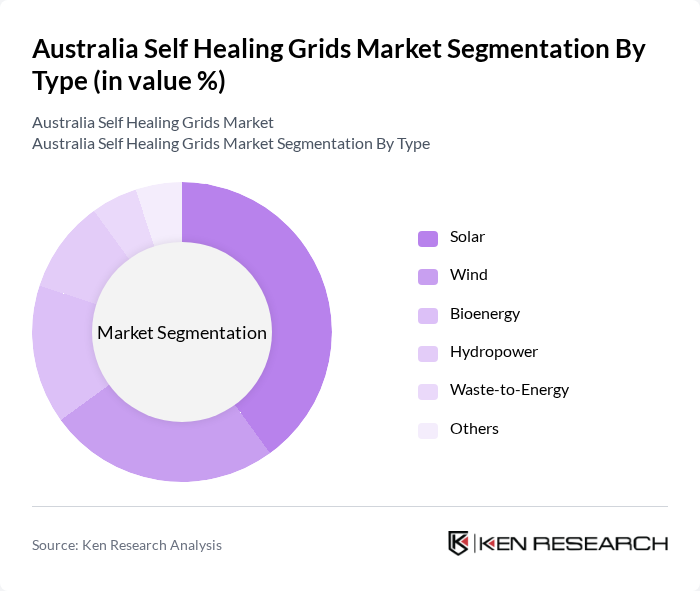

By Type:The market can be segmented into various types, including Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, and Others. Each of these segments plays a crucial role in the overall energy landscape, with specific applications and technologies driving their growth.

The Solar segment is currently dominating the market due to the increasing adoption of photovoltaic systems and government incentives promoting renewable energy. The growing awareness of environmental sustainability and the declining costs of solar technology have led to a surge in installations across residential and commercial sectors. Wind energy also plays a significant role, particularly in regions with favorable wind conditions, contributing to the overall energy mix.

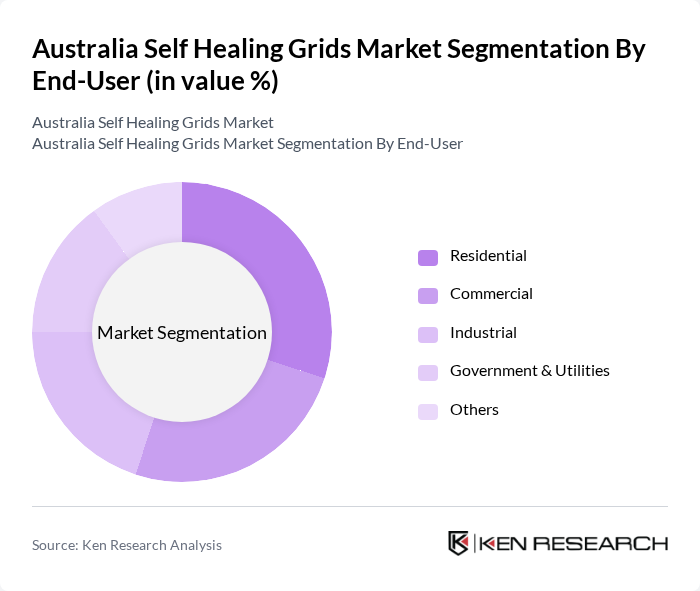

By End-User:The market can also be segmented by end-user categories, including Residential, Commercial, Industrial, Government & Utilities, and Others. Each segment has unique requirements and contributes differently to the overall market dynamics.

The Residential segment is leading the market, driven by the increasing installation of solar panels and energy-efficient systems in homes. The trend towards energy independence and rising electricity costs have encouraged homeowners to invest in self-healing grid technologies. The Commercial sector follows closely, as businesses seek to reduce operational costs and enhance sustainability through renewable energy solutions.

The Australia Self Healing Grids Market is characterized by a dynamic mix of regional and international players. Leading participants such as AGL Energy, Origin Energy, EnergyAustralia, Red Energy, Simply Energy, Infigen Energy, Neoen, Australian Renewable Energy Agency (ARENA), Powerlink Queensland, TransGrid, Jemena, AusNet Services, Western Power, TasNetworks, Clean Energy Finance Corporation (CEFC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the self-healing grids market in Australia appears promising, driven by ongoing technological advancements and increasing investments in renewable energy. As the government continues to support innovative energy solutions, the integration of AI and IoT technologies will enhance grid management capabilities. Additionally, the shift towards decentralized energy systems will create new opportunities for self-healing grids, enabling more resilient and efficient energy distribution networks across the country.

| Segment | Sub-Segments |

|---|---|

| By Type (e.g., Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy) | Solar Wind Bioenergy Hydropower Waste-to-Energy Others |

| By End-User (Residential, Commercial, Industrial, Government & Utilities) | Residential Commercial Industrial Government & Utilities Others |

| By Region (Eastern Australia, Western Australia, Northern Territory, Southern Australia) | Eastern Australia Western Australia Northern Territory Southern Australia |

| By Technology (Photovoltaic, CSP, Onshore/Offshore Wind, Biomass Gasification) | Photovoltaic CSP Onshore Wind Offshore Wind Biomass Gasification Others |

| By Application (Grid-Connected, Off-Grid, Rooftop Installations, Utility-Scale Projects) | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects Others |

| By Investment Source (Domestic, FDI, PPP, Government Schemes) | Domestic FDI PPP Government Schemes Others |

| By Policy Support (Subsidies, Tax Exemptions, RECs) | Subsidies Tax Exemptions RECs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies Implementing Self-Healing Grids | 100 | Grid Managers, Operations Directors |

| Infrastructure Developers in Renewable Energy | 80 | Project Managers, Technical Leads |

| Government Agencies Overseeing Energy Policies | 60 | Policy Makers, Regulatory Affairs Specialists |

| Research Institutions Focused on Smart Grid Technologies | 50 | Researchers, Academic Professors |

| Consultants Advising on Energy Efficiency Solutions | 70 | Energy Consultants, Sustainability Advisors |

The Australia Self Healing Grids Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for reliable energy systems and advancements in smart grid technologies, including AI-driven fault detection and IoT integration.